Mutual Funds and ETFs attracted inflows of ~$156B in March 2021. Morningstar reported that major investor preference remains for passively managed funds. Passively traded ETFs raked in $98B, while open-end mutual funds attracted $59B.

The markets' preference for passive funds was more pronounced for the equity category- passive funds attracted inflows of $57B while actively managed equity funds shed $2.3 B in March

In this blog, we compare the AUM inflows across different fund houses and categories for the quarter ended March 2021, using information from NPORT filings on RADiENT.

Passively Managed Index Fund vs Actively Managed Funds

According to a report by Morningstar, actively managed large-value funds attracted only $2.2B of the total inflows of $ 20B within the equity category in March. To better understand the fund flows of actively and passively managed US Equity funds, the following tables compare funds based on their total redemption (outflows), total sales (inflows), total assets and percentage change in these metrics from those reported on 31 Dec 2020.

Net Fund Flows are measured by subtracting share redemptions (outflows) from share sales (inflows), on monthly or quarterly basis.

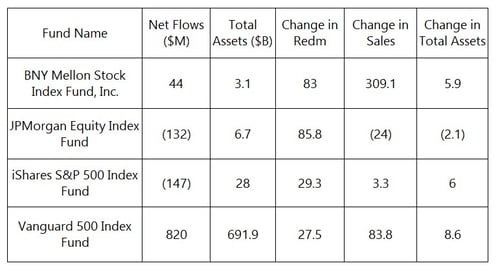

Passively Managed Index Funds

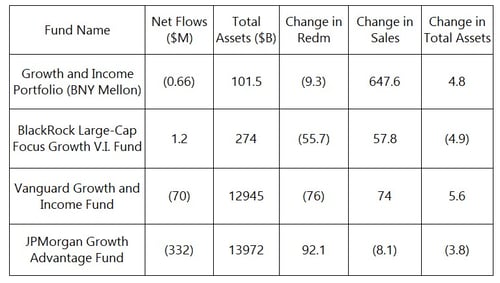

Actively Managed Funds

Key Insights:

-Index funds continued witnessing better net flows for the period ending on 31 March 2021, when compared to actively managed funds.

- Both actively managed and passively managed index funds seem to have a similar change in total assets from Q4 of 2020 to Q1 2021.

- Vanguard and BNY Mellon witnessed the maximum growth for both their active and passive funds, in terms of percentage increase in total assets based on their Q4’ 2021 filing.

-Vanguard’s index funds had the highest YoY inflow rate, compared to the other fund families.

Investor sentiment focused on passive investing could be a result of a majority of active equity managers failing to beat their benchmarks in 2020. The SPIVA (S&P indices Versus Active) scorecard showed that 60% of actively managed large-cap US equity funds, and 57% of the actively managed broad based US equity funds failed to beat their indices in 2020. “The results are even more dire when comparing performance over longer time horizons – 69.3% and 75.3% of large-cap managers lagged the S&P 500 over the most-recent three and five-year periods, respectively.”

Index-fund leaders Vanguard and iShares raked in the most assets. Vanguard collected roughly $42 billion assets in March, over 95% of which went to passive strategies, while iShares gathered $22 billion. (Morningstar)

Additionally, Fidelity had an intake of more than $20B for the month of March 2021, majority of it was through passively managed funds. Form NPORT data on RADiENT shows that Fidelity 500 Index (FXIAX) gathered more than $6B in Feb 2021.

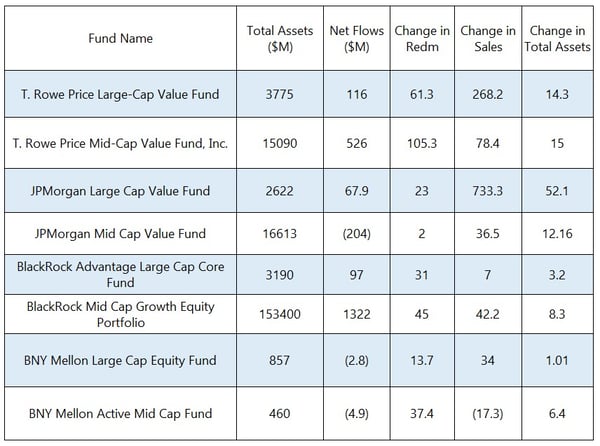

Large-Cap and Mid-Cap Funds

Comparing T.Rowe, JP Morgan, BlackRock and BNY Mellon.

