Berkshire Hathaway's market value held by 13F filers was recorded as $348B for Q2 2023. The firm's market value held by 13F filers was up by $23B by the end of the second quarter.

Form D is a filing that is required to be filed by companies and individuals who intend to raise capital by selling securities in the United States through private placements. Private placements are offerings of securities that are not made to the general public but are instead offered to a select...

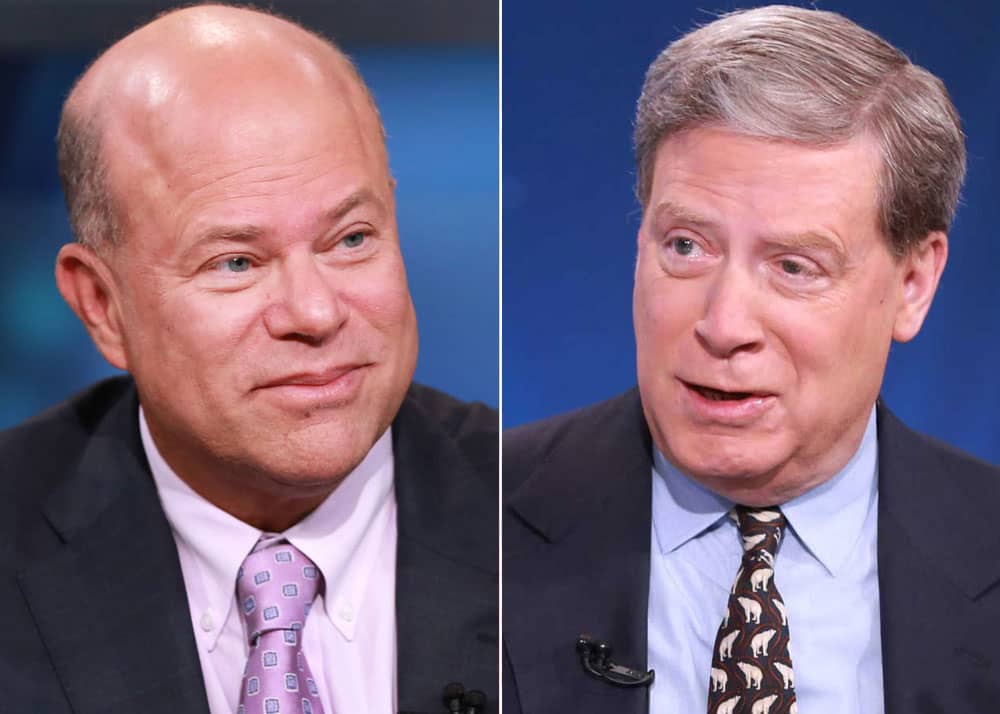

Hedge fund managers Stanley Druckenmiller and David Tepper loaded up on stocks benefitting from the AI boom during the 1st and 2nd quarters of 2023. Radient analyzes the Q2 2023 13F filings for these managers.

Scion Asset Management’s Michael Burry made headlines with the recent 13F filing. The filing showed that the firm’s market value increased from $110M in Q1 2023 to $1.7B in Q2 2023, However, it is worth noting that this includes the notional value of 2000 put options. If the value of these...

About the Webinar

You'll learn how Radient's artificial intelligence and investment technology can seamlessly integrate with HFR's analytics to gain unparalleled efficiencies and dramatically reduce time spent on research and diligence.Key Takeaways:

RADiENT studies the recent 13F filings and focuses on the Q4 2022 disclosure by Berkshire Hathaway. Berkshire Hathaway, Inc. maintains a diverse investment portfolio that is valued at $299B and is comprised of 49 companies that remain unaltered from the previous quarter. The portfolio's top five...

Environmental, social, and governance (ESG) funds, also known as socially responsible funds or sustainable funds, have gained significant popularity in recent years. ESG investing has become increasingly important to investors who are seeking to align their investments with their personal values...

Exchange-traded funds (ETFs) have been increasingly popular among investors as a way to diversify portfolios and access a range of assets with ease. In 2022, some ETFs have outperformed others, delivering impressive returns for their investors.In 2022, while the S&P 500 lost 19% on the year, the 10...

2022 saw several lows for the crypto sector. Crypto stocks have rebounded strongly as Bitcoin has jumped about 40% this year. Crypto-related ETFs are the best-performing products among equity ETFs year-to-date. The revival of crypto exchange-traded funds has been driven by positive developments in...

A sub-adviser is a separate entity that provides investment advice to the primary investment advisor, who is then responsible for implementing the advice and managing the investment portfolio. The primary advisor is responsible for filing Form ADV, which contains information about the investment...

We analyze how tumultuous Q3 and Q4 of 2022 were.

Highlights

- Investors pulled $26B from hedge funds in Q3 2022

- The HFRI fund-weighted composite index was down 6.66% through the year in September 2022

- US equities made robust gains in Q4, with much of the progress made in November

- Global hedge funds...

Look at some of the highs and lows of US Securities for Q1 and Q2 2022.

Highlights:

- The S&P 500 decreased by -4.6% in Q1

- Q1 2022 Market Cap: Large Caps (-4.6%) outperformed Mid (-4.9%) and Small Caps (-7.5%).

- HFRI Equity Hedge (Total) Index detracted -3.86% over Q1 2022

- HFRI Fund of Funds...

FTX filed for bankruptcy on November 11, after traders rushed to withdraw $6B from the platform.

Post-Covid there are several new private fund managers who joined the market. Here’s a list of some of the rising stars.

We at RADiENT are thrilled to announce an investment from deftly.vc!

ESG funds have been on a rise in recent times, at their current growth rate, ESG-mandated assets are on track to represent half of all professionally managed assets globally by 2024.

Hedge funds are actively managed funds that attempt to profit from broad market swings caused by political or economic events. Hedge fund managers use several instruments and strategies. In our blog, we analyze hedge funds that focus on a combination of different sectors. RADiENT looks at some of...

The S&P 500 lost 20% in the first sixth months of 2022, the worst mid-year performance in over half a century.

%201.png)