Hedge funds are actively managed funds that attempt to profit from broad market swings caused by political or economic events. Hedge fund managers use several instruments and strategies. In our blog, we analyze hedge funds that focus on a combination of different sectors. RADiENT looks at some of the major hedge fund manager’s recent 13F filings.

In this blog article, we will take a closer look at the hedge fund industry and analyze some of the major hedge fund managers' recent 13F filings. Specifically, we will focus on Lazard Asset Management, Highlander Capital Management, and Ashford Capital Management and examine their investment portfolios, top holdings, and recent trading activity.

Lazard Asset Management

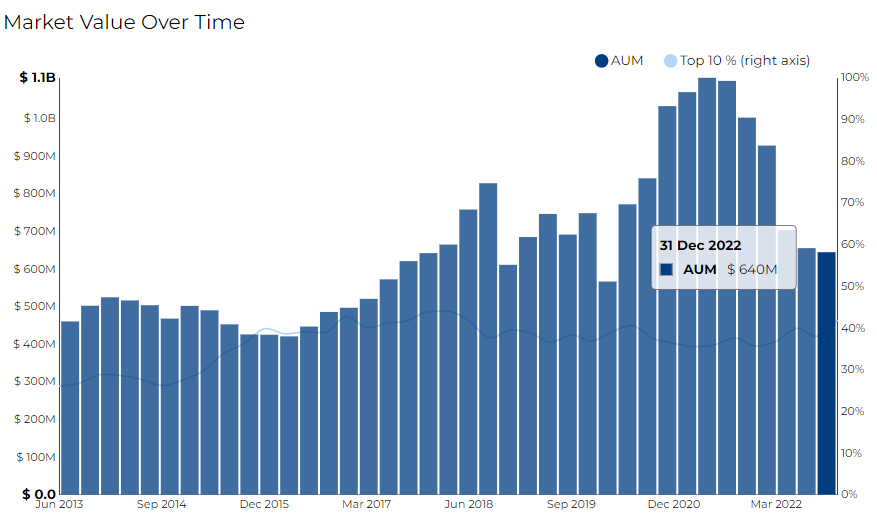

Lazard Asset Management, a New York-based hedge fund primarily focuses on the IT, finance, and healthcare sectors.

