Manager research and due diligence are important for both individual and institutional investors. RADiENT helps its users find the perfect manager, depending on their specific criteria and requirements.

Users can search for managers by location, AUM-managed fund type, etc.

To search for managers on RADiENT, users simply need to toggle to the advisers' tab. The Advisers tab on RADiENT, has Form ADV data, from, 2013 for all registered advisors in the US. The fields on Form ADV are used for manager research. The form contains questions that pertain to the type of funds managed by the adviser, sub-adviser information, regulatory and judicial risks associated with the advisers, type and number of clients served, etc.

Searching for Fund Managers on RADiENT

Form ADV

On the Advisers Tab, the Advanced Search bar allows users to search for managers using several filters at once.

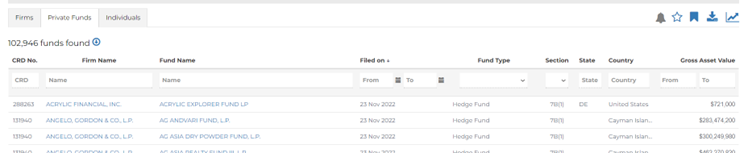

On the Advisers Tab, users can also search for private fund managers by clicking on the ‘Private Funds’ tab and filtering for fund managers by the fund or firm name. Users can also set multiple filters on this screen. Example: State of registration, Gross Asset Value, etc.

For Example, let's say you want to search for all the funds that AQR holds. After toggling to the Advisers Tab, you would have to lay out particular criteria in the Advanced Search Bar.

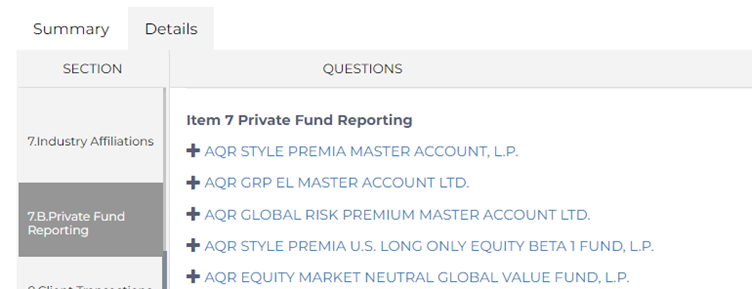

From the results, select the firm you are interested in and navigate to its detailed ADV filing tab, as shown.

You can access the details of any and all of these funds by simply clicking on the fund's name. All the private fund data can be easily exported to an Excel sheet within a few seconds using the export button on the top right corner of the page.

Screener on RADiENT

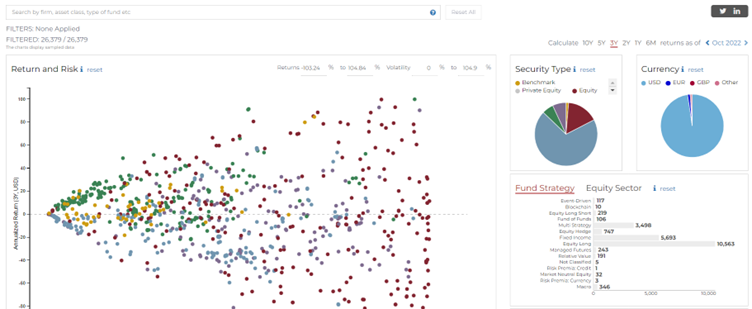

Users can leverage the RADiENT screener to search for hedge funds by setting up various filters on the performance, risk, and strategy metrics.

Users can also look up the specific fund by searching for them in the search bar on the screener.

The two pie charts, let users filter for the fund type and the denomination of the fund. The graph filter on the left can be used to select a range of risk and return metric that suits the user.

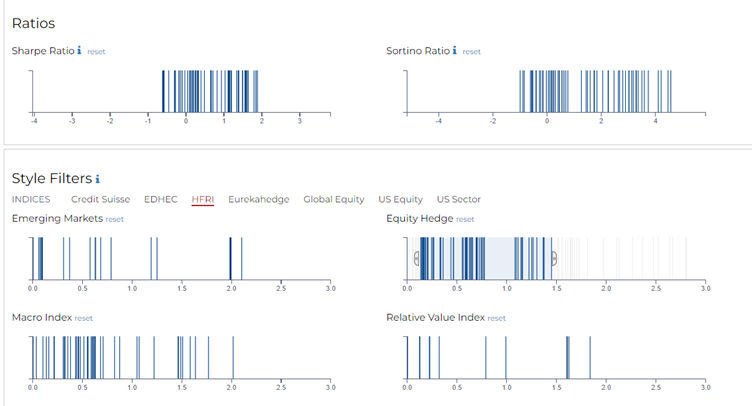

The sliding ratios and style filters further allow users to set custom filters to sort for funds. You can set filters for the desired range of ratio and style filters.

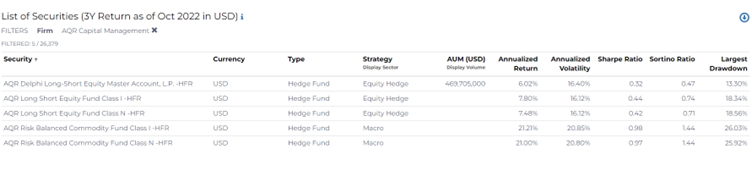

The last tool on the screener is a list of securities table that helps users analyze, compare and track securities similar to ones they may have searched for or securities that adhere to filters the user has set.

For example, when analyzing AQR’s funds, a table with funds that belong to AQR will show up on the screen.

