The S&P 500 lost 20% in the first sixth months of 2022, the worst mid-year performance in over half a century.

Hedge funds as a whole also outperformed the market in the first half of 2022. The HFRI Fund Weighted Composite Index, an equal-weighted index that takes assets out of the equation, fell 3.1% in June and 5.9% in the first half of this year. Still, from January to June, it outran the S&P 500 and the Nasdaq Composite by 16% and 25.5%, respectively, according to HFR.

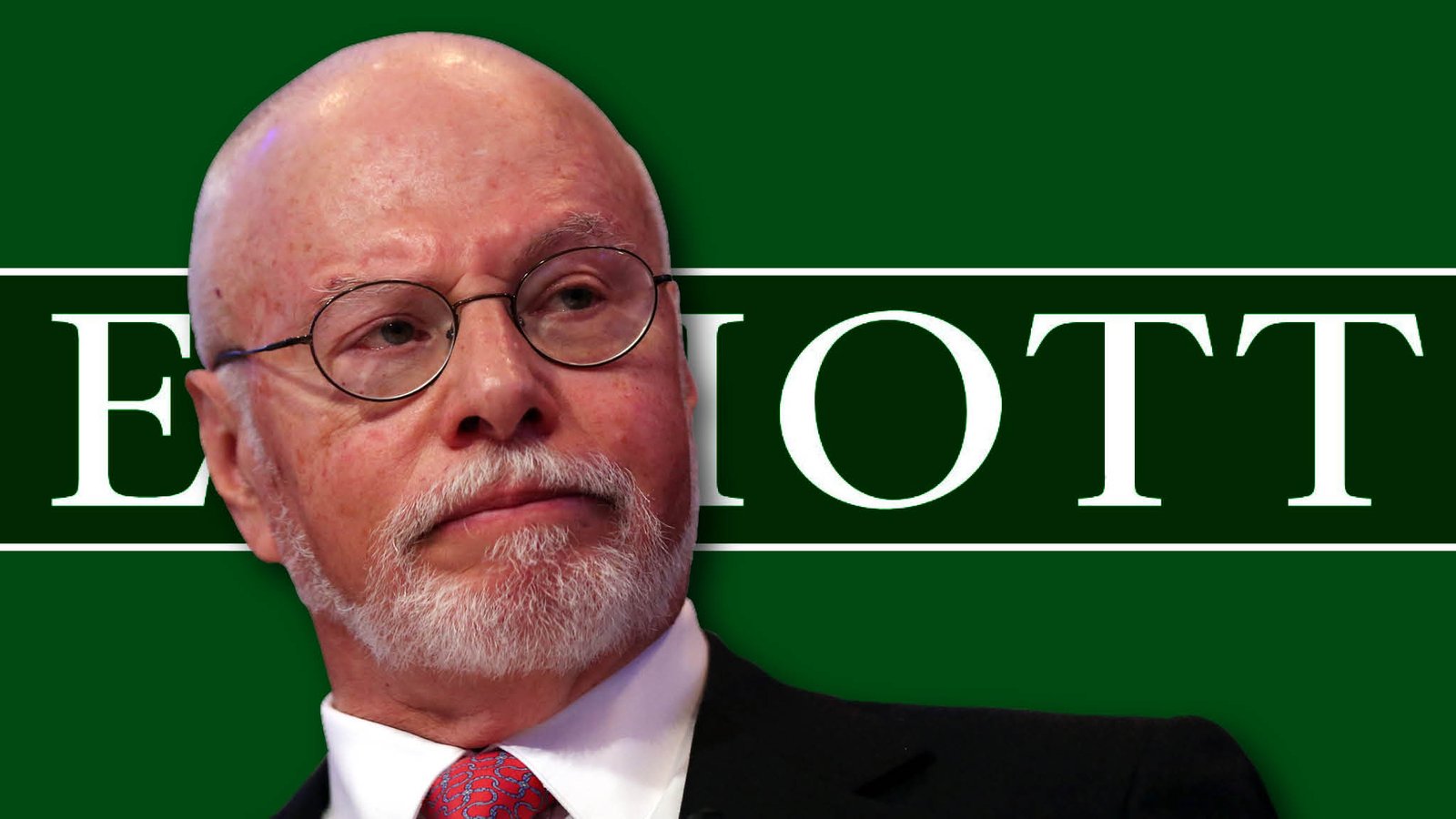

Elliott Investment Management LP

Managed by: Paul Singer

Elliott Management has a 55-year-long history with over $50B in AUM. The fund won awards for both Multistrategy Hedge Fund Manager of the Year and Institutional Hedge Fund Manager of the Year in 2022. ( NASDAQ)

The firm’s recent Form 13F filing discloses a market value of $8.7B with a turnover of 50%. The firm saw a change of ~70% in its market value due to movements in the price of securities. Elliott entirely liquidated 12 positions ( incl. iShares TR US Real Estate ETF, Evergy Inc, and Twitter) and added 9 new positions (incl PayPal, Pinterest, and Aerojet Rocketdyne Holdings) to its portfolio. Singer's firm majorly invests in the energy, finance and communications sectors, its largest holdings are- Howmet Aerospace Inc, Marathon Pete Corp, iShares TR SH iBoxx ETF, and Suncor Energy Inc.

