The US GDP has started showing signs of recovery with a 6.4% growth in Q1’2021. Economists now expect the economy to grow at the pace of 10% (CNBC) in Q2 of 2021, as a result of vaccinations against COVID-19 and consumption optimism.

Q1 2021 saw a boost in personal income by 21% as personal consumption expenditure grew alongside investment in housing, equipment and intellectual property.

Vaccination rollouts, along with the stimulus package announced by the US government, fuelled the US dollar. McKinsey reported that spending on consumer discretionary accelerated and forecasts that more than 50% of US consumers will treat themselves particularly on categories such as apparel, beauty and electronics.

The US equities market witnessed all-time highs. The S&P 500 hit a record high, gaining 6.2% in Q1' 2021, and cyclical sectors and industries such as financials, materials and industrials outperformed their counterparts.

Small-Cap stocks surged on a stronger GDP, because of higher exposure to cyclical sectors and outperformed Large-Cap securities in Q1.

US Fixed Income

Trends show that the 10-year US Treasury yield closed at 1.74% at the end of Q1 2021 and was up by 81 base points from Q4’2020. (As of 8th July 2021, the 10-Year US Treasury yield fell as low as 1.25%, its lowest point since February).

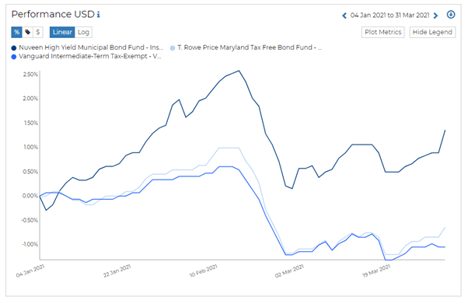

Municipal bond funds outperformed treasury funds for this quarter - visit RADiENT to explore the performance of such funds!

Comparing the Q1’21 performance of the top 3 municipal funds since Dec 2020, RADiENT data shows that Nuveen’s NHMX was the best performer followed by Vanguard’s VWITX and T.Rowe’s MDXBX. NHMX’s annualised return stood at 11.91%!

Energy sector

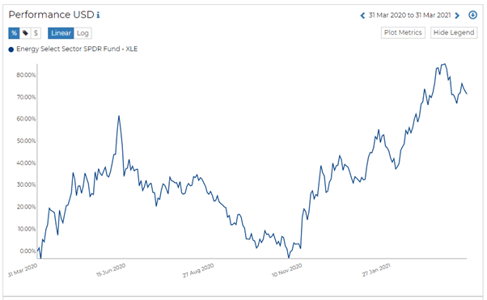

After taking a major hit in 2020, the energy sector bounced back strongly, with a return of 30.8% in Q1 2021. The SPDR ETF which tracks energy companies in S&P 5oo, returned 78% over the last 12 months. XLE holds some large securities like- Exxon Mobil, Chevron, Conoco Phillips and EOG Resources.

Forbes reports that the demand for oil and petroleum has nearly recovered to match the pre-pandemic level, thereby boosting the energy sector return for Q1 2021. FactSet classified 57 companies as “midstream” which were down by 31.9% on an average in 2020, these midstream companies returned an average of 25.6% in Q1 2021. The top 20 companies returned an average of 25,8% in the first quarter of 2021. Exxon Mobil, the sectoral leader saw a quarterly return of 35.7% followed by Chevron with returns at 25.8%. To track the movement of ExxonMobil and the other energy sector companies and funds, visit RADiENT’s securities tab!

Real Estate

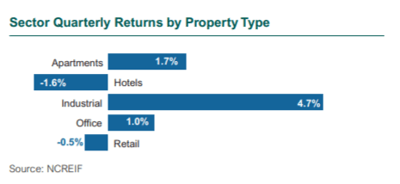

The Callan Institute reports that the hotel and retail sectors were some of the most challenged sectors. The rents collected for Q1 2021, show that industrials, apartments and office sectors reaped stable incomes, while retail suffered a decline in net operating incomes. “ Class A/B urban apartments were relatively strong, followed by Industrial and Office.”

Hedge Funds

HedgeFund week reports “ Hedge funds have made their strongest first-quarter start in more than 20 years, gaining more than 6% in the three months to the end of March, with returns powered by a mix of successful calls on deep value equities amid accelerated volatility, renewed economic optimism, and soaring cryptocurrencies.”

Equity hedge funds gained nearly 7.4% and increased hedge fund AUM to $4.416T in Q1 2021. Macro hedge funds were the big asset losers with investors pulling $4.4 B from these funds, along with long/ short equity funds which saw outflows of $3.4B.

On the flipside, Multi-Strategy funds in March 2021 saw positive net flows of $2.27B (Hedgeweek). Funds employing Event-Driven Strategies ended Q1 ’2021 with outflows worth$3.9 B whereas Macro-strategies experienced outflows of $2.3B. “ 56% of Macro-strategy funds experienced outflows, the worst performance among all hedge fund strategy categories.”( InstitutionalInvestor)

As the market recovers from the shocks of 2020, it would be interesting to track the growth and movement of funds and securities. You can track, compare and build portfolios for several securities and funds using the RADiENT platform!

i) Callan Institute, "Capital Markets Review" 2021

v) https://www.cnbc.com/2021/04/09/the-economy-is-on-the-cusp-of-a-major-boom-and-economists-believe-it-could-last.html