Environmental, social, and governance (ESG) funds, also known as socially responsible funds or sustainable funds, have gained significant popularity in recent years. ESG investing has become increasingly important to investors who are seeking to align their investments with their personal values and beliefs, as well as to mitigate potential risks associated with environmental and social factors.

As the demand for ESG investing continues to grow, more companies are incorporating ESG principles into their business practices, and ESG funds are likely to play an increasingly important role in the investment landscape.

The goal of ESG funds is not only to achieve financial returns but also to make a positive impact on the world by supporting businesses that are committed to sustainability, social responsibility, and ethical practices.

ESG funds invest in companies that meet certain environmental, social, and governance criteria, and the range of funds available has expanded rapidly in recent years

RADiENT looks at some of the ESG fund types investors can choose from:

Public ESG Funds

iShares ESG Aware MSCI USA ETF

iShares ESG's top sectors are Technology, Consumer Cyclical, and Healthcare. It also avoids funding several industries that are harmful to society such as firearms, tobacco, nuclear weapons, and other weapons.

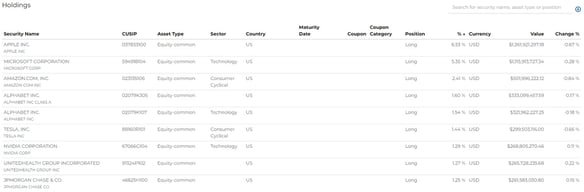

The iShares ESG Aware fund's recent Form N-PORT shows that the fund holds significant positions in Apple Inc. valued at $1.36B, Microsoft Corp. valued at $1.15B, and Amazon.com Inc. valued at $501M and tracks the S&P 500 index, among them being the top holdings for this fund.

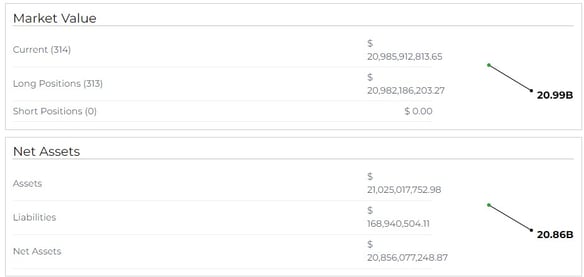

iShares ESG fund's current market value at $20.9B.

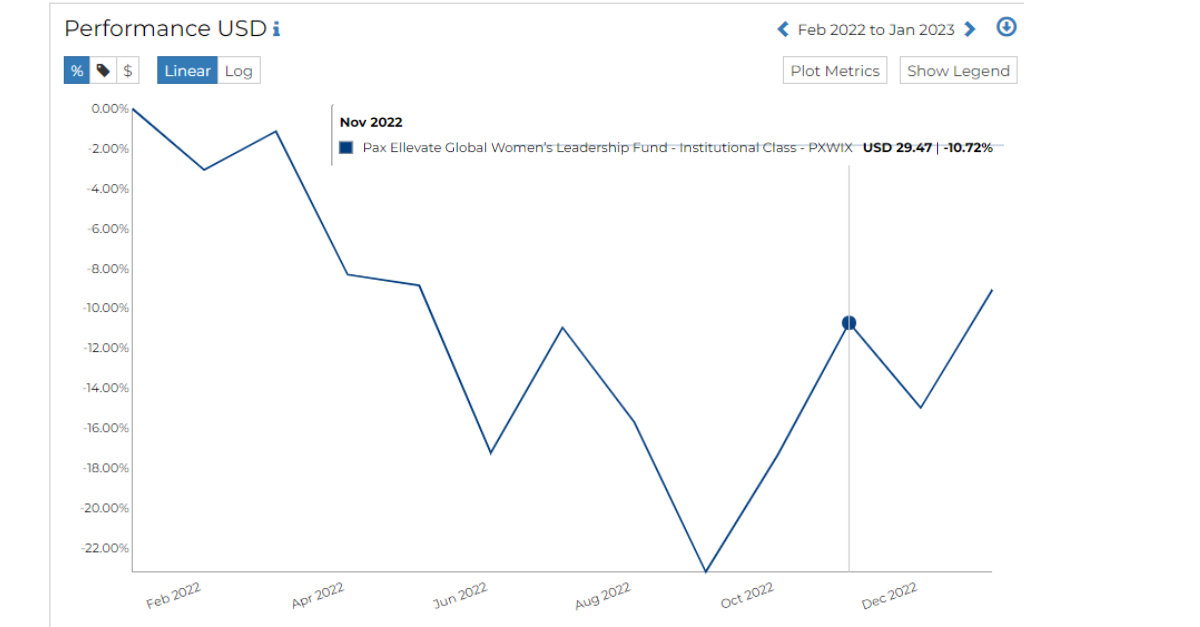

Pax Ellevate Global Women’s Leadership Fund

The Pax Ellevate Global Women's Leadership Fund is an ESG fund that supports equal rights for women in the business world. This cause-specific ESG fund invests in companies that support leadership and policies promoting the hiring, training, and retention of women.

