Form N-PORT, introduced in 2019 by the SEC, is required to be filed by all registered management investment companies and exchange-traded funds (ETFs) organized as Unit Investment Trusts, quarterly. The form discloses comprehensive fund information such as

- portfolio holdings,

- risk metrics,

- and information on fund flows

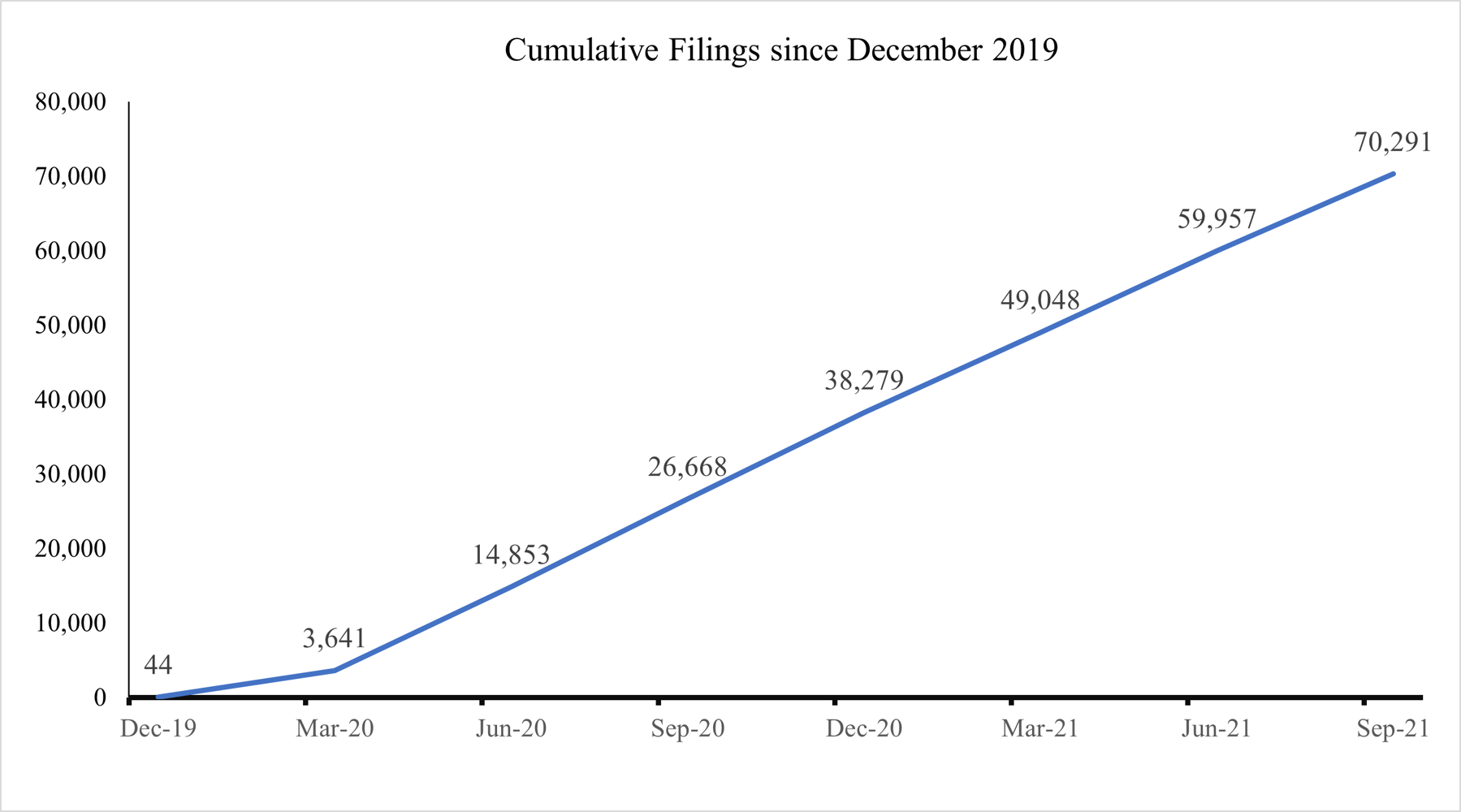

As of Oct 2021, RADiENT has portfolio data sourced from over 70,000 filings.