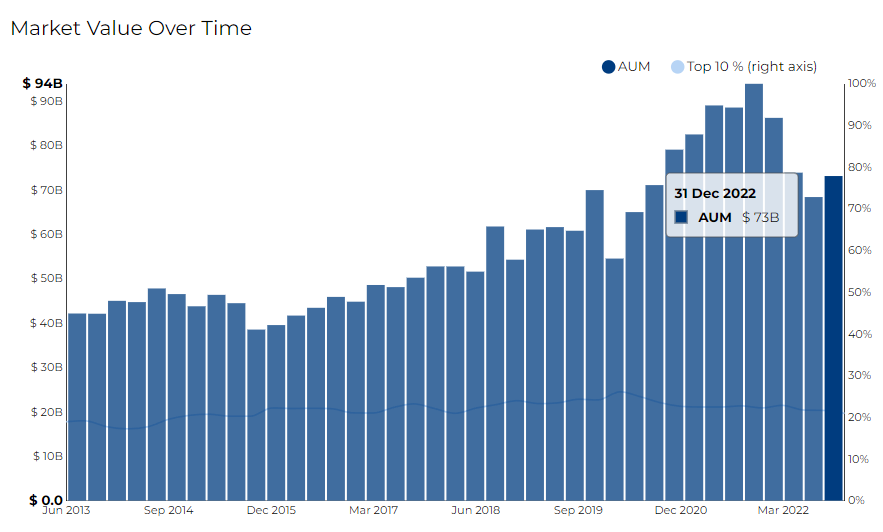

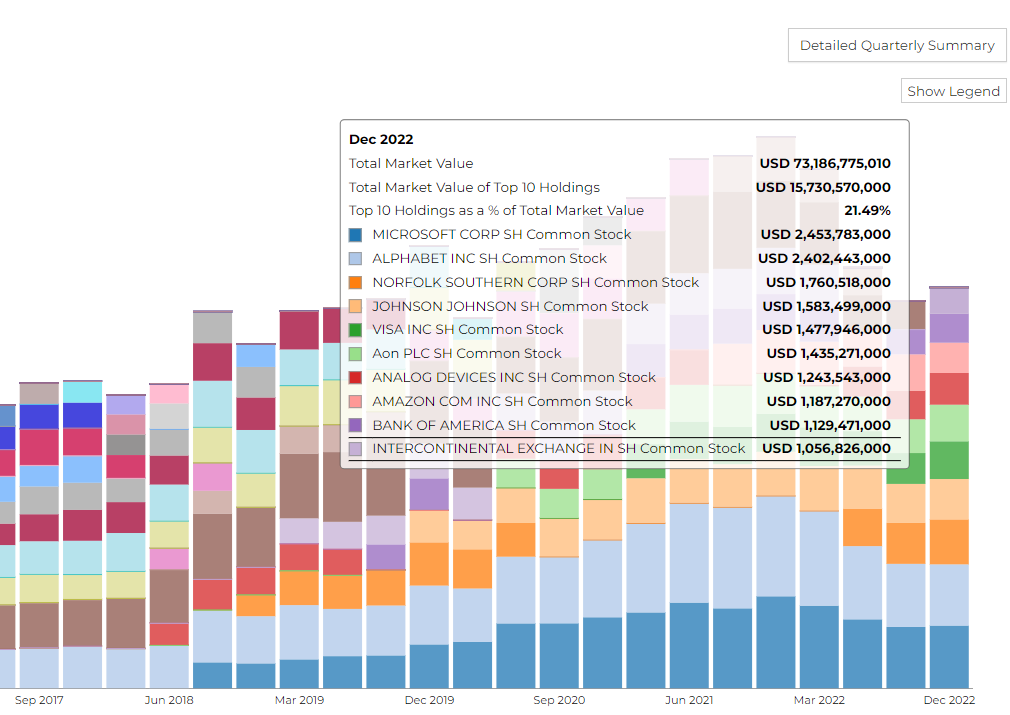

The firm's 13F market value as of Q4 2022 stood at $73B with a turnover of 25%. The firm added 353 new securities and entirely liquidated 261 holdings from its portfolio in the last quarter. The top 10 holdings of the firm contribute to 21% of the total market value of the firm. The top holdings were MSFT(3.81%) valued at $2.4B, GOOGL(3.11%) valued at $2.4B, and NSC(2.73%) valued at $1.7B.

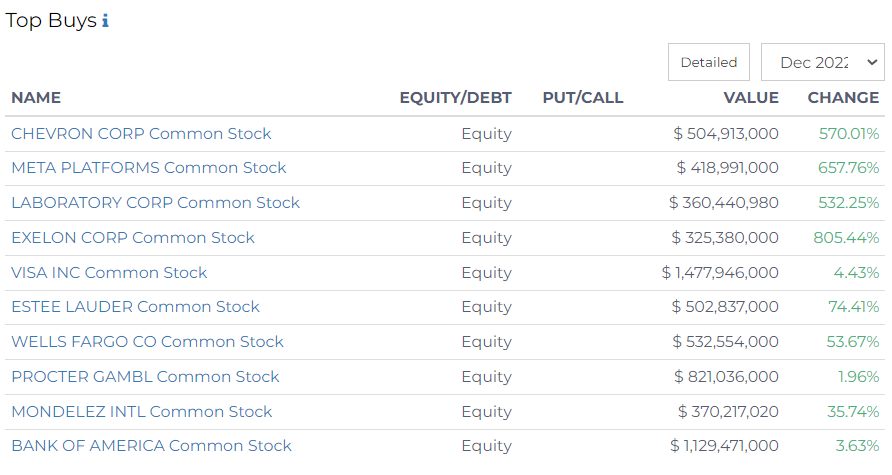

In Q4 of 2022, Lazard boosted their holdings from Visa Inc valued at $1,477,946,000, Bank of America at $1,129,471,000, and Procter Gambl at $821,036,000.

The top 5 trades of Lazard Asset Management include- Lowe's Companies Inc, NorthWestern Corp, Norfolk Southern Corp, Consolidated Edison Inc, and Medtronic PLC.

