Form N-PORT data holds comprehensive information on equity and debt funds, and the proportion of asset classes in their portfolio over time.

RADiENT data is updated daily to capture all restatements and amendments in the SEC mandated Form N-PORT. In our blog, we track the growth in the debt funds since the inception of the filing, and focus on the largest funds in this category.

DEBT FUNDS

According to RADiENT data, at the end of December 2019, only 7 debt funds filed Form N-PORT. This includes BNY Mellon Alcentra Global Multi-Strategy Credit Fund, BNY Mellon Variable Investment Fund and Homestead Trust Funds.

However, by the end of December 2020, there were 8463 debt funds disclosing their portfolios. Nearly 3,717 funds have over 90% of their holdings allocated to fixed income instruments.

The top 5 purely debt funds (>95% of holdings are allocated to debt instruments) with the largest market value, as of December 2020 are as follows:

|

Fund Name |

Proportion of Debt |

Market Value (USD) |

|

Vanguard Total International Bond Index Fund (BNDX) |

99.5% |

$156 B |

|

Vanguard Intermediate-Term Tax-Exempt Fund (VWITX) |

98.35 |

$79B |

|

iShares J.P Morgan USD Emerging Markets Bond ETF ( EMB) |

99.8% |

$67B |

|

Vanguard Short-Term Bond Index Fund (BSV) |

99% |

$58B |

|

iShares iBoxx Investment Grade Corporate Bond ETF (LQD) |

95.7% |

$57B |

As of 15 September 2021, there are 7,149 funds with more than 50% of their holdings in debt instruments.

The top 5 funds with the highest market value and more than 95% of their holdings in debt as of 15 September 2021 are as follows:

|

Fund Name |

Proportion of Debt |

Market Value (USD) |

|

Vanguard Total International Bond Index Fund (BNDX) |

98% |

$165B |

|

Vanguard Intermediate-Term Tax-Exempt Fund (VWITX) |

97.5% |

$86B |

|

Vanguard Short-Term Bond Index Fund (BSV) |

99.3% |

$67B |

|

iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) |

95% |

$60B |

|

Vanguard Short-term Inflation-Protected Securities Index Fund (VTIP) |

99% |

$50B |

The tables show that Vanguard is the market leader in terms of the market value of the funds and by the proportion of holdings in debt instruments.

