Latest 13F Disclosures: Berkshire Hathaway’s Holdings

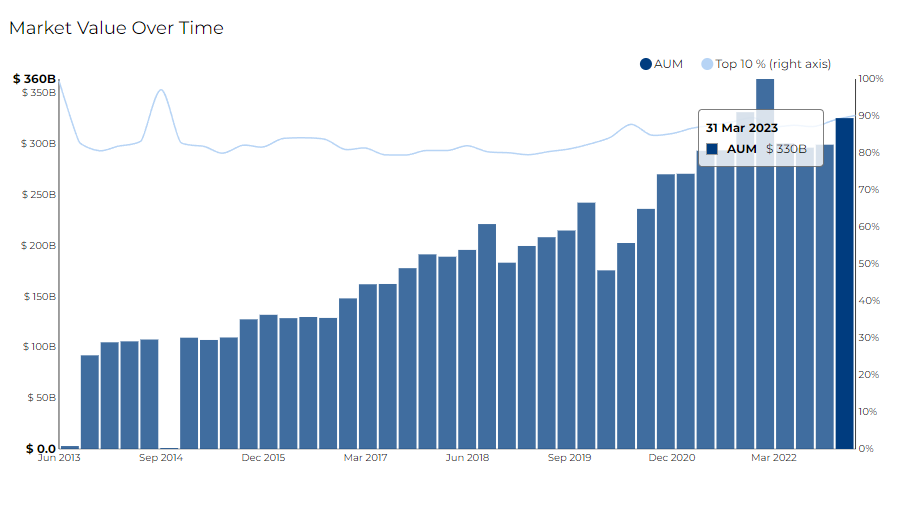

Berkshire Hathaway Inc submitted its latest 13F filing on May 15, 2023, reflecting the financial activities for the quarter ending on March 31, 2023.

In a previous blog post, Radient provided a detailed analysis of Berkshire Hathaway's performance during the Q4 of 2022. This report encompassed portfolio adjustments, market shifts, and other invaluable insights derived from the 13F filings. It's advisable to first review this Q4 2022 analysis to provide more crucial context that can aid in data-driven investment strategies.

Drawing on the data and insights gathered via Radient, the focus now turns to significant highlights, equity transactions, and sales at Berkshire Hathaway for Q1 2023, as reported in their most recent 13F filing.

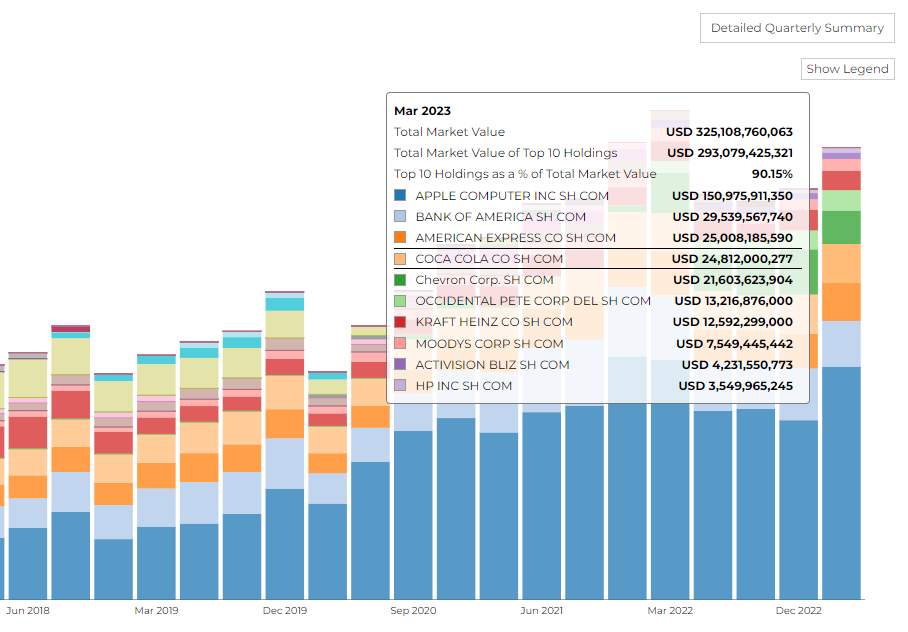

Berkshire Hathaway is a multinational conglomerate headed by Warren Buffett. The firm's 13F market value as of Q1 2023 stood at $325.10B with a turnover rate of 14.58%.

The firm has holdings in 48 securities while entirely liquidating 4 securities from its portfolio.

The top 10 holdings of the firm contribute to 90.15% of the total market value of the firm.

The top three holdings were Apple Inc valued at $150.97B, Bank of America valued at $29.53B, and American Express valued at $ 24.81 B.