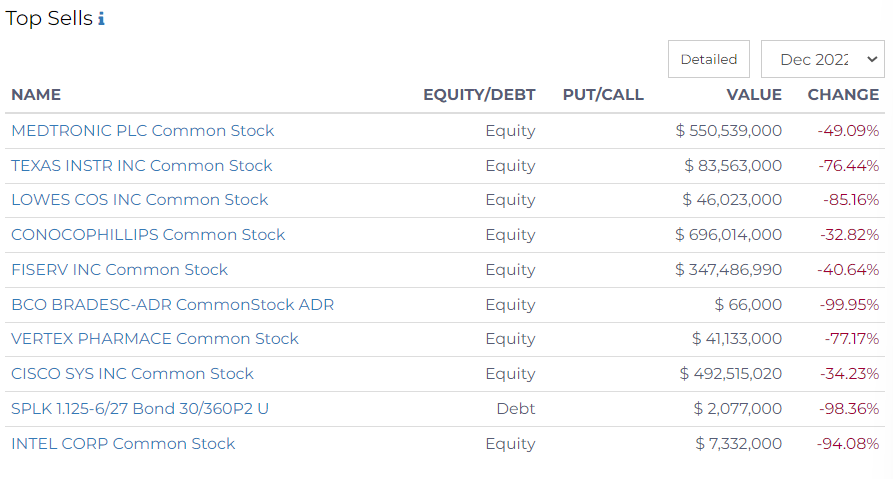

Lazard reduced their investment in LOW by 1.9M shares and bought 1.1M shares of NSC during the last quarter. Lazard Asset Management LLC reduced its investment in Medtronic PLC by 2.2M shares. The stock traded for an average price of $89.87 during the quarter.

Track the complete 13F filing of Lazard Asset Management on RADiENT.

