FTX filed for bankruptcy on November 11, after traders rushed to withdraw $6B from the platform.

The fall of FTX, which seemed more stable than other companies, and the pull-out by Binance have jolted the market. FTT’s price has fallen about 80% since November 8. The prices of bitcoin and ether, some of the most valuable tokens, have both fluctuated widely since November 8, at one point dropping more than 20%.

With the collapse of FTX, several private funds and firms have reportedly been caught off guard.

Galois Capital

Launched by Kraken veteran Kevin Zhou, hedge fund- Galois Capital was caught off guard after close to half its assets were trapped on collapsed crypto exchange FTX. Galois Capital confirms that it had up to $45M in exposure to FTX. The firm told Bloomberg News that its exposure was in the range of $40M-$45M.

RADiENT data shows that the firm’s hedge fund had a total gross asset value of $205M, as per its latest Form ADV filing, filed on 1 June 2022. The firm also reported only one client under the pooled investment vehicles category in its ADV disclosure.

Ikigai Asset Management

This California -based hedge fund had a "large majority" of its assets on defunct crypto exchange FTX, according to the firm's founder and chief investment officer Travis Kling.

Ikigai reportedly raised $30M from its existing investors to start a new venture fund in May. Currently, Ikigai had more than 275 investors around the world.

Tiger Global Management

This hedge fund had been among the most prominent investors in Sam Bankman-Fried’s FTX crypto exchange. Tiger was part of a group of investors in FTX’s January Series C round that valued the company at $32 B. It previously also participated in a Series B round that valued FTX at $25 B. Tiger Global lost about $38M.

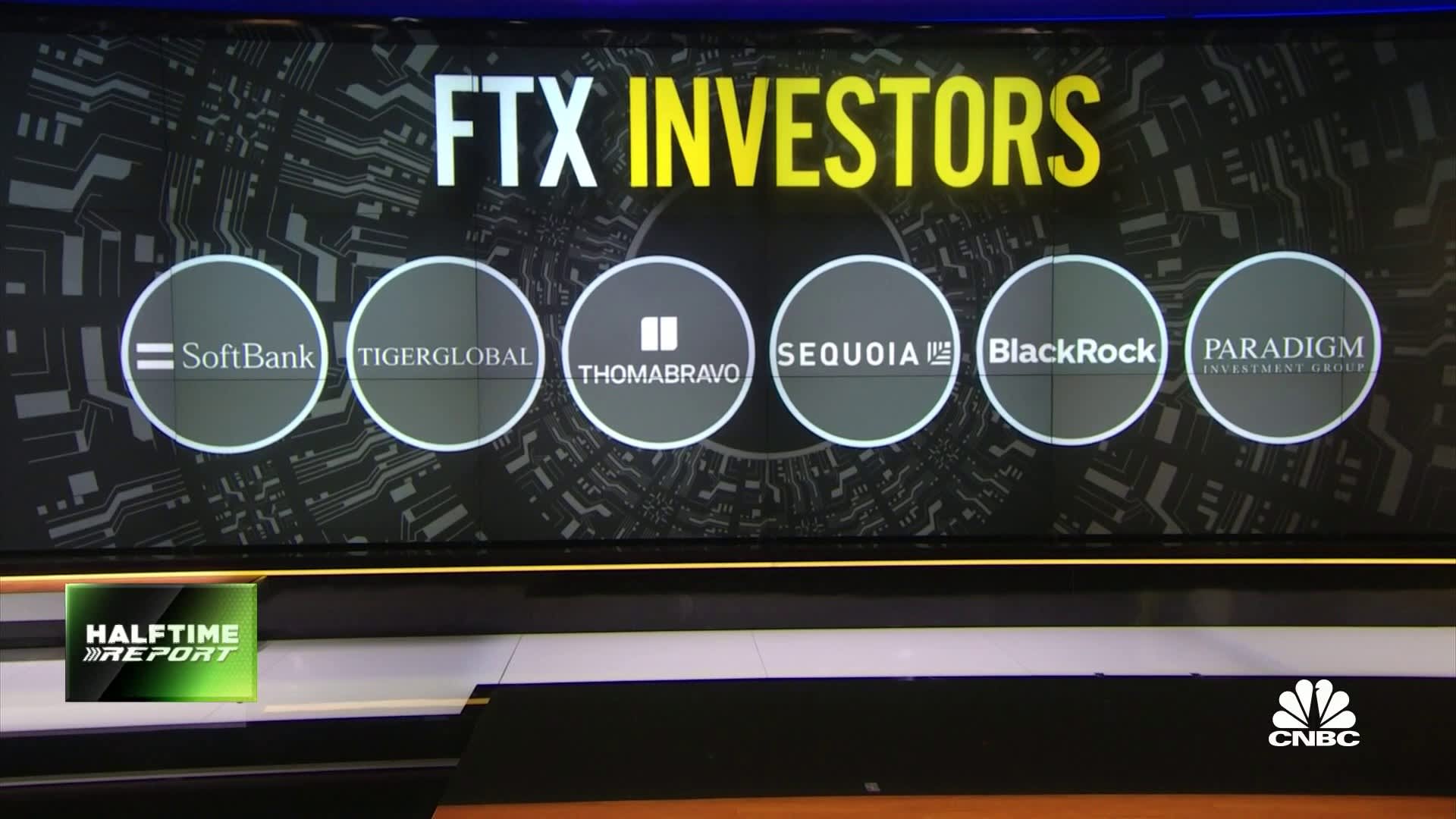

Other prominent investors in FTX’s latest rounds include SoftBank, Sequoia Capital, Ribbit Capital, BlackRock, Temasek Holdings, and the Ontario Teachers’ Pension Plan Board. Sequoia said it has written down its entire $210M investment, and SoftBank is reported to have lost $100M.

Multicoin Capital Management

Crypto-focused venture capital firm Multicoin Capital has around 10% of the total assets under management of its Master Fund stuck as pending withdrawals on FTX. the firm describes itself as a “thesis-driven investors that make long-term, high-conviction investments in category-defining crypto companies and protocols across public and private markets.” The firm's Form ADV discloses a total regulatory AUM of nearly $9B with only 15 clients in its pooled investment vehicles category. The firm also discloses 4 private equity funds, 4 venture capital funds and 1 hedge fund.

Multicoin was able to move about 24% of its FTX-held assets before the withdrawal freeze went into effect on November 9. The stuck assets include bitcoin (BTC), ether (ETH) and USD.

"'Crypto Fund Research expects a record number of investor redemption requests from crypto hedge funds in November that could total about $2 billion. The current record stands at $1.3 billion — set in June following the collapse of Terra’s algorithmic stablecoin."

Galaxy Digital

Crypto financial services company Galaxy Digital Holdings, said on November 9 that it was looking to cut nearly 62% of its exposure to FTX. The company has disclosed that it had an exposure of $76.8M in cash and digital assets to FTX.

Galaxy Digital Capital Management LP's recent Form ADV data discloses 9 private funds with a total gross asset value of $1.13B. The firm reportedly has 3 venture capital funds, 3 hedge funds, and 3 other private funds in its portfolio. The firm also discloses that it has only 15 clients belonging to the pooled investment vehicles category.

Track the recent regulatory filings of these funds and firms on RADiENT.