RIAs require up to date data on the universe of investments, to regularly advise their clients and manage their portfolios. Apart from gathering information on funds and investments, RIAs also need to stay updated with the activities of service providers in the market, the policies and investment strategies followed by the other RIAs etc. The majority of such information can be extracted from Form ADV of firms.

Form ADV captures a large spectrum of data that RIAs can gather information on

-The executive body of other RIAs, as well the direct owners of the RIAs. This information can help RIAs find firms with similar structures

-All the branches and global offices of its peers

-Affiliations between different advisors and broker-dealers

-Disciplinary disclosures by firms

-Unsatisfied judgment and liens, investment-related arbitrations and civil judicial action

-The majority of client types its competitors serve

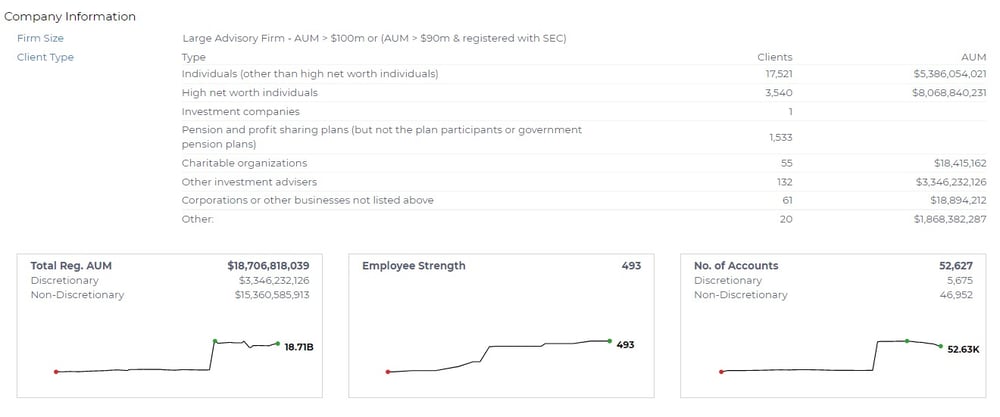

-The kind of accounts its peers hold- discretionary or non-discretionary

-The investment strategies and investment instruments employed

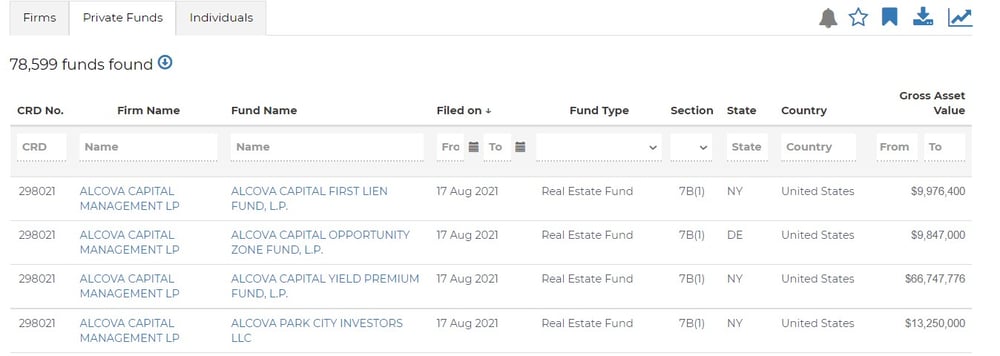

-Private fund activities

RIAs can also choose to search for individual investment adviser representatives and track their professional conduct and background, including current registrations, employment history, and disclosures about certain disciplinary events involving the individual.

How RADiENT enables its users to access this data?

RADiENT improves analysis efficiency and communication for the RIAs. Without the availability of a platform that aggregates information, it would become tedious for RIAs to search for certain fields across individual Form ADV filings, for different firms.

Searching by Client Type Served

RADiENT provides a breakdown of the client types any RIA firm serves along with the Total AUM under each of these client categories. The client composition of a firm gives a general understanding of the population the company serves, the risk aversion of the clientele and the reason behind the growth of such RIAs.

