Top Buyers and Sellers in NVIDIA's Equity: Insights from latest 13F Filings.

NVIDIA Corporation, a global leader in the technology sector, specializes in the production of graphics chips for personal computers. The company is structured into three segments: the Graphics Processing Unit (GPU) Business, the Professional Solutions Business (PSB), and the Consumer Products Business (CPB).

NVIDIA's mobile processors and GPUs are used extensively across multiple platforms and industries, from cell phones and tablets to create visual effects in movies.

The firm's core innovation lies in GPU and mobile processor technologies, with GeForce, Quadro, and Tesla as its key GPU product brands. Listed on NASDAQ, NVIDIA maintains a workforce of 11,528 employees.

This blog post will delve into the key players who have been buying and selling NVDA shares from the latest 13F filing for March 2023.

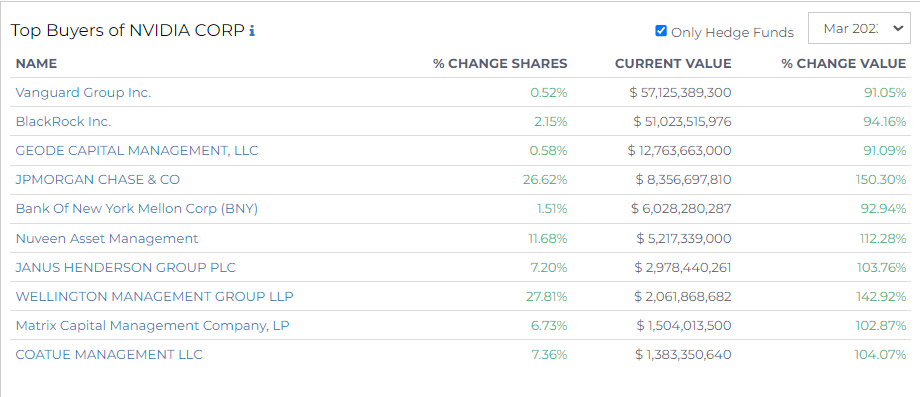

Top Buyers of NVIDIA (NVDA)

The foregoing analysis detailing the top buyers of NVIDIA Corporation is based on data and insights garnered from Radient Analytics.

Leading the pack is Vanguard Group Inc., which increased its shares by 0.52%, bringing the current value of its holdings to $57.13 billion. This represents a 91.05% change in value.

Hot on Vanguard's heels is BlackRock Inc., which saw a 2.15% increase in shares, placing the current value of its holdings at $51.02 billion - an increase of 94.16% in value.

Geode Capital Management, LLC also boosted its stake in NVIDIA with a 0.58% increase in shares, culminating in a current value of $12.76 billion. This translates into a 91.09% change in value.

A significant leap in NVIDIA shares was observed by JPMorgan Chase & Co., which raised its stake by 26.62%. This puts the current value of its holdings at $8.36 billion, marking a 150.30% change in value.

Bank of New York Mellon Corp (BNY) showed a 1.51% increase in shares, bringing its holdings' current value to $6.03 billion, indicating a change in value of 92.94%.

Other top buyers include:

- Nuveen Asset Management, which experienced an 11.68% increase in shares ($5.22 billion current value, 112.28% change in value),

- Janus Henderson Group PLC with a 7.20% increase in shares ($2.98 billion current value, 103.76% change in value),

- Wellington Management Group LLP increased its stake by 27.81% ($2.06 billion current value, 142.92% change in value).

- Rounding off the list, Matrix Capital Management Company, LP saw a 6.73% rise in shares ($1.50 billion current value, 102.87% change in value), and

- Coatue Management LLC with a 7.36% increase in shares ($1.38 billion current value, 104.07% change in value).

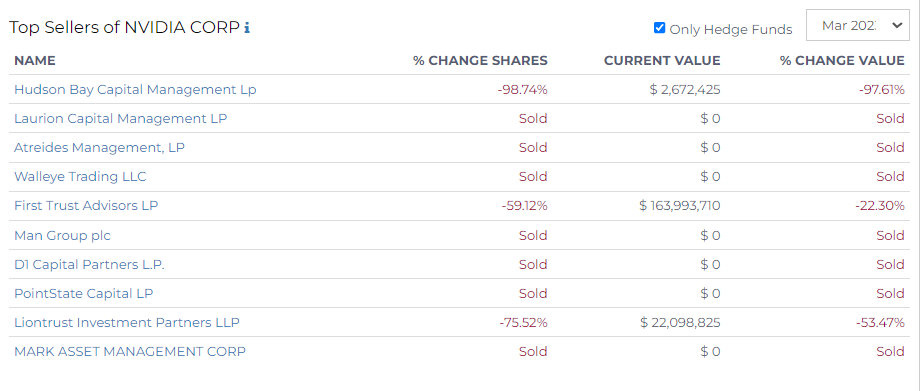

Top Sellers of NVIDIA (NVDA)

In a significant shift, several major investors have offloaded their stakes in NVIDIA Corporation, as illustrated by recent data from Radient Analytics.

Hudson Bay Capital Management Lp reduced its NVIDIA holdings by 98.74%, leaving its current value at $2.67 million, representing a 97.61% decrease in value.

First Trust Advisors LP also significantly cut down its stake by 59.12%. This reduction left the current value of its holdings at $163.99 million, marking a 22.30% decrease in value.

Liontrust Investment Partners LLP reduced its holdings by 75.52%, leaving the current value at $22.10 million - a significant decrease of 53.47% in value.

The following firms have all completely sold off their holdings in NVIDIA:

- Laurion Capital Management LP

- Atreides Management, LP

- Walleye Trading LLC, Man Group plc

- D1 Capital Partners L.P.

- PointState Capital LP

- Mark Asset Management Corp

For more up-to-date 13F and Form ADV filings, hedge fund news, and insights, explore our main blog and SEC Filings blog.