13F Filing Review: Lazard Asset Management LLC (Q1 2023).

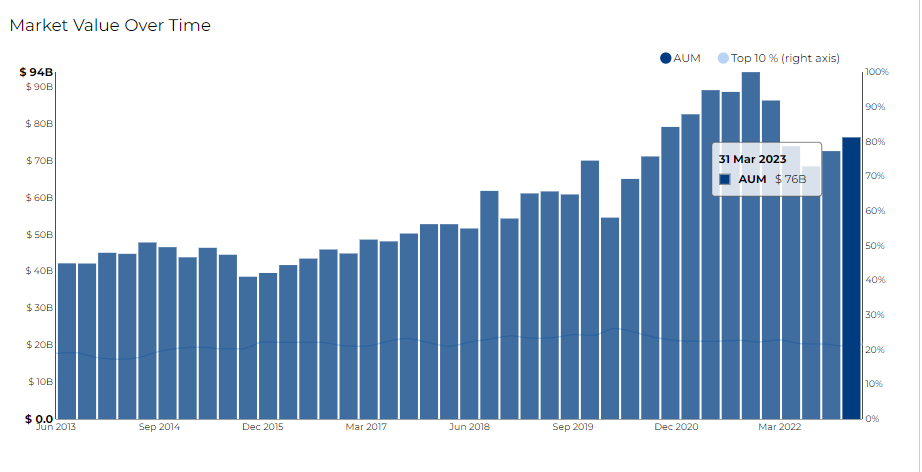

Lazard Asset Management filed its most recent 13F on 12 May 2023, for the quarter ended 31 Mar 2023.

In an earlier blog post, a detailed analysis of Lazard's Q4 2022 performance was provided.

This analysis included portfolio changes, market trends, and 13 other valuable insights. It is recommended to review this Q4 2022 analysis first.

Understanding the firm's past quarter performance can offer essential context, which can be instrumental in driving data-based investment strategies.

Drawing on the data and insights gathered via Radient, the focus now turns to significant highlights, equity transactions, and sales at Lazard Asset Management for Q1 2023, as reported in their most recent 13F filing.

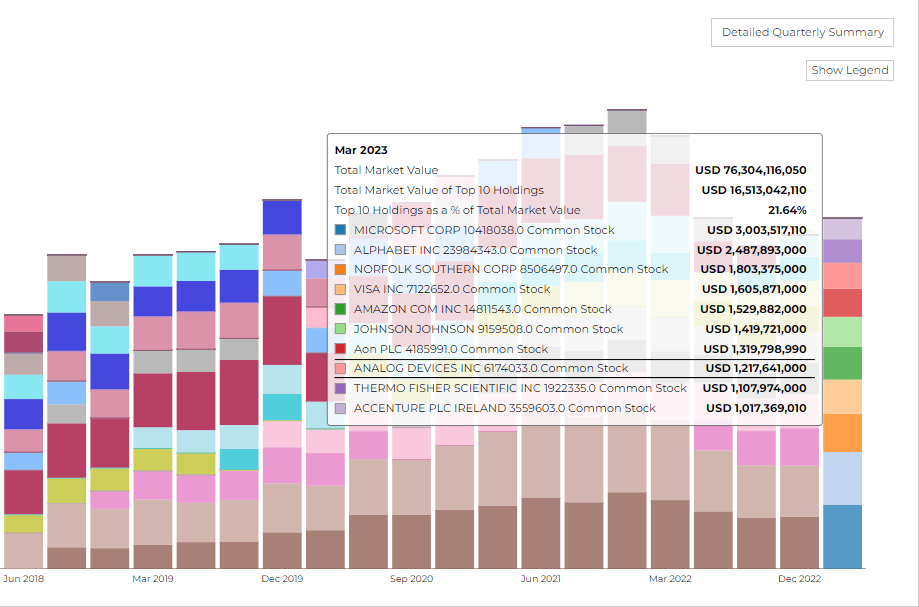

The firm's 13F market value as of Q1 2023 stood at $76B with a turnover rate of 25.60%.

The firm added 263 new securities and entirely liquidated 336 holdings from its portfolio in the last quarter.

The top 10 holdings of the firm contribute to 21.64% of the total market value of the firm. The top three holdings were MSFT valued at $3B, GOOGL valued at $2.4B, and NSC valued at $1.8B.