Additional Client Information

Via RADiENT, RIAs can easily extract information on the client interaction of other firms. Example one can look up if the RIA firm has custody of any advisory client’s cash or bank accounts or securities.

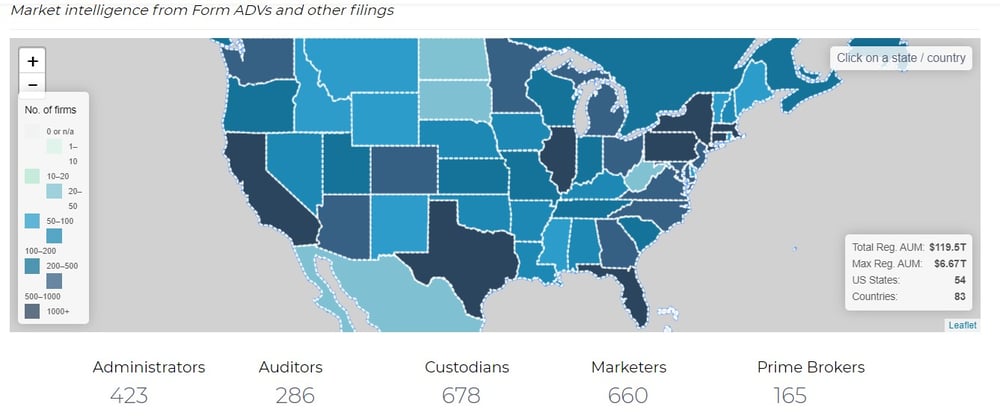

Service Providers Profile

For new fund managers or existing RIAs, it is important to find service providers who fit in with the firms' policies and procedures. The RADiENT platform provides users with a consolidated list of all the service providers, the number of funds and firms they service and the total GAV they handle. Users can also create custom lists when researching service providers using a combination of filters they want.

Employee Details

Alongside gathering information on the number and designation of employees, RIAs may also be interested in knowing how many other RIA firms employees are registered representatives of a broker-dealer or licensed agent of an insurance company etc. RADiENT makes sure that such information is readily available to its users

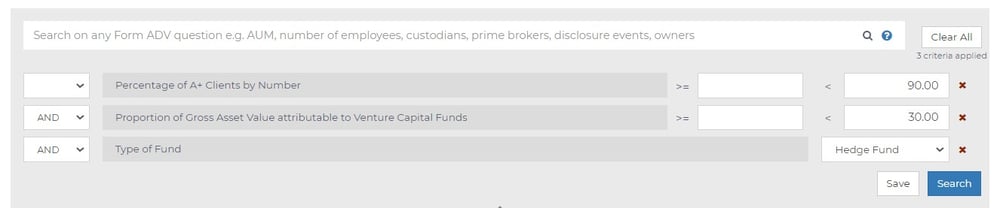

RADiENT enables users to look up any question asked on the Form ADV filing alongside several filters. For eg one can search for “ Registered Prime brokers, type of funds and the latest date of filling” to look at category-specific service provider information.

Market and Investment Insights

With RADiENT, RIAs can easily gather information on the M&A of firms and gain insights on alternative investment products that may not be available to wirehouse advisors

Filter by location

One can also search for other RIAs using a location filter along with a combination of other filters like- Total Registered AUM, Growth in AUM etc.

Market Intelligence on Non-Traditional investments

RIAs can gather information on firms involved in non-traditional investments to gain market intelligence. A study showed that “Only 40% RIAs surveyed felt comfortable with their knowledge of PE funds”. RADiENT makes sure that RIAs have access to up to date consolidated information on PE, real-estate and other investment funds.

Easy Analysis and Forecasting

Lastly, RADiENT provides RIAs with a complete analysis of their investments, financial forecasting and planning, compliance and reporting oversight, and more.

To know more about the RADiENT platform reach us at support@radientanalytics.com