A sub-adviser is a separate entity that provides investment advice to the primary investment advisor, who is then responsible for implementing the advice and managing the investment portfolio. The primary advisor is responsible for filing Form ADV, which contains information about the investment advisor, including its business practices, conflicts of interest, and background information about its key personnel- such as sub-advisers. The subadviser is not responsible for filing Form ADV, but the primary advisor is required to disclose the identity of any subadviser and their role in the advisory relationship in their ADV.

Institutions and individuals can use the Form ADV to conduct due diligence on a subadviser:

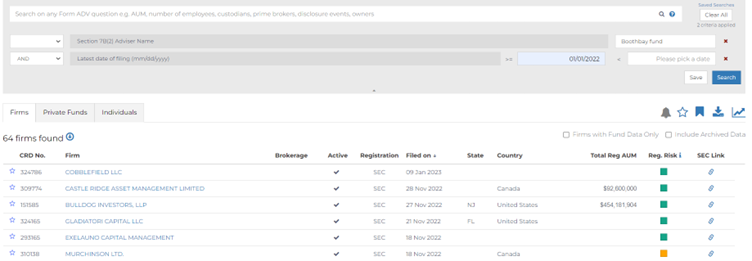

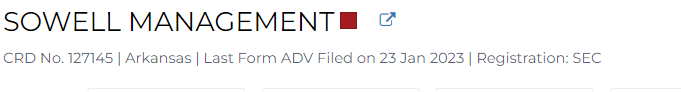

1) Search for the sub-advisers Form ADV on RADiENT.Using RADiENT users can search for

-Advisers who have listed certain other advisers as their sub-adviser in 7B(2) of their ADV filings, and/or

- A complete list of all the sub-advisers disclosed in the ADV filing of any specific Adviser.

Example: Boothbay Fund Management has been disclosed as a sub-adviser in the Form ADVs of 64 firms from the start of Jan 2022.

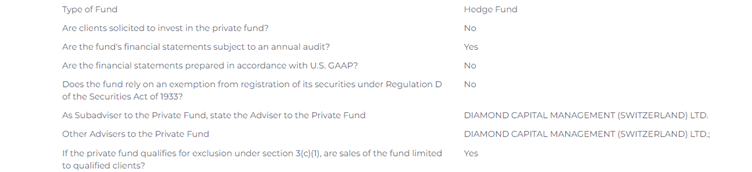

Example: Chimera Capital Management LLC reports Diamond Capital Management (Switzerland) Ltd as the subadviser to its Diamond Neutral Fund (hedge fund) in its latest Form ADV.

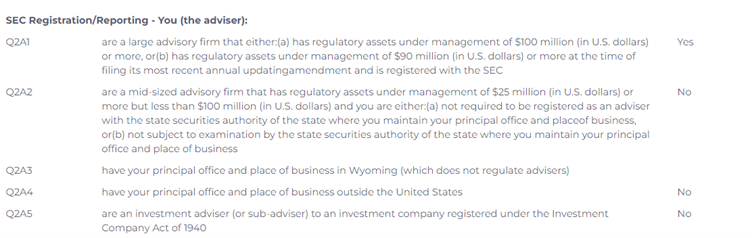

2) Review the subadviser's Form ADV Part 1, which contains information about the subadviser's business, including its ownership, investment strategies, and conflicts of interest. Look for any disciplinary actions or legal proceedings.

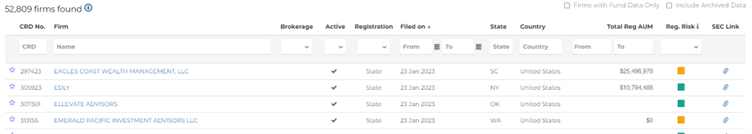

RADiENT has a color-based regulatory risk tool, that simplifies this step.

Here, RADiENT uses the item 11 disclosure of a firm’s ADV filing to assign them to different regulatory risk categories. Item 11, has 25 questions pertaining to the disciplinary history of a firm and its advisory affiliates.

- The Green tile indicates no question was answered “yes”.

- Yellow indicates one or more questions, except those relating to felony /misdemeanor charges/convictions, were answered "yes".

- The red tile indicates the firm answered “yes” to one or all questions pertaining to being charged with / convicted of a felony/misdemeanor.

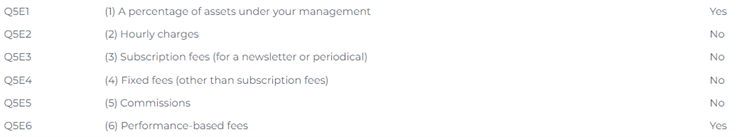

3) Review the subadviser's Form ADV Part 2A, which contains information about the subadviser's investment strategies and performance.

4) Review the subadviser's Form ADV Part 2B, which contains information about the subadviser's compensation and fees. RADiENT allows users to easily download these data fields into an excel with a simple click.

RADiENT lets users access sub-advisers/advisers' historical Form ADVs to track and compare the differences in the operations of the firm.

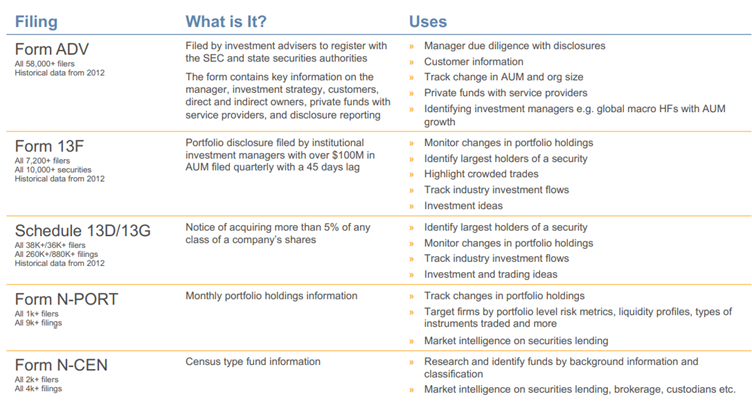

Users can also access the other SEC filings that the sub-advisers file. RADiENT provides data from filings such as Form 13F, Form NCEN, Form NPORT, Form D, etc.

RADiENT enables users to gain insights about the advisers' private fund information, fund management, service provider relations, and 13F holdings.

To know more about sub-advisers and their data on RADiENT, you can reach out to us at support@radientanalytics.com.