News:

- PayPal rose increasingly well during the pandemic as households shopped online but shares slid more than 60% this year as people returned to their pre-pandemic spending habits. Earlier this year, the company cut its 2022 earnings forecast, which led to the company's worst one-day selloff in its history as a publicly traded company. Following this, activist Elliott Management took an interest in PayPal, the company entered into an information-sharing agreement with Elliott Management. PayPal said the company and Elliott Management "are aligned with the mutual goal of maximizing shareholder value, with the initial focus being improved profitability and increased return of capital."

- Elliott Management, exited Twitter during the second quarter, soon after Elon Musk announced plans to buy the social media company. It owned 10 million shares at the end of the first quarter.

Managed by: Ray Dalio

The firm’s first hedge fund was launched in 1991 and since then it has had an average annualized return of 11.4%. Fast-forward to 2022 and Bridgewater has delivered returns of 32% in the first half of this year.

The firm reported a market value of $24B for the quarter ending 30 June 2022. The top 10 holdings of the firm make up 30% of its total market value, the largest held security is Procter Gamble Co. The firm discloses a turnover of 22.4% with most of its holdings belonging to the consumer staples and financial sectors. The hedge fund lost nearly $5B in market value from its last 13F disclosure, 96% of this loss is attributed to the trading activities of the firm.

Bridgewater Associates in 2022:

One of the primary drivers of Bridgewater’s 2022 success so far has been taking short positions against major European stocks. Some of these include global apparel giant Adidas (ADS) and the enterprise resource planning software company, SAP (SAP) ( NASDAQ).

Its "All Weather" strategy, a multi-asset investment approach structured to be indifferent to shifts in economic conditions, caught on in China, where unpredictable "black swan" events including Beijing's tech crackdown, the Russia-Ukraine war, and COVID lockdowns have roiled markets. Bridgewater launched its first onshore China fund in 2018 and, since then, two other funds have been established. Bridgewater's founder Ray Dalio unloaded his firm’s entire stake in e-commerce giant Alibaba amid a fire sale of its holdings in U.S.-listed Chinese stocks.

Last November, Dalio launched what is believed to be the single biggest fundraising in China at the time, collecting the equivalent of $1.25B from Chinese investors and eclipsing a rival offering from BlackRock.

Man Group offers a mix of long-short funds, private market funds, real estate funds, multi-asset funds, and fixed funds. One of Man Group’s core values is responsible investing, which it achieves through its funds’ compliance with ESG investing goals.

Man Group’s quant fund has gained 29.2% this year, it is the second-best performing year since it launched in 1999. It’s important to note these types of actively managed funds can perform particularly well in both bull and bear markets by analyzing price trends.

As of 2nd August 2022, Man Group posted weaker than expected inflows and stated that its clients have asked for more of their money back in recent months ahead of further expected market turbulence.

In January 2022, the group launched Capital Asset Solutions (CAS) Initiative that would combine the breadth of Man Group’s investment capabilities across global credit markets with specialized expertise in regulation, product structuring, and liquidity management to build solutions for clients operating in complex, regulated markets. The focus is predominantly on the global retirement services and savings market distributed through insurance, pension fund, and wholesale channels.

The CAS initiative is supposed to develop and manage an institutional investor-focused multi-asset credit strategy that dynamically allocates to both liquid and private markets across Man Group.

In addition, CAS will strategically partner with insurance firms to deliver tailored and flexible solutions focused on both liabilities and asset management that will look to help them improve their competitiveness, increase their resilience and grow. This will involve providing insurers with flexible capital, either through direct investment, reinsurance, or other forms of balance sheet enhancing transactions, as well as leveraging Man Group’s sophisticated asset management capabilities.

The recent 13F disclosure by the firm shows a market value of $24B. According to RADiENT, this is a debt-holding firm with a reported turnover of 197%. The firm completely liquidated nearly 2060 securities and added 1,922 new positions in its portfolio during the last quarter. The firm removed some major equities like- Microsoft, Apple, Taiwan Semiconductor, Amazon, etc from its portfolio, replacing them with holdings in debt positions of the same companies.

Visit RADiENT to track similar portfolio managers and hedge funds.