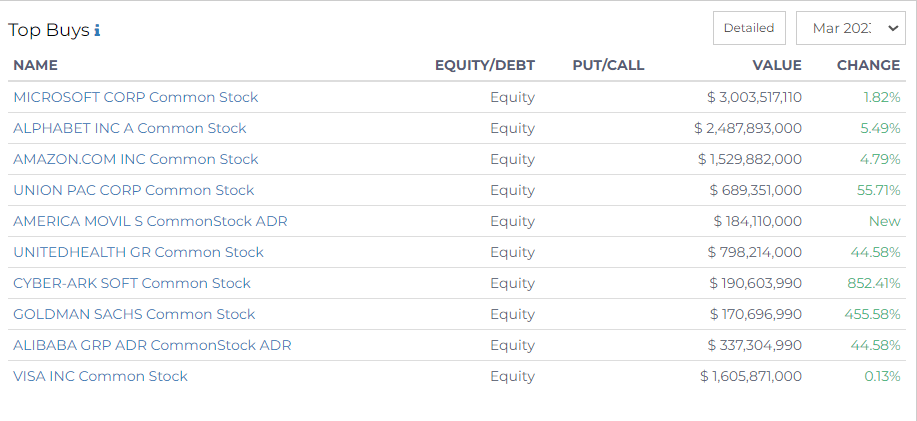

Top Buys by Lazard Asset Management

Lazard's most significant investments, as outlined in their recent 13F filing, display a strategic focus on tech industry giants and key players in the healthcare and finance sectors. The following table has been sourced from Radient.

Topping the list is Microsoft Corp, with an investment value of approximately $3 billion, marking an increase of 1.82% from the previous quarter. Following Microsoft, the firm invested $2.48 billion in Alphabet Inc Class A shares, which experienced a growth of 5.49%.

Not far behind is Amazon.com Inc, where Lazard invested about $1.53 billion, witnessing a quarterly gain of 4.79%. Next is Visa Inc. with an equity stake valued at approximately $1.606 billion, though this position saw a minimal change of just 0.13%.

The company also took large positions in the healthcare and railway sectors.

- An investment of $798.2 million was allocated to UnitedHealth Group, witnessing a gain of 44.58%.

- Furthermore, Lazard increased its stake in Union Pacific Corp, the railway company, by an impressive 55.71%, amounting to approximately $689.4 million.

Other notable buys include:

- There were significant additions to holdings in Cyber-Ark Software and Goldman Sachs, witnessing increases of 852% and 455%, respectively, amounting to $190.6 million and $170.7 million.

- Meanwhile, their stake in Alibaba Group ADR common stock saw a 44.58% increase to approximately $337.3 million.

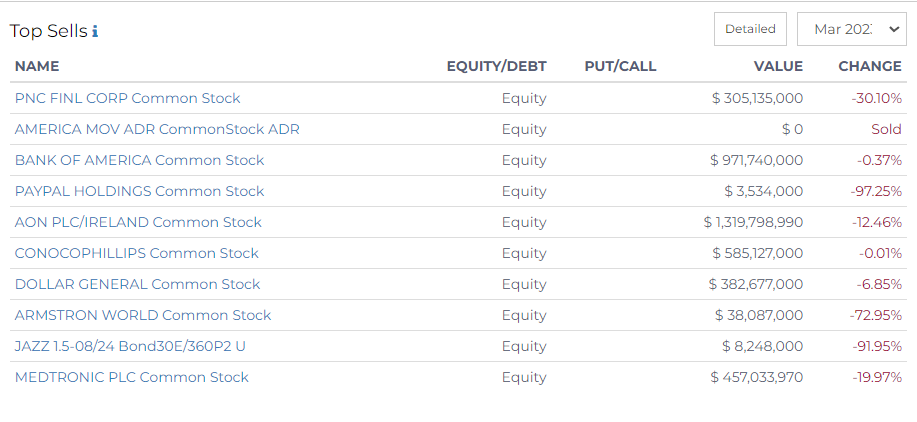

Top Sells by Lazard Asset Management

Here are the firm's top equity sales outlined in their latest 13F filing.

Lazard completely liquidated all its stakes in America Movil ADR's common stock during the quarter.

After America MoviL ADR, PayPal Holdings tops the rest, with Lazard reducing its stake by approximately 97.25%, leaving a total value of around $3.53 million.

Not far behind is Jazz 1.5-08/24 Bond30E/360P2 U, which saw a reduction of 91.95%, bringing its value to just about $8.25 million.

Armstrong World Industries also experienced a significant decrease in shares, with Lazard reducing its position by 72.95%, amounting to approximately $38.09 million.

The stake in PNC Financial Corp saw a reduction of 30.10% and left a value of around $305.14 million.

Other notable equity sales included:

- Lazard's stake in Medtronic PLC decreased by almost 20% to about $457 million.

- In the retail sector, Dollar General's stake was reduced by 6.85%, bringing its total value to roughly $382.68 million.

- Despite being the largest reduction in terms of the total value, AON PLC/Ireland's common stock saw a decrease of 12.46%, resulting in a value of approximately $1.32 billion.

- Other stocks, such as ConocoPhillips and Bank of America, experienced less significant reductions of 0.01% and 0.37%, respectively, resulting in values of approximately $585.13 million and $971.74 million.

For more up-to-date 13F and Form ADV filings, hedge fund news, and insights, explore our main blog and SEC Filings blog.