In our previous blogs, we looked at some of the best hedge funds and their managers. In this blog, we take a deeper look at some of the top-performing fund managers of actively managed mutual funds.

For this blog, we have considered funds with more than $1B in net assets, whose fund managers have successfully beaten category averages several times during their tenure.

Vanguard Wellington Fund (VWELX)

Net Assets: $ 105 Billion

Expense Ratio: 0.25%

Fund Strategy: Growth and Income

Turnover: 34%

Minimum Investment: $3000

Founded in 1929, Wellington Fund is Vanguard’s oldest mutual fund and USA’s oldest balanced fund. It offers exposure to stocks (about 60-70% portfolio) and bonds. Another key attribute is broad diversification—the fund invests in stocks and bonds across all economic sectors. These securities include investment-grade corporate bonds, with some exposure to U.S. Treasury and government agency bonds, and mortgage-backed securities.

Daniel Posen took over as the lead manager in July 2020 after working closely with his predecessor, Edward Bousa, since 2015 and undergoing careful vetting by both Vanguard and Wellington, the subadvisor for this fund.

Pozen targets high-quality, dividend-paying large caps with a durable edge. According to TrustNet, Daniel Pozen’s overall and rising market performance outperformed the peer group composite for 5 out 7 years.

Source: TrustNet

Source: TrustNet

RADiENT data shows that VWELX's annualized return for the last one year stands at 17.12% with a Sharpe Ratio of 2.23.

Akre Focus Fund (AKREX)

Net Assets: $11.7 Billion

Expense Ratio: 1.32%

Fund Substrategy: Growth Based

Turnover: 4%

Minimum Investment: $2000

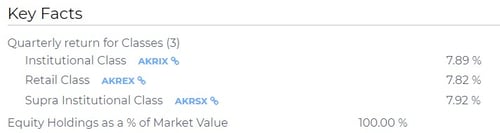

The Akre Focus Fund (Institutional share: “AKRIX;” Retail share: “AKREX”) was launched on August 31, 2009, and currently has net assets of approximately $17.8 billion (as of November 30, 2021). The Fund is non-diversified and maintains a focused portfolio of investments.

The fund was managed by Chuck Akre who stepped down at year-end 2020. John Neff, at the firm since the strategy’s 2009 launch alongside Chris Cerrone has been managing the fund since then. The managers recently sold insurer Markel MKL, a holding since inception, and have spent more time assessing software businesses Salesforce. The portfolio’s technology stake was at an all-time high of 38% in mid-2021.

The fund invests primarily in securities of companies listed on U.S. stock exchanges. Investments consist primarily of common stocks of companies of any size market capitalization. It may also invest in preferred stocks, warrants, options, and other equity-like instruments, such as partnership interests, limited liability company interests, business trust shares and rights, REITs, and other securities that are convertible into equity securities.

Nearly 71% of the fund’s total market value is influenced by its top 10 holdings, which include- Mastercard, Moodys, American Tower, VISA and O Reilly Automotive. Form N-PORT data on RADiENT shows that the fund primarily focuses on the financial, communications and real estate sectors.

The Goldman Sachs High Yield fund ( GSHIX)

Net Assets: $2.2 Billion

Expense Ratio: 0.74%

Fund Strategy: Fixed Income

Turnover: 69%

GSHIX invests primarily in high yield, fixed income securities that, at the time of purchase, are non-investment grade securities. The fund may also invest in loans directly, through loan assignments, or indirectly, by purchasing participations or sub-participations from financial institutions.

This open-ended fixed income mutual fund employs fundamental analysis with a top-down and bottom-up security picking approach to create its portfolio.

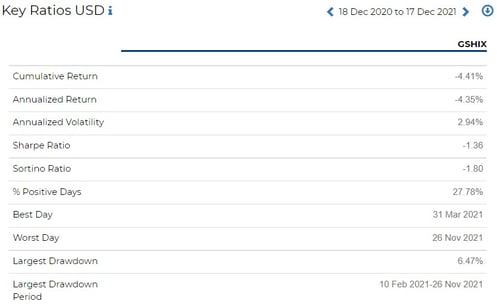

GSHIX benchmarks the performance of its portfolio against the Barclays U.S. High-Yield 2% issuer capped bond index. Goldman Sachs Trust - Goldman Sachs High Yield Fund was formed on August 1, 1997, and is domiciled in the United States. GSHIX seeks a high level of current income and may also consider the potential for capital appreciation.

The fund is managed by:

Robert Magnuson- a member of the high yield portfolio management team specializing in credit research.

Ashish Shah- Co-Chief Investment Officer of global fixed income, Global Head of corporate credit and Head of the cross-sector strategy within fixed income.

Lori Pomerantz- Portfolio Manager on Goldman Sachs Asset Management, L.P

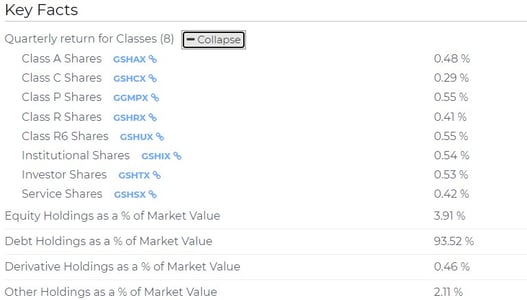

Latest Form N-PORT data on RADiENT shows that debt holdings contribute nearly 93.5% to GSHIX’s market value. For the period ending Sept 2021, the fund liquidated 120 securities which include- American Axle, PQ Corp, and Quikrete Holdings. The fund also significantly increased its holdings in Goldman Sachs Financial Square Government Fund and CCO Holdings.

To find and track such funds and their performance, visit RADiENT!

To know more reach out to us at support@radientanalytics.com