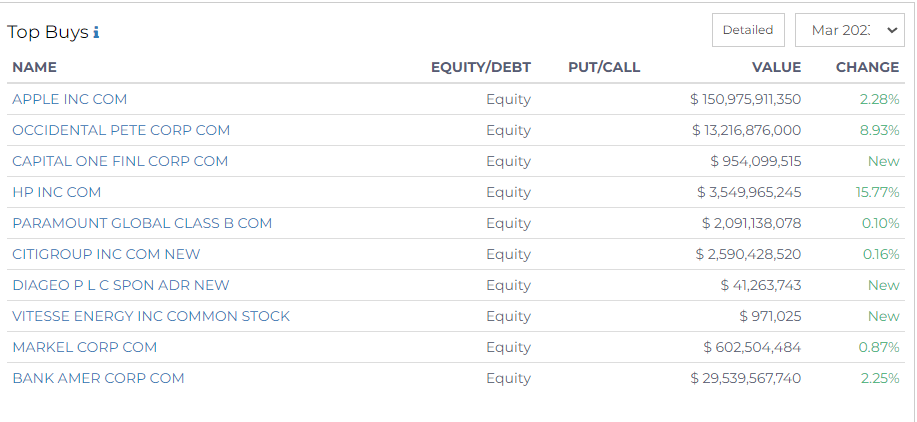

Top Buys by Berkshire Hathaway

Berkshire Hathaway revealed a series of significant investments. Let's take a look at their top 10 buys, categorized by their common sectors:

Technology:

- On top of the list in terms of current value is Apple Inc. Berkshire Hathaway has ramped up its investment in Apple Inc., increasing its stake by 2.28%.

- Meanwhile, the firm has also increased its investment in HP Inc. by 15.77%, resulting in a total value of $3.55 billion. HP Inc. is ranked at 3rd for

Financial Services:

The financial services sector has witnessed some substantial moves by Berkshire Hathaway.

- The company has strengthened its position in Bank of America, increasing its stake by 2.25%, bringing the total value to about $29.54 billion.

- Citigroup Inc. also saw an increase in stake, although comparatively minimal, of 0.16%, making its total worth approximately $2.59 billion.

- Markel Corp. too experienced a growth of 0.87%, with its total value reaching $602.5 million.

- Additionally, the firm has added Capital One Financial Corp. to its portfolio with a new investment worth approximately $954.1 million.

Energy:

Berkshire Hathaway has made strategic investments in the energy sector as well.

- Occidental Petroleum Corp. saw an impressive 8.93% increase in investment, making its total worth around $13.22 billion.

- Furthermore, Berkshire has initiated a new stake in Vitesse Energy Inc., albeit small, valued at around $971,025.

Media and Entertainment:

In the media and entertainment industry, Paramount Global Class B witnessed a slight rise of 0.10%, resulting in a total value of about $2.09 billion.

Alcoholic Beverages:

Berkshire Hathaway also ventured into the alcoholic beverages industry, initiating a new stake in Diageo PLC. This new investment is valued at approximately $41.26 million.

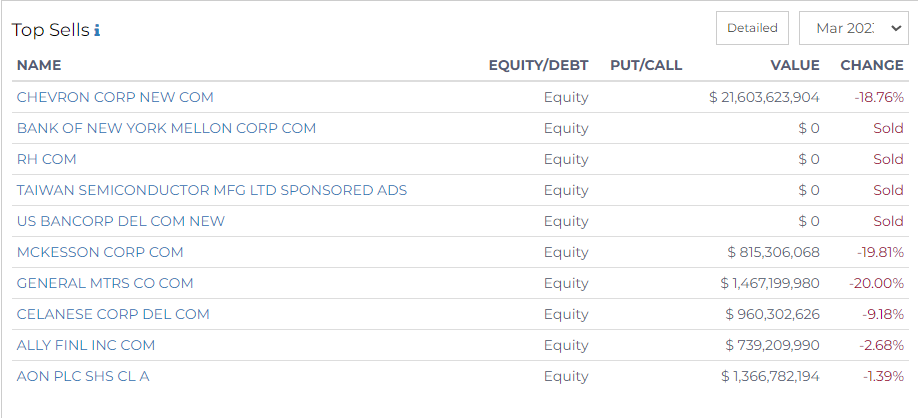

Top Sells by Berkshire Hathaway

The firm has significantly reduced its holdings in several companies and completely divested from others.

The top three sectors where the most significant divestments have been made are:

Financial Sector:

This sector has seen the most considerable divestments, with Berkshire Hathaway completely selling off its stakes in the Bank of New York Mellon Corp and US Bancorp. Additionally, it also reduced its stake in Ally Financial Inc by 2.68%, currently valued at $739 million.

Technology Sector:

Berkshire Hathaway completely divested its holdings in Taiwan Semiconductor Manufacturing Ltd.

Healthcare Sector:

Berkshire significantly reduced its stake in McKesson Corp, a pharmaceutical company, The value of the remaining stake is $815 million, reflecting a decrease of 19.81%.

Other notable sales made by the firm are:

- Chevron Corp: The value of the remaining stake is around $21.6 billion, marking a decrease of 18.76%.

- The firm completely divested its holdings in RH Com, a home furnishing company.

- General Motors Co., with the value of the remaining stake standing at around $1.47 billion, marking a decrease of 20%.

- Berkshire also reduced its stakes in Celanese Corp. valued at $960 million indicating a decrease of 9.18%.

- Lastly, the company reduced its stake in AON Plc to around $1.37 billion, marking a decrease of 1.39%.