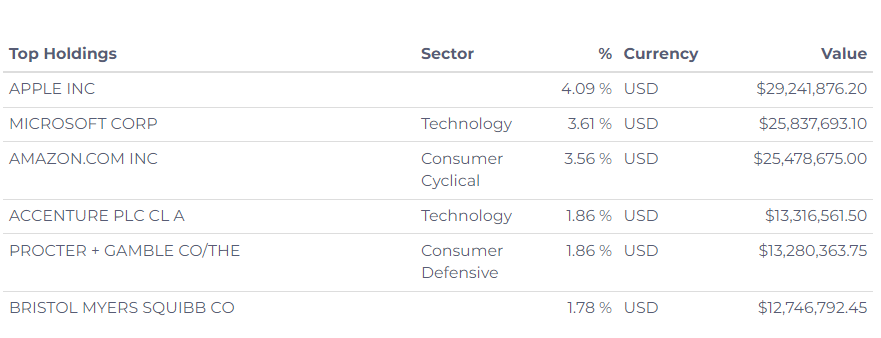

The fund focuses on promoting gender diversity on boards and in leadership positions, as well as advocating for fair pay for women. The portfolio holds over 400 large-cap stocks, with Apple INC., Microsoft, Amazon.com INC., and Accenture PLC among the top holdings.

The recent Form NPORT of this fund discloses a current market value of $706.7M, with nearly 24% of its market value attributed to the top 10 securities held by the fund. Some of the largest securities deleted by the fund in the last quarter were Natwest Group, GSK PLC, Expedia Group, etc.

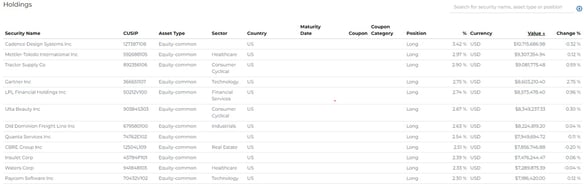

Nuveen ESG Mid Cap Growth ETF

NuShares ETF Trust - Nuveen Esg Mid-Cap Growth ETF (NYSEMKT: NUMG) invests in about 60 rapidly growing mid-sized US companies that have high projected EPS, historic EPS, and sales per share growth. It tracks the TIAA ESG USA Mid-Cap Growth Index, which includes companies with high ESG scores and low carbon scores and excludes controversial business activities. Notable companies held by the portfolio include Gartner, Quanta services, Mettler-Toledo International and GoDaddy.

This is an ESG fund that focuses on mid-cap growth companies in the information technology and healthcare sectors. It has seen almost 16% growth in the past five years and is designed to support U.S. enterprises. The fund's focus on healthcare makes it attractive to investors interested in improving healthcare access in the U.S.

Calvert International Responsible Index Fund

Calvert International Responsible Index Fund is one of the ESG funds that gives a major emphasis on avoiding investments in companies associated with gambling, weapons, and animal testing.