Highlander Capital Management

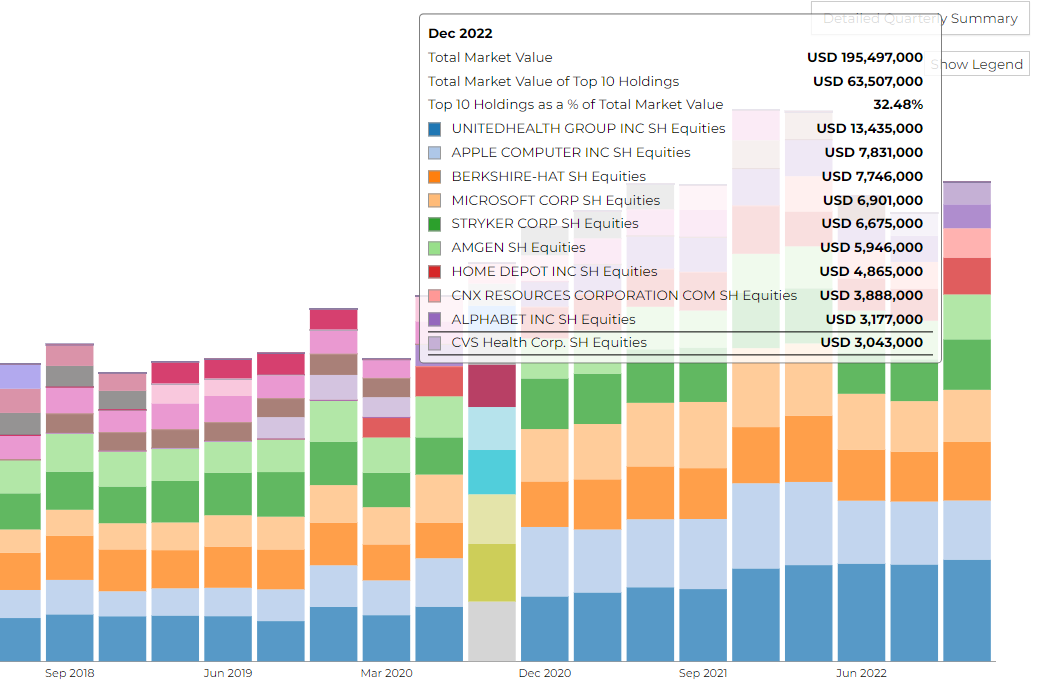

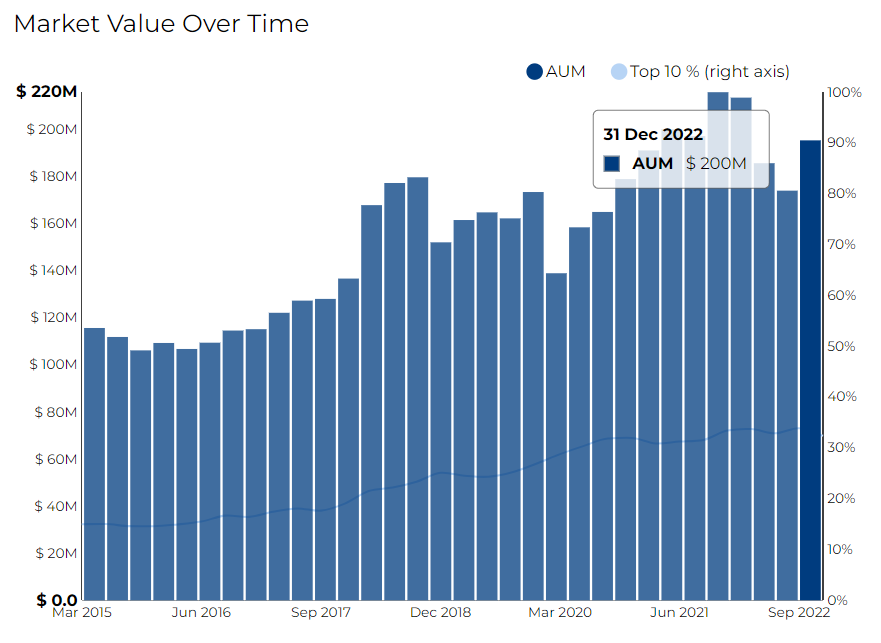

Highlander Capital Management is a hedge fund that manages over $260M in assets on behalf of 251 clients, as per their Form ADV from March 2022. The hedge fund's primary focus is on the healthcare and finance sectors. In their 13F filing for the fourth quarter of 2022, they reported managing over $191 M in 13F securities and held a top 10 concentration of 32.48%.

The firm's 13F market value as of Q4 2022 stood at $193M with a turnover of 15%. The firm added 70 new securities and entirely liquidated 33 holdings from its portfolio in the last quarter.

The top 3 holdings for this fund are UnitedHealth Group Inc at $13.4B which is in the healthcare sector, Apple Computer Inc at $7.78B, and Berkshire-HAT at $7.74B in the financial sector.

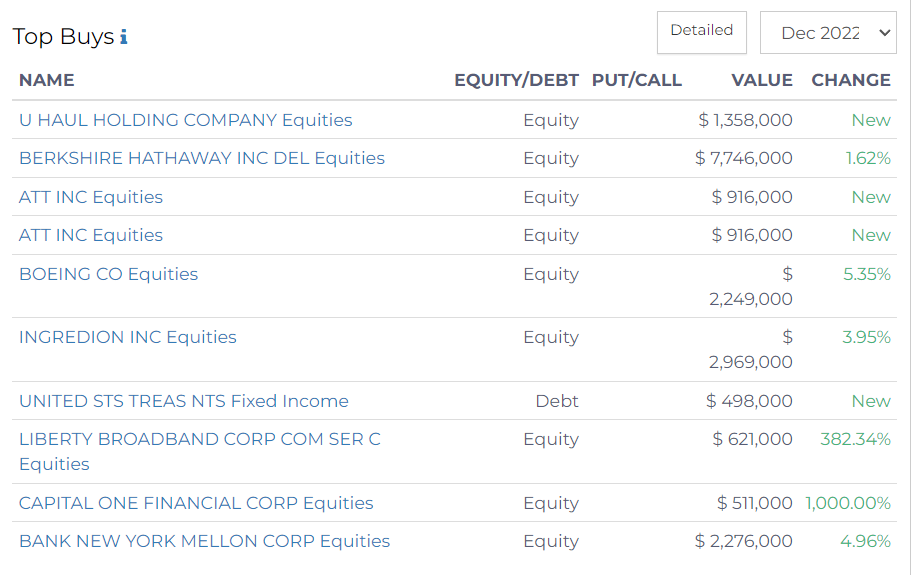

In the last quarter, Highlander Capital Management boosted its holdings in Berkshire Hathaway. Highlander Capital’s stake in Berkshire Hathaway is valued at $7.7M, followed by Ingredion Inc valued at almost $3 M, and Bank New York Mellon Corp valued at $2.2M.