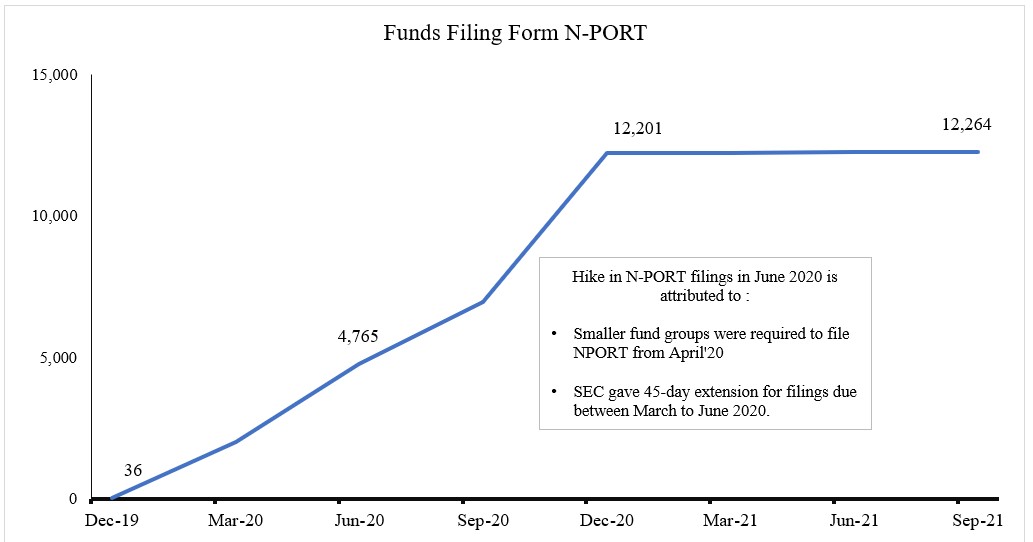

RADiENT extracts N-PORT data daily, and structures this information, to provide portfolio insights to its users. Users can access historical filings data for over 12,000 funds and derive professional insights on manager performance.