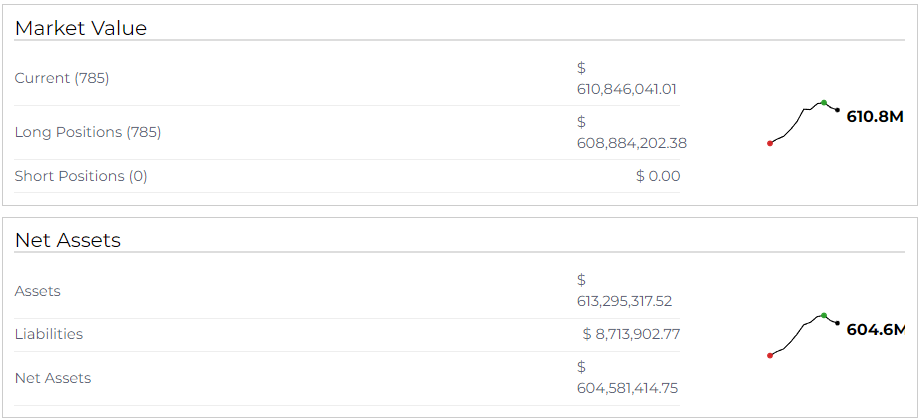

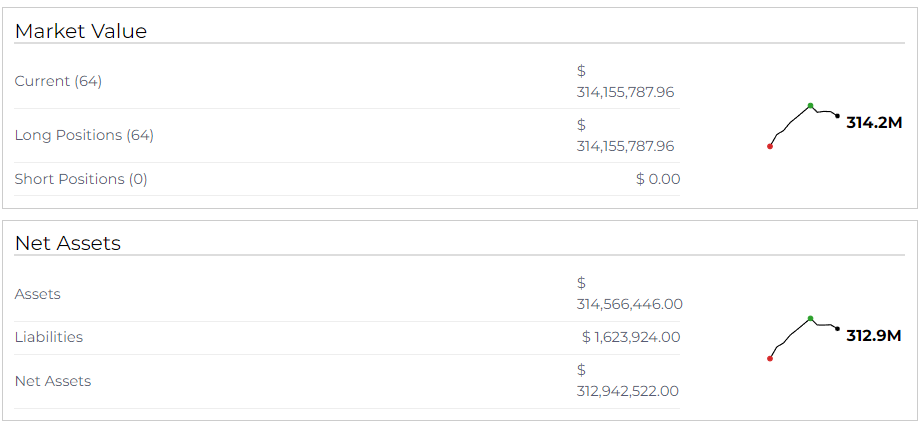

This ESG Fund has a portfolio that includes over 800 stocks, net assets valued at $604.6M, and a market value of $610.8M.

The fund's recent Form N-PORT discloses that the fund entirely liquidated 14 securities from its portfolio in the last quarter. The fund primarily focuses on securities from the financial, basic materials and industrial sectors.

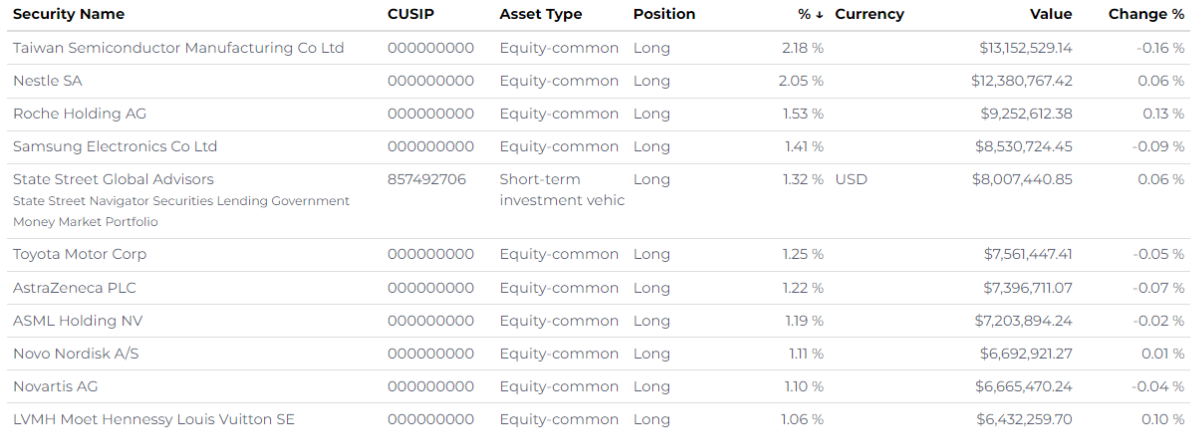

Taiwan Semiconductor Manufacturing Co Ltd, Nestle SA, Roche Holding AG, and Samsung Electronics Co Ltd are among the fund's top holdings on RADiENT.

Private ESG funds.

Avenue Capital

A New York-based investment firm called Avenue Capital managed by Marc Lasry, the fund has a portfolio worth over $144 million. Avenue Capital has announced plans to establish a new fund, Avenue Sustainable Solutions Fund, with the primary objective of raising $600 million. The fund's main aim is to offer flexible capital and other associated services to impact-focused businesses in North America. The adviser's recent Form ADV shows that they already managed 32 private funds with a total gross asset value of $7.7B.

