In our previous blogs, we looked at some of the best hedge funds and their managers. In this blog, we take a deeper look at some of the top-performing fund managers of actively managed mutual funds.

Jasmeet Sodhi

Recent Posts

Form N-PORT data holds comprehensive information on equity and debt funds, and the proportion of asset classes in their portfolio over time.

In May 2021, the SEC introduced changes to the advertising and cash solicitation rule now referred to as the “Marketing Rule”—given in Rule 206(4)-1 under the Investment Advisers Act of 1940.

In March 2020, large investors bought bitcoin in sizeable blocks of more than $30 M each. This accelerated in October and reached its crest in early February 2021, when bitcoin was at a whopping $33,000. In April 2021, Coinbase, a prominent cryptocurrency platform revealed that these investors were...

Form N-PORT, introduced in 2019 by the SEC, is required to be filed by all registered management investment companies and exchange-traded funds (ETFs) organized as Unit Investment Trusts, quarterly. The form discloses comprehensive fund information such as

RADiENT released its maiden fixed income dataset on Snowflake.

Besides complete portfolio information, this dataset also contains details on performance, fund flows, and realized and unrealized gains.

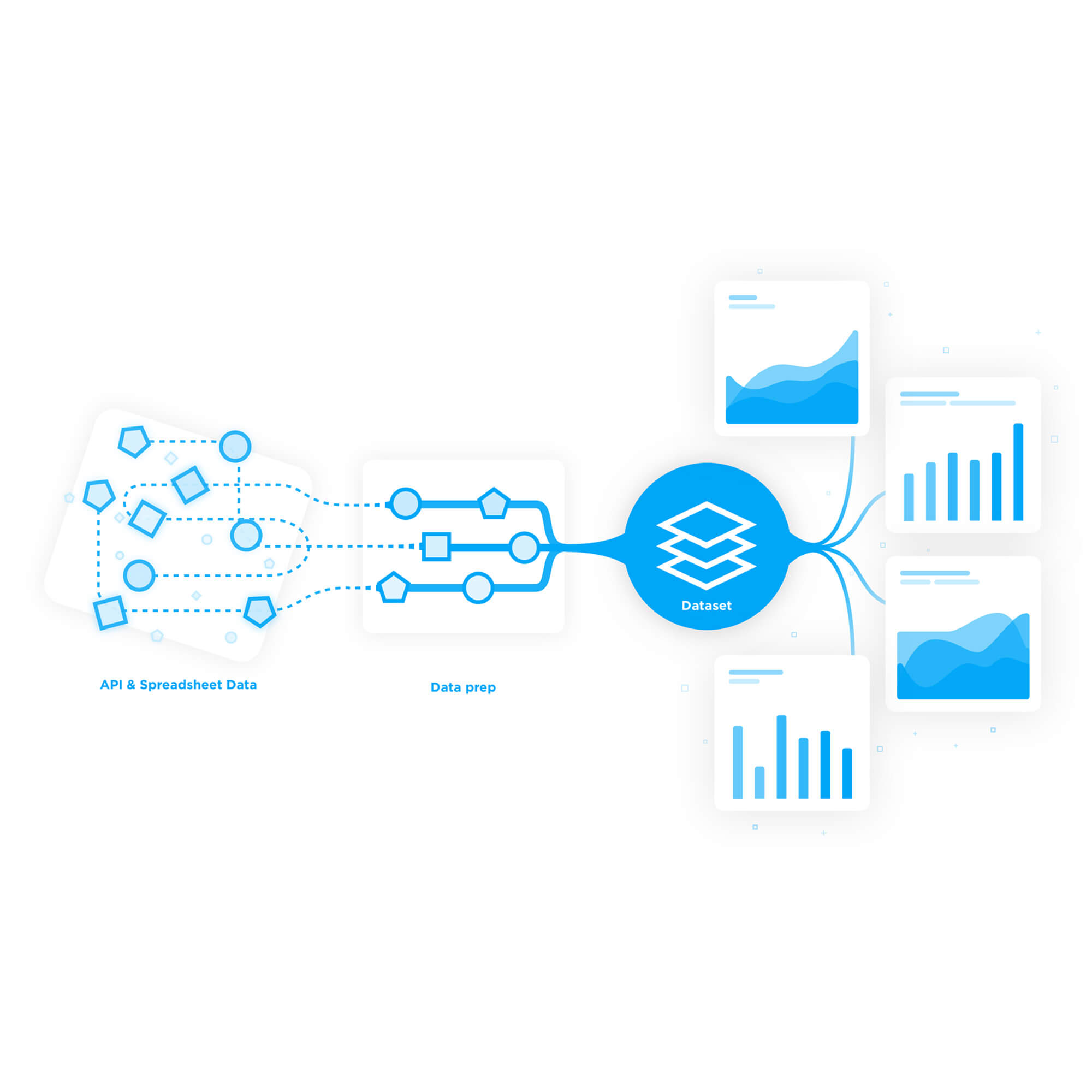

The RADiENT platform acquires, integrates, and generates insights from financial and regulatory data. This data can be accessed by users using RADiENT's interface or by subscribing to our datasets and APIs. This data allows users to track private and public funds, analyze regulatory filings and...

Cannabis stocks have been gradually gaining popularity with investors. Cannabis is illegal at a federal level in the US, however, favourable legislation is sweeping over North America – several US states have legalized recreational marijuana over the last few years, and in October 2018, Canada...

13F season has just ended! RADiENT has aggregated 13F filings across 4889 filers, with Vanguard Group Inc being the largest filer ($4T).

RIAs require up to date data on the universe of investments, to regularly advise their clients and manage their portfolios. Apart from gathering information on funds and investments, RIAs also need to stay updated with the activities of service providers in the market, the policies and investment...

A firm and its funds are serviced by several external service providers. These services providers include custodians, administrators and broker-dealers who are an important arm in the operations of funds and assist in the valuation of assets, securities lending, advice on regulations and fund...

Form ADV enables investors, advisers and service providers to gain a deeper insight into the functioning of a firm, its funds and regulatory disclosures. The form ensures that data collected from firms is exhaustive and complete, however because of the sheer volume of data and format, Form ADV is...

The US GDP has started showing signs of recovery with a 6.4% growth in Q1’2021. Economists now expect the economy to grow at the pace of 10% (CNBC) in Q2 of 2021, as a result of vaccinations against COVID-19 and consumption optimism.

Q1 2021 saw a boost in personal income by 21% as personal...

Introduced along with Form NCEN, Form NPORT is filed by registered management investment companies and exchange-traded funds (ETFs) organized as Unit Investment Trusts.

The SEC introduced Form NPORT to modernize and enhance the quality of information available to users. This form records a fund’s...

Mutual Funds and ETFs attracted inflows of ~$156B in March 2021. Morningstar reported that major investor preference remains for passively managed funds. Passively traded ETFs raked in $98B, while open-end mutual funds attracted $59B.

The markets' preference for passive funds was more pronounced...

Introduced in 2016, Form N-CEN is an annual filing that focuses on providing census type information and an overview of an entire fund complex - funds, strategies, associated service providers, turnover rates, etc.

Vanguard and BlackRock are two of the largest fund and ETF houses. With AUM of over $1.5T each, both the fund houses closely track market indices, provide diversified asset exposure, and employ a host of passive investment strategies, which allow the funds to have some of the lowest expense ratios...

We are excited to announce that RADiENT has entered into a partnership with Morningstar, a global investment research platform and a comprehensive data provider. Our partnership aims to make manager research simple and more effective, by combining Morningstar’s universe of high quality fund data...

.jpg)

-1.jpg)