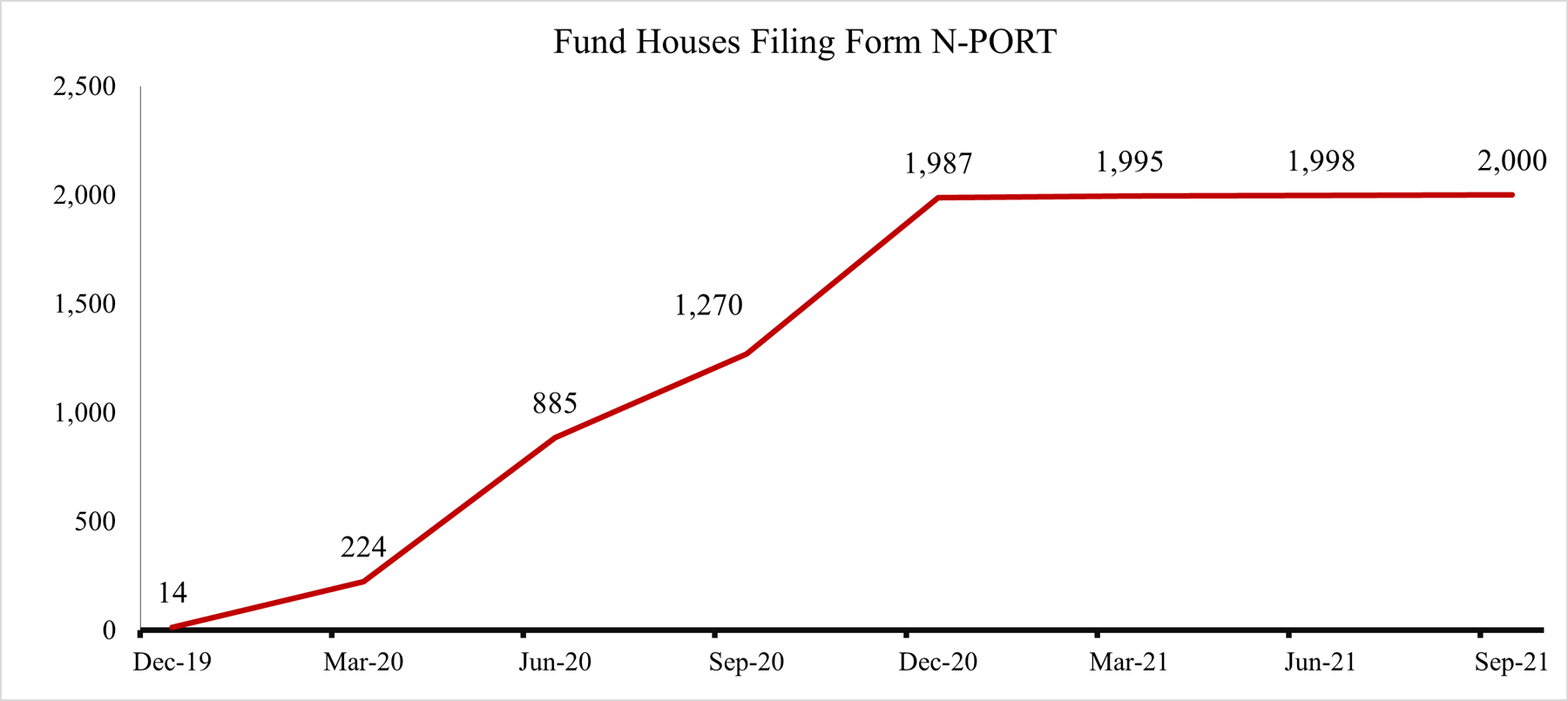

Firms and Funds on RADiENT ( as of 15th September 2021)

The following graphs show the total number of funds and firms, whose information from regulatory filings is housed on RADiENT. This information is further linked to performance and benchmark data from leading providers such as Morningstar and HFR.