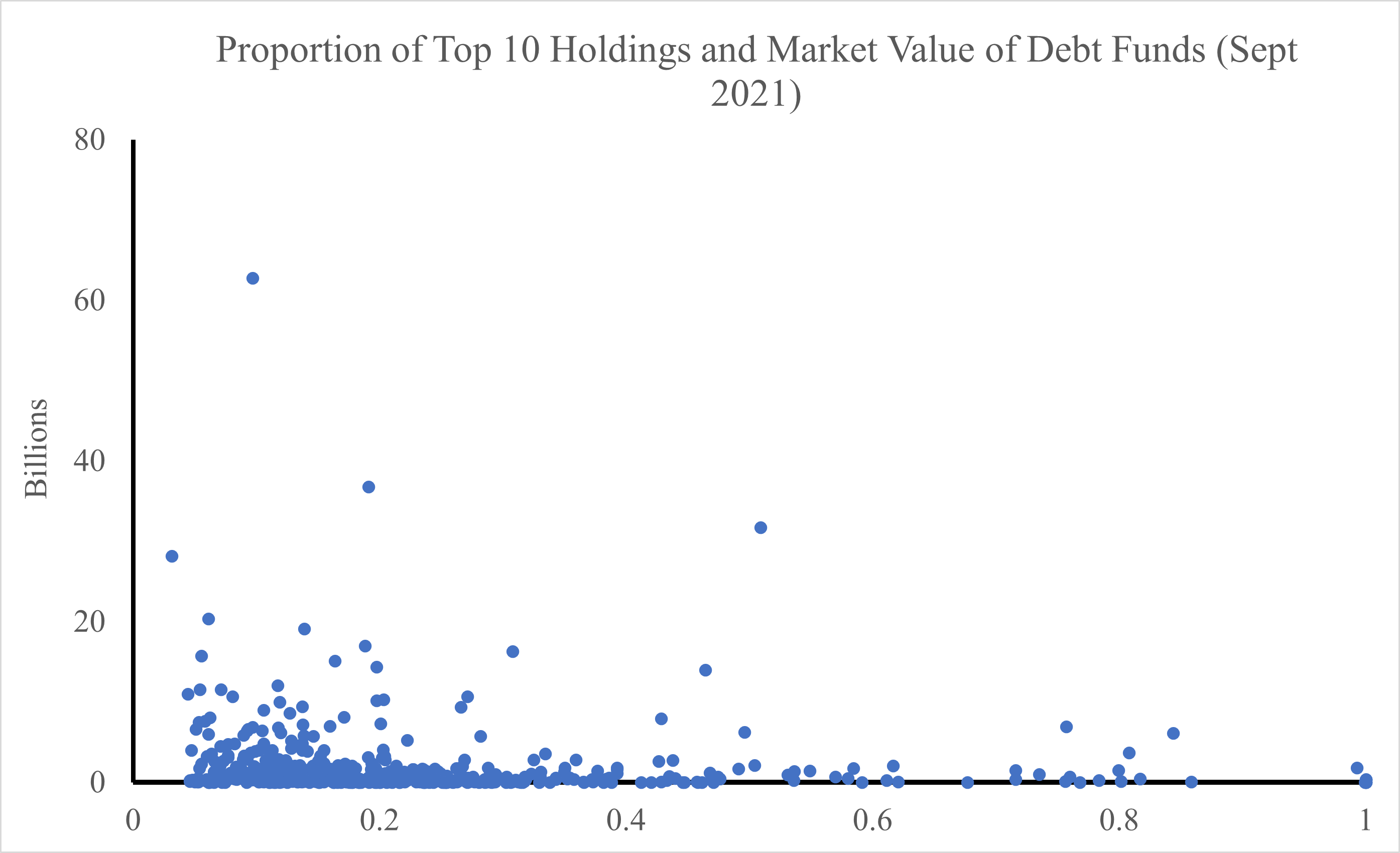

The following graph shows the total market value and the proportion of the top 10 holdings in the portfolio of all debt funds filing Form NPORT in Sept 2021

The graph shows that the majority of funds with high market value have not alloted a significant proportion of their portfolios to their top 10 holdings.

Debt Funds (March 2021)

The top 5 funds with the highest market value and debt holdings between 90-100% for the quarter ended in March 2021 are managed by Vanguard and iShares.

|

Fund Name |

Fund Group |

|

Vanguard Short-Term Bond Index Fund (BSV) |

Vanguard Bond Index Funds |

|

Vanguard Intermediate-Term Bond Index Fund (BIV) |

Vanguard Bond Index Funds |

|

Vanguard Short-term Inflation-Protected Securities Index Fund (VTIP) |

Vanguard Malvern Funds

|

|

Vanguard Inflation-Protected Securities Fund (VIPSX) |

Vanguard Bond Index Funds |

|

iShares TIPS Bond ETF (TIP) |

iShares Trust |

These funds were also the top-ranking funds in March 2020.