The change in redemption, sales and assets of the funds is as of 31 March 2021 (Q1) in comparison to the funds flows as of 31 Dec 2020 (Q4).

(Large-Cap Funds are highlighted in blue)

Key Insights:

-Mid-cap Fund with largest outflows (by change %age): T. Rowe Price Mid-Cap Value Fund, Inc.

-Large-Cap fund with the largest increase in total Assets (by %age Change): JPMorgan Large-Cap Value Fund

-Large-Cap Fund with the highest increase in redemption (by %age change): T. Rowe Price Large-Cap Value Fund

The data also shows that T. Rowe saw the highest increase in outflows in Q1’ 2021 for both it’s Large-Cap and Mid-Cap funds, when compared to its peers for the same time period.

The table shows that for the Large-cap and Mid-cap funds managed by the same fund families, Large-cap funds seem to be performing better. They saw a higher increase in sales on an average when compared to Mid-Cap funds. The percentage change in redemption per fund for Mid-Cap funds is significantly higher when compared to that of Large-Cap funds.

According to a report by NASDAQ, Large-Cap Value Funds saw the highest increase in inflows while “Small and Mid-Cap funds were largely neglected over the past year despite posting the best performances. This trend continued in Q1—Mid-Cap Value gained 16.7%, the second highest of any Small or Mid-Cap grouping, yet actually lost assets over the quarter.”

ETFs

NASDAQ reports that passively managed ETFs raked in the largest amounts of funds ($210.8 B) for the Quarter ending March 2021.

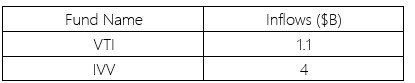

Vanguard’s Total Stock Market ETF (VTI)and iShares Core S&P 500 ETF (IVV) saw the largest inflows for ETFs in March. According to Morningstar, Vanguard topped the ETF providers league in March as the firm’s ETFs raked in ~ $30.3B.

On the flipside, Vanguard Total International Stock ETF (VXUS) lost $52.8B and Vanguard Total International Bond ETF (BNDX) and iShares iBoxx Investment Grade Bond ETF ( LQD) collectively saw an outflow of $35.3 B.

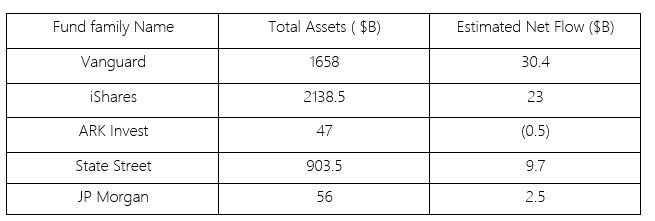

Assets and Estimated Net Flows of Largest ETF provider fund families as of March 2021.

ARK Invest’s ARK Innovation ETF, ARK Autonomous Technology and Robotics ETF and ARK Next generation Internet ETF saw an outflow of $ 34 M, $3M and $23M respectively, in January 2021.

ARK Invest known for its bets on innovation companies like- Tesla, Roku, Baidu etc, saw its fund flows plunge mostly due to the pullback in tech stocks. With the Tech sector, the energy sector also took a hit as COVID-19 took hold last spring. Of the 10 ETFs that were trading at the largest premiums and discounts, eight of the ETFs belonged to the energy sectors.

Additionally, materials sector ETFs seemed to have performed well during this period, with SPDR ETF XLB, which tracks materials companies in the S&P 500, brought in the most with $761 million of inflows. You can visit RADiENT to track the stellar performances of funds like- Guggenheim S&P 500 Equal Weight Materials ETF (RTM) and Vanguard Materials ETF(VAW).

In conclusion, it was found that Large-Cap funds and firms that focused on passively managed funds gathered the largest inflows among the largest fund families. “Vanguard, the largest U.S. firm by total assets, collected roughly $44 billion in April, 89% of which went into passive funds. iShares came in second with $16 billion of inflows, primarily accruing to its index-tracking ETF lineup. Fidelity took in more than $5 billion, powered by its passive fund businesses”.

i) https://www.morningstar.com/articles/1034016/emerging-trends-in-us-fund-flows-accelerate-in-march