13F season has just ended! RADiENT has aggregated 13F filings across 4889 filers, with Vanguard Group Inc being the largest filer ($4T).

In this blog, we explore the buys, sells and sectoral preferences of some of the most popular hedge fund managers

General trends on RADiENT show that:

-Geode Capital Management continues to be the largest hedge fund filer for Q2 2021.

-MSFT is the top holding by value across all funds. RADiENT data shows that 276 hedge funds hold this security.

-Alibaba faced a brutal quarter after China’s regulatory crackdown. 377 13F filers reduced their holdings in this security.

-Warren Buffet continues accumulating Kroger Shares while selling investments in the healthcare space.

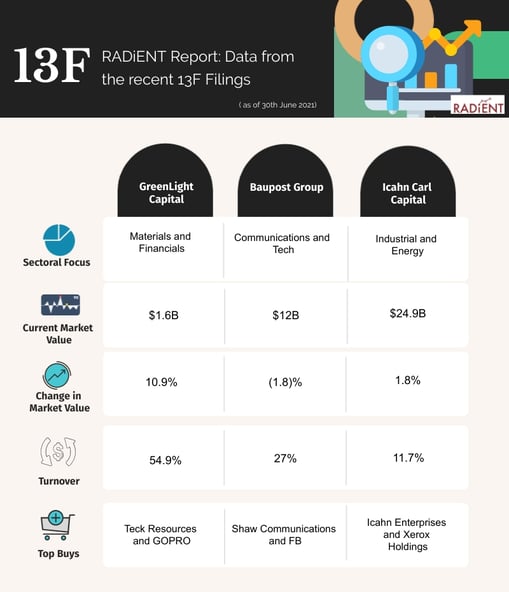

Using Form 13F data on RADiENT, we have compiled a comparative review of three popular hedge fund managers with AUM ranging from $1.6B to $24B ( all the data is as of 30th June 2021).

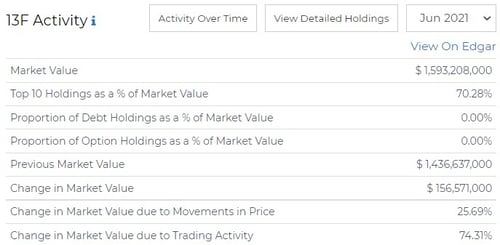

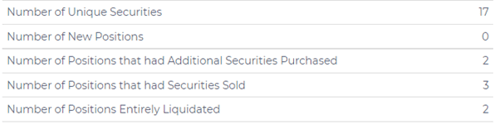

13F data shows that David Einhorn’s Greenlight Capital’s top 10 holdings contribute to nearly 71% of the total market value of holdings. This fund’s largest holding is Green Brick Partner Inc. This security is valued at $396M in the latest portfolio and represents 24.8% of Einhorn’s total holdings.

Teck Resources was the largest addition of the fund this quarter and represents 5.85% of the portfolio, valued at $93M. The portfolio structure shows that Einhorn is currently inclined towards investing in capital goods, technology and financials.

The fund completely sold out its holdings in ADT Inc, FSRX and ALIT.

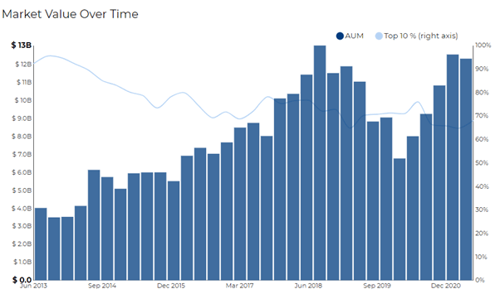

Seth Klarman’s Baupost Group’s top bought securities are SJR at $218M, FB at $537M and Micron Tech at $608M. The top 10 holdings contribute to ~68% of the fund's total market value. Baupost saw a reduction of 1.8% in its AUM since its last 13F filing. Klarman's portfolio currently shows a preference for technology and consumer services.

RADiENT data shows that the change in market value due to movement in price is nearly (220%), whereas the change in market value due to trading activity is +320.1%. Baupost increased its holding in Micron by 32% and Theravance Biopharma by 13.5%, and both securities fell by (14%) and (43%) respectively, in August. Theravance has been losing ground ever since the phase 2 trial for an oral drug failed to meet its primary endpoint.

Nearly 20% of the fund’s portfolio is allocated to LBTYK (Liberty Global PLC) valued at $1.4B, and Intel at $1.2B. Interestingly, Baupost has been trimming its holdings in Intel this quarter. The fund completely exited 6 securities – FOXA, FOX, PEAK, DBRG, JOBY and FNF.

Carl Icahn’s hedge fund has a total AUM of ~$24.9B and witnessed a growth of 1.8% in market value from the last quarter. The fund is highly concentrated, and its top 10 holdings contribute to 92.6% of the fund’s total market value. The fund increased its holdings in the Icahn Enterprises, which now represent 53.8% of the portfolio.

The fund is heavily focused on industrials(57.9%) and energy (18.15%).

Occidental Pete Corp (OXY) is the second-largest security held by this fund at a value of $1.4B, nearly 6% of the portfolio. However, the fund sold out of OXY shares worth $1.5B and reduced its allocation to the stock by 43% from the last filing. Other large exits include Herbalife and Tenneco Inc.

You can easily analyze more 13F Filings via RADiENT! To know more, sign up or reach out to us at support@radientanalytics.com