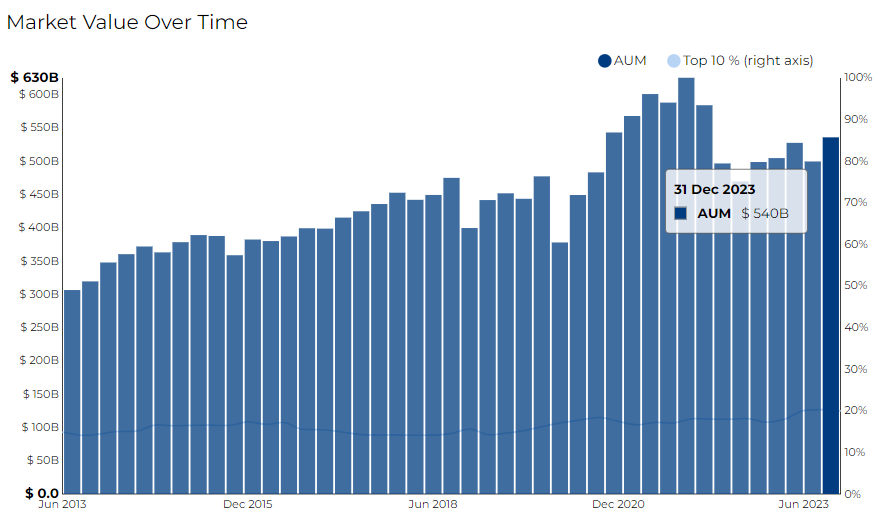

Wellington Management Group disclosed $535.7B in assets and holds 1799 securities in its portfolio. The top 10 holdings account for 20.0% of the portfolio.

The firm's largest allocation is in Healthcare, Technology, Financial Services sectors.

- Turnover: 17.95%

- Positions entirely liquidated: 161

- Number of new positions added: 162

Top Buys

Netflix Inc total holding is worth $1.8B

Change in shares: + 540.9%

Apple Inc total holding is worth $11.6B

Change in shares: 3.58%

Intuit total holding $690M

Change in shares: 173%

Securities completely sold out include:

- Match Group Inc

- Viper Energy Partners LP

- New Relic Inc

- Mirati Therapeutics Inc

Top 5 securities in the portfolio

- MSFT worth $23B

- Unitedhealth Group worth $12.8B

- Amazon worth $11.8B

- Apple worth $11.6B

- Alphabet $10.8B

Wellington Management's recent Form ADV data shows:

- A total of 1,338 clients

- 89 private funds with a total gross asset value of $36B.

- The recent ADV disclosure also lists 184 private funds that provide Wellington with their sub-advisory services.

There is a lot more that you can uncover on Wellington Management Group. To know how write to us at support@radient.io