ValueAct Capital

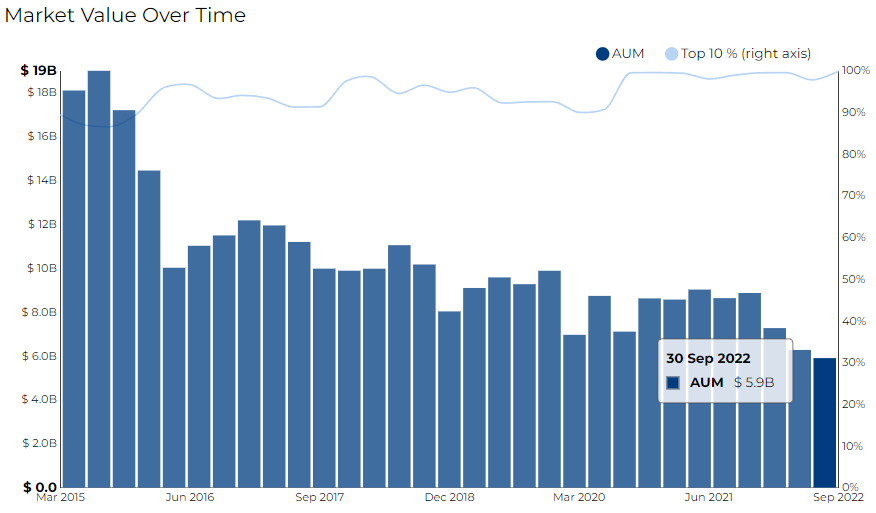

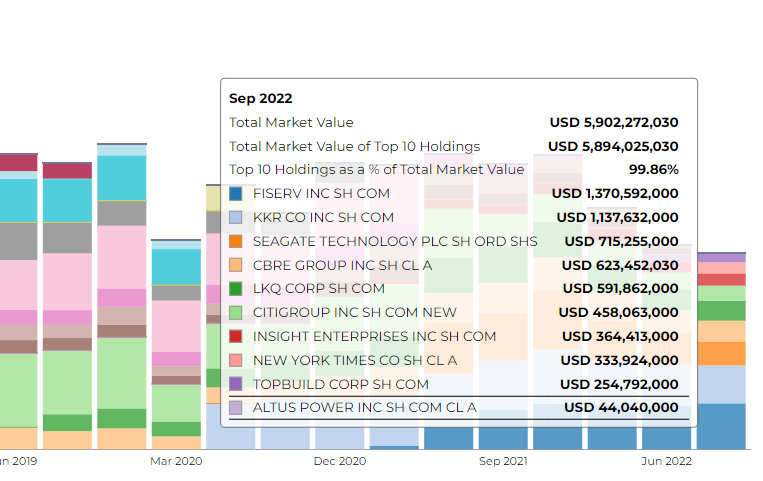

ValueAct Capital is a California-based hedge fund with a portfolio value of over $5.9B as of September 2022 on RADiENT, focusing mainly on the finance and technology sectors.

The fund has a strong ESG-focused approach to investments, and its former manager, Jeffrey Ubben, instilled this philosophy during his twenty-year tenure.

Citigroup Inc. was a top holding of ValueAct Capital but was fully exited by another asset management firm, Artisan Partners Limited Partnership, in Q1 2021 due to a $900 million clerical error that incurred a public reprimand from federal regulators.

Top Holdings for this ESG Fund are Fiserv Inc SH Com valued at $1.3B, KKR Co Inc. SH Com valued at $1.1B, and Seagate Technology PLC valued at $715K on RADiENT.

Generation Investment

Generation Investment Management, a London-based hedge fund managed by David Blood and Al Gore, focuses on ESG and impact investing. It is an investment firm that focuses on long-term investing and integrates sustainability research into its financial analysis. Its investment approach is based on the idea that sustainability risks and opportunities have a direct impact on long-term business profitability.

Generation Investment Management was founded in 2004 in London, England, and has built a global research platform to support its investment strategy.

With a market value of close to $17B, the fund has investments concentrated in the technology, healthcare, and finance sectors. The recent Form ADV discloses that the adviser manages 53 other private funds.

Investing in ESG funds is an effective way to align your investments with your values and contribute to a sustainable future. With the increasing demand for ESG investments, it is crucial to analyze the portfolio data of these funds to ensure that they align with your specific ESG goals.

RADiENT analytics is a great tool that can provide investors with relevant and valuable data to help make informed investment decisions that align with their values and promote a sustainable future.