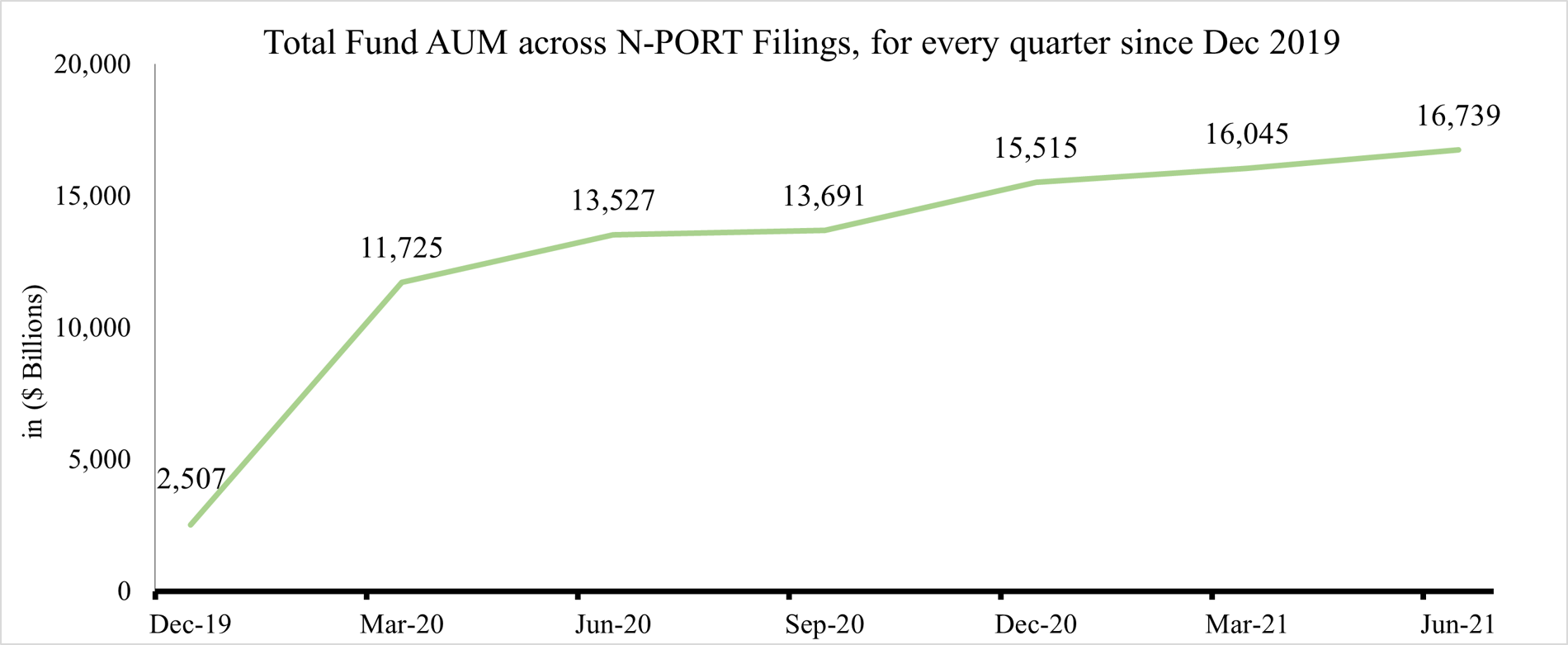

As a larger number of firms and funds come under the ambit of Form N-PORT, the total AUM disclosed via Form N-PORT has increased significantly. Since March 2020, the AUM disclosed on Form N-PORT has increased ~20 times. This data includes disclosures by all funds other than money market funds and SBICs.

This graph shows that recorded AUM increased nearly 3 times since Sept 2020.