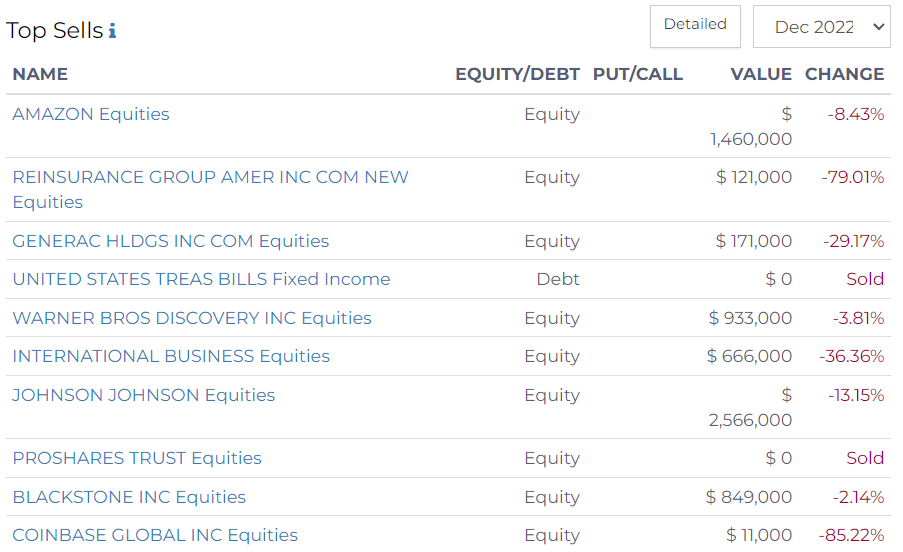

In Q4 of 2022, Highlander reduced 13.15% of their shares from Johnson Johnson equities and 8.43% of their shares from Amazon Equities.

Users can track the top holdings and other 13F performance metrics of Highlander Capital Management via RADiENT!

Ashford Capital Management

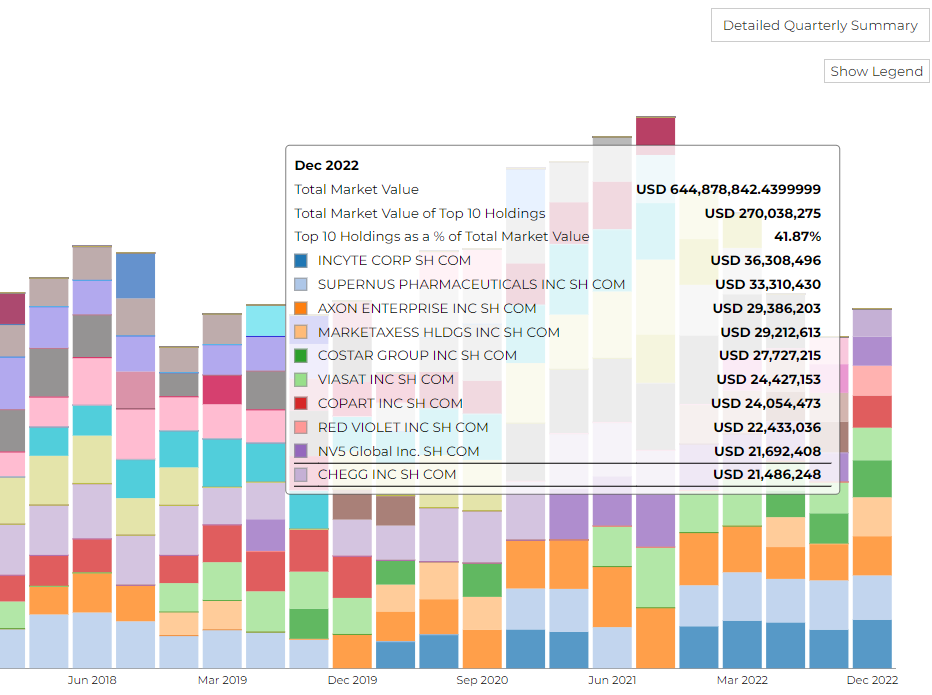

Ashford Capital Management is a hedge fund that manages a total of $809M in assets on behalf of 105 clients, according to its Form ADV filed on December 7, 2022. In its most recent 13F filing the firm disclosed $644M worth of securities and revealed that its top 10 holdings accounted for 41.87% of its portfolio.

The fund primarily focuses on the industrial and healthcare sectors.

