Post-Covid there are several new private fund managers who joined the market. Here’s a list of some of the rising stars.

Andrew Cohen

Difesa Capital Management

In 2019, Andrew and Peter Cohen co-founded Difesa Capital Management. The hedge fund firm specializes in equity and equity-linked investments focusing on SPACs. Despite the troubles faced by blank-check companies during 2020’s SPAC boom, Difesa, which manages a little less than $100 million, posted a 19.9% gain in 2021 and is up 105 % since its July 1, 2019, inception.

“There are revenue- and cash flow–driven businesses coming through the SPAC market,” Andrew Cohen says. “There are many ways to make money, and we’re able to extract value through all kinds of phases and protect capital and create idiosyncratic alpha.”

Difesa Capital Management’s recent 13F filing shows that the firm has a market value of $180M with a turnover of 25%. Difesa majorly invests in the finance and IT sectors.

The firm’s portfolio holds 15.4% of its market value in options. Some of the largest traded securities by the firm for the quarter ending 30th June 2022 are -SPDR SP 500 ETF TR (SPY), SK Growth Opportunities Corp (SKGR), Warrior Tech Acquisition, B Riley Principal 150 Merger, and Investcorp India Acquisition. View the complete holdings and sectoral allocation report on RADiENT.

Difesa's Form ADV disclosure shows total reg AUM of $144M and private funds with a total gross asset value of $60.3M. Visit the firm's recent Form ADV here.

Michael Englander

Greenland Capital Management

His father Israel (Izzy) Englander is the founder of multistrategy giant Millennium Management, and his uncle was hedge fund pioneer Jack Nash, co-founder of Odyssey Partners. In 2006, Michael joined his father at Millennium, where he worked as an analyst and a sub-portfolio manager for 3 different portfolio managers — 2 in credit long-short strategies and 1 in an equity long-short strategy focused on healthcare stocks.

Here, Englander built and managed a development platform for emerging portfolio managers with shorter track records than those of the more seasoned talent that Millennium tends to target. This unit inside Millennium — called Series — was set up under the firm’s U.S. equity long-short division. From the outset, Englander planned to expand the mandate to include additional strategies, geographies, and asset classes.

The entire business unit — including the management team and PMs — was spun out at year-end 2021, and on January 3, 2022, Greenland launched its flagship hedge fund under the new entity.

Form ADV data shows that this New York Based firm has only 3 clients that fall under the ‘Pooled Investment Vehicles’ category. The filing also discloses private fund data with over $1B in management.

Michael Simanovsky

Conversant Capital

Found in 2020, Conversant Capital is a hybrid hedge fund firm, which invests across the capital structure in credit and equity, public and private companies, and real estate and adjacent sectors such as senior living and digital infrastructure.

Michael Simanovky, previously worked with the investment bank Houlihan Lokey on the restructuring team, with Rothschild, an investment giant Cerberus, and Senator Investment Group before finally finding his own hedge fund- Conversant Capital.

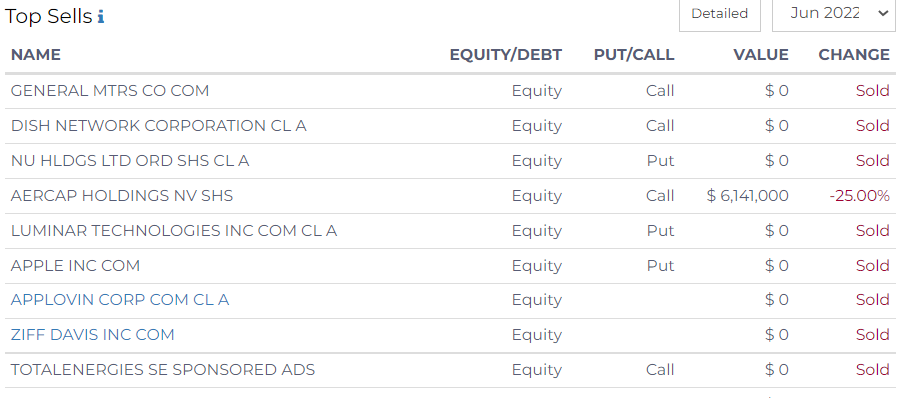

Form 13F filing on RADiENT shows that the firm has a market value of $440M as of 30 June 2022. Conversant holds 17 unique securities, the largest of which are- Radius Global Infrastructure (RADI), Capital SR Living Corp, Indus Realty Trust Inc (INDT), and Digitalbridge Group Inc (DBRG). You can access the detailed report, here.

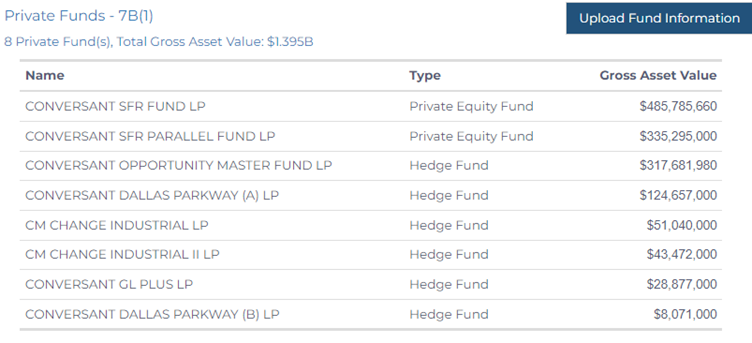

The firm’s latest Form ADV discloses an AUM of $1.39B and 8 private funds with a total gross asset value amounting to $1.39B. The company discloses 2 private equity funds and 6 hedge funds in its item 7B.

Recent Updates

July 2022: Investment funds managed by P10 and managed by Conversant are investing a combined $180M of equity capital in Crossroads at $10.76 per share, with the ability to commit up to an additional $310 million of total equity capital at the same price within the next 120 days.

Ryan Packard

Hiddenite Capital Partners

After graduating from John Hopkins University, Ryan Packard worked with Morgan Stanley, Anchorage Capital Partners and an event-driven firm Soroban Capital Management. In 2020, Packard started Hiddenite Capital Partners after working for 5 years with Roystone Capital.

Hiddenite manages between $90M and $100M, focuses on global long-short equity — specifically industrials and tech — but also makes credit investments and adds options on top of them.

“Industrials and tech are the antitheses of each other,” Packard says. “They play well off each other due to the disruption element. Tech drives changes seen in the industrial economy.”

13F filings on RADiENT disclose that the firm has a market value of $97M with a turnover of over 109%. The top 10 holdings in the portfolio contribute nearly 48.5% to the firm's market value for the quarter ending 30 June 2022. The firm primarily invests in securities from the IT, energy and finance sectors. Some of the most traded securities by the firm include- NXP semiconductors (NXPI), Shell PLC (SHEL), Microsoft (MSFT), General Motors (GM) and Dish Network Corporation (DISH). View the firm's complete 13F filing, here.

Form ADV disclosure by the firm shows a total reg. AUM of $161M and hedge fund with a gross asset value of $161M. Users can access the service provider data of these private funds via a firm's latest Form ADV. Hiddenite's hedge fund is serviced by the prime brokerage arm of Morgan Stanley & Co, UBS Securities and Goldman Sachs & Co.

Track these new fund managers via RADiENT. To know more, write to us at support@radientanalytics.com

i) https://www.institutionalinvestor.com/article/b1xhjsrhcdksfk/Meet-2022-s-Hedge-Fund-Rising-Stars