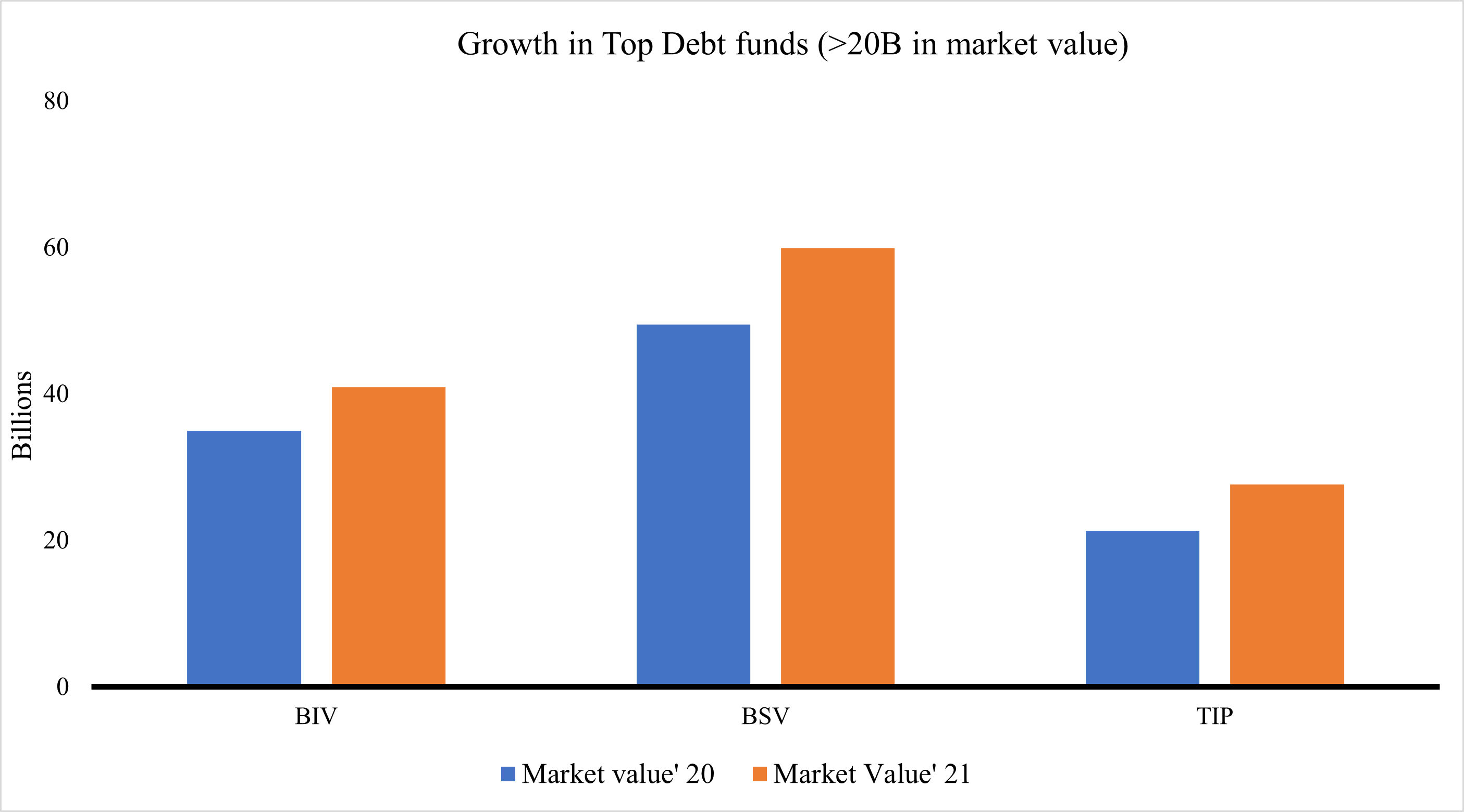

Top Debt Funds in 2020 and 2021

- Funds and ETFs of Vanguard and iShares have maintained their positions in the market as the largest debt funds.

- iShares TIPS Bond ETF (TIP) grew the most at ~30%. Whereas Vanguard’s BIV grew 17% and BSV 21%.

- EMB ( iShares J.P. Morgan USD Emerging Markets Bond ETF) was one of the top debt funds in March 2020 but was replaced by IGOV ( iShares International Treasury Bond ETF) in 2021.

- In Sept 2021, all the funds that filed Form NPORT 19 funds were categorised as inflation funds

Users can access Form NPORT data via RADiENT or through the cloud platform-Snowflake! To know more, write to us at support@radientanalytics.com