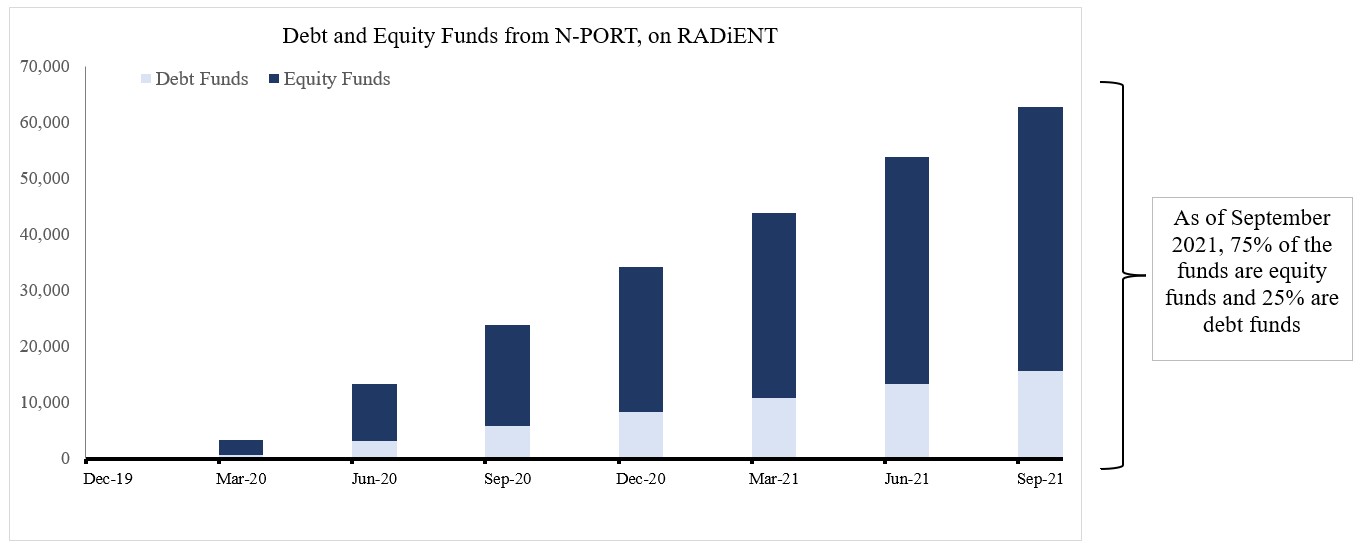

Fund Composition Types: Equity and Debt Funds

Form N-PORT contains portfolio information for equity, debt and alternative funds. Debt funds are funds that primarily invest in fixed income instruments such as government bonds, corporate debt securities, money market instruments, etc., while equity funds allocate a majority of their portfolio to equity instruments

The number of equity funds filing Form N-PORT grew from 2,558 on March 2020, to 33,105 in March 2021 and 47,290 as of 15th September 2021

Debt funds increased from 772 as of March 2020 to 15,618 as of 15th September 2021.

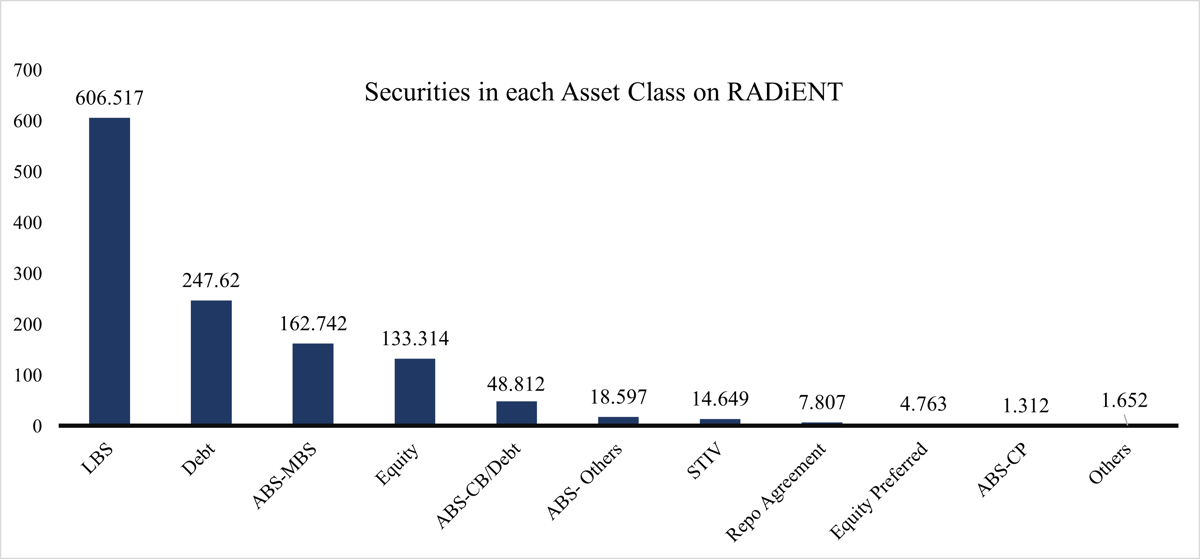

Asset Classes on N-PORT

(as of 15th September 2021)

Others include: commodities, real estate and Security Notes

Others include: commodities, real estate and Security Notes

- The category of Loan Backed Securities contains the highest number of securities on N-PORT on RADiENT, followed by Debt and Mortgage Backed Securities

- Loan Backed securities are different from Mortgage Backed Securities, as the former are bonds backed by a pool of loans. The types of loans can be car loans, credit card debt, student loans and even solar power loans, but they do not include mortgages.

- Top 3 MBS funds by value are : iShares MBS Bond ETF, SPDR Portfolio Mortgage Backed Bond ETF and Vanguard MBS ETF.

Users can access fund level disclosures such as portfolio holdings and risk metrics via Form NPORT on RADiENT or by reaching out to us at support@radientanalytics.com

RADiENT’s first dataset on fixed-income holdings can also be found on the cloud platform – Snowflake Data Marketplace!