Form 13F

Form 13F is a quarterly report that is required to be filed by all institutional investment managers with at least $100 million in assets under management. It discloses their equity holdings and can provide insights into what the smart money is doing in the market.

Form 13F data on RADiENT is arranged in an easy-to-read manner in the form of graphs and tables. On the 13F tab, users can search for the recent hedge fund 13F filers, and top securities held by hedge funds according to their recent 13F filings and can filter and search for 13F filings by setting various filters.

Users can filter for 13F filers via the name of the firm, date of filing, AUM managed, percentage attributed to the top 10 securities in the portfolio, a change in AUM, etc.

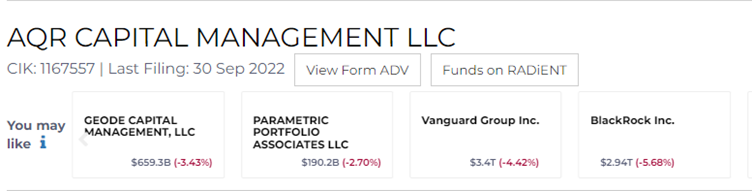

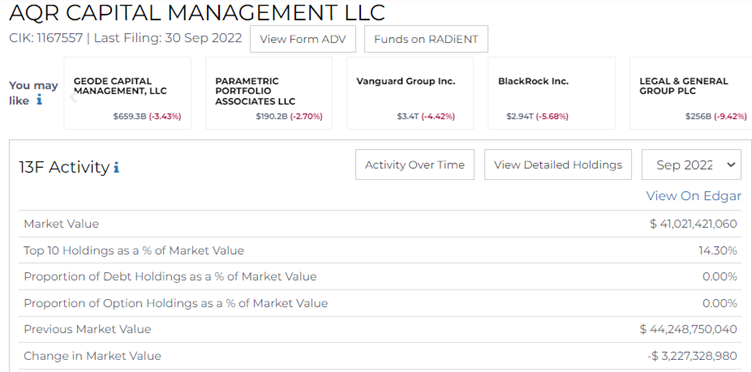

Users can also select similar firms based on the filing that they open. RADiENT employs its algorithm to look for similar firms, based on the size of the firm, location, and current market value.

When a user looks up the recent 13F filing of AQR, they can track the firms' detailed holdings, performance over time, sectoral allocations, etc. Users can also compare the recent filings with historical 13F filings to track firm-level changes. Similar to the Form ADV filing, all 13F filing data can be easily exported in the form of an excel.

Leveraging RADiENT’s Securities to analyze funds and conduct manager due diligence

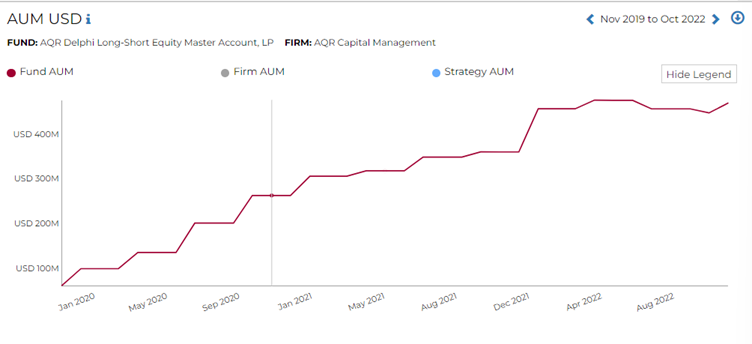

RADiENT’s Securities page has interactive growth charts and tables that are easy to read and analyze. This page also integrates data from our data partners- Eurekahedge, Morningstar, and HFR, allowing users to track several asset managers and their funds using a single- consistent tool.

Users can set custom date ranges, and analyze one security against another and/or against indices. The securities page aggregates all regulatory filings data, performance, and fund documents to provide users with a chance to access all and complete details of the security.

Performance and Growth

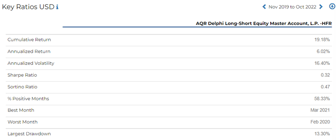

RADiENT data shows that AQR Delphi Long-Short Equity Master Account has a cumulative return of about 19% for the last 3 years with its worst month marked as February 2020.

Users can gauge the performance of the security for the select period, track its returns, volatility, drawdowns, Sharpe and Sortino ratios, etc via the ‘Key Ratios’ table.

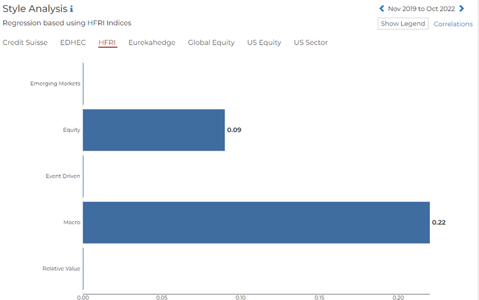

The Securities page also provides users with insights on the security’s monthly returns, style analysis, and other regulatory disclosures.

Users can toggle between global indices, sectoral indices, and specifically constructed indices to analyze their securities.

You can also track the key facts of the fund and access its up-to-date regulatory and compliance data. The regulatory filings available on-screen include – Form ADV, Form 13F, Form NCEN, Form NPORT, etc.

Factsheets

RADiENT also offers a unique tool, called the RADiENT factsheet. This factsheet is quick to download pdf that allows users to compare a given security against other securities and/ or indices for custom time periods. This factsheet can be completely customized to the requirements of the users, that is the user can opt for the metrics that he/ she wants to include in the factsheet. Read more about the factsheet, here.

To know more about these filings and RADiENT features, visit our offerings page or write to us at support@radientanalytics.com