Pfizer Inc. is an American multinational pharmaceutical and biotechnology corporation headquartered in New York City. It is one of the world's largest pharmaceutical companies by revenue and market capitalization. Pfizer develops and produces medicines and vaccines.

Pfizer is best known for its COVID-19 vaccine, Comirnaty, which was developed in collaboration with BioNTech. Comirnaty was the first COVID-19 vaccine to be approved for emergency use in the United States and Europe, and it has been widely administered around the world.

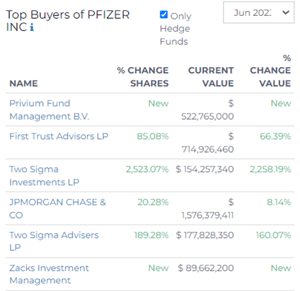

Some insights on the 13F security :

Radient data shows that 13F filers hold ~$164B of Pfizer ( #13F security) for the Q2 2023

Number of hedge funds holding security: 280

Percentage of value held by hedge funds: 41%

Top Buyer of Pfizer’s 13F security: St Germain DJ Co Inc ( $5.1B)

Privium Fund Management BV increased its holding in shares by 114% by adding 7,710 shares.

Two Sigma Investments increased their holdings in the shares by 2523% from $6.5M in value to $154M in value.

AQR Capital Management decreased its holdings in Pfizer 42%. AQR previously held shares worth $380M, by the end of Q2 2023, the value of the shares in the portfolio had decreased to $196M.

Other 13F Insights on Pfizer:

Top Seller of Pfizer’s 13F security: Brandywine Global Investment Management

The top firm holders of Pfizer are:

Vanguard Group Inc ( $18.6B)

Blackrock Inc ($16B)

Wellington Management Group ($8.5B)

Capital World Investors ($7B)

St Germain D J Co ($5.1B)

Geode Capital Management ($4B)

Access more 13F insights on Pfizer. Sign up today.