Ashford Capital Management's largest holding is INCYTE Corporation valued at $35M. Supernus Pharmaceuticals Inc and Axon Enterprises are the other top securities in the firm's portfolio. The firm entirely liquidate 6 securities and added 4 new positions to its portfolio over the last quarter. Track the full 13F filing of Ashford Capital Management via RADiENT.

More about some of the top holdings per sector from the hedge funds above.

Microsoft

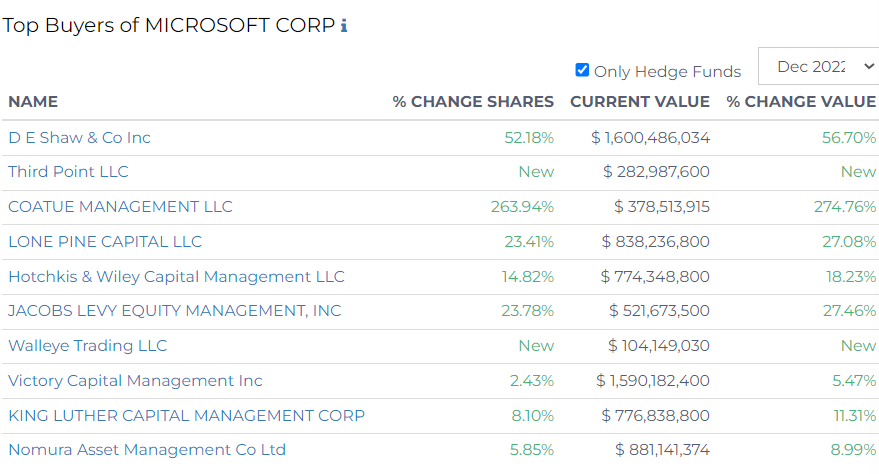

According to the recent 13F filings, the 13F value for this security at the end of 2022 stood at $6.8T with only 0.37% of its value held by hedge funds. 115 hedge funds held this security by the end of 2022.

The top hedge fund buyers of this security include- D E Shaw & Co Inc, Third Point LLC, and Coatue Management LLC.

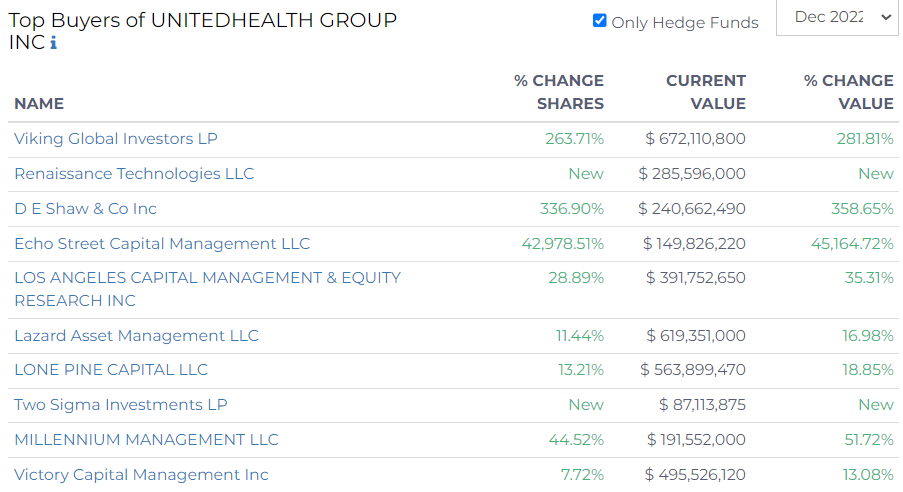

UnitedHealth Group Inc.

According to the recent 13F filings, the 13F value for this security at the end of 2022 stood at $2T with only 0.61% of its value held by hedge funds. 72 hedge funds held this security by the end of 2022.

The top hedge fund buyers of this security include- Viking Global Investors LP, Renaissance Technologies LLC, D E Shaw & Co, and Echo Street Capital Management.

The hedge funds that sold out most of this security from their portfolio include- Sanders Capital LLC, Eagle Capital Management, and Clearbridge Investments. Balyasny Asset Management, a Chicago-based hedge fund completely liquidates this security from its portfolio over the last quarter.

Visa Inc.

According to the recent 13F filings, the 13F value for this security at the end of 2022 stood at $1.8T with only 0.37% of its value held by hedge funds. 72 hedge funds held this security by the end of 2022.

Track more 13F disclosures via RADiENT!