Blog Highlights

- Since its inception in 1996, Greenlight Capital L.P. has returned 18.82x, annualized at 12.3%, net of fees and expenses.

- Third Point LLC trimmed its position in Upstart Holdings to 4.2% of the portfolio, from 21.5% last quarter. The total value of holdings now amounts to $605M in Q4, compared to $3.9B in Q3. By Dec. 3, Third Point had sold about 40% of its shares, with most stock sales in the fourth quarter.

- In the first 10 months of 2021, Third Point was up 35.7 per cent, its best performance in more than a decade.

What is Form 13F?

Form 13F is a quarterly filing that is required to be filed by all institutional investment managers with at least $100 million in AUM. This form discloses firm-level holdings of 13F securities (13(f) securities generally include equity securities that trade on an exchange, including the Nasdaq National Market System, certain equity options and warrants, shares of closed-end investment companies, and certain convertible debt securities), and can provide insights into crowded trades and the portfolios of Wall Street’s largest investors.

Previously, we looked at the Q2 and Q3 13F disclosures from 2021's, specifically funds managed by Greenlight Capital, Baupost, Icahn Capital, Sachem Head and Third Point. You can read the reports on Q2 and Q3 filings here!

In our new blog, for the funds mentioned above, we take a look at :

- Their portfolio holdings as of 31-Dec-2021

- Growth in AUM managed

- Top bought and sold securities

- Sectoral Exposure

Greenlight Capital

Greenlight Capital is managed by its Founder and President, David Einhorn. Einhorn is known for his bold investment calls, both long and short.

The firm’s Q4 13F filings disclose a market value of $1.7B, an increase of $256M from its Q3 disclosure. Approximately 86% of the change in the market value of the firm is due to movements in the price of held securities or assets. RADiENT data shows that the firm bought 12 new securities and entirely liquidated 13 securities during Q4 2021.

76% of the firm's total market value can be attributed to its top 10 holdings. The top 5 holdings of Greenlight include Green Brick Partners, Bright House Finl, Tesla, Teck Resources and Change Healthcare Inc. Nearly 44% of the firms' portfolio holdings are in the materials sector, the firm started increasing its exposure to this sector from Q3 2019 onwards. The materials sector securities held by Greenlight Capital are Chemours Co, Green Brick Partners, SPDR Gold Trust, Teck Resources and Graphic Packaging Holding Company. Greenlight acquired 49% of Green Brick Partners in October 2014, David Einhorn was appointed as the Chairman of the Board following the transaction.

The firm, however, trimmed its holdings in Teck Resources (~25% selling at prices between $24.6 and $30) and Chemours Co (25% selling at prices between $28 and $34).

More from Greenlight Capital :

Greenlight Capital invests in the public equity and fixed income markets of the United States. It primarily invests in value. “The Greenlight Capital funds (the “Partnerships”) returned 11.9% in 2021 compared to 28.7% for the S&P 500 index. Since its inception in May 1996, Greenlight Capital, L.P. has returned 1,882.6% cumulatively or 12.3% annualized, both net of fees and expenses. Greenlight’s investors have earned $4.7 billion, net of fees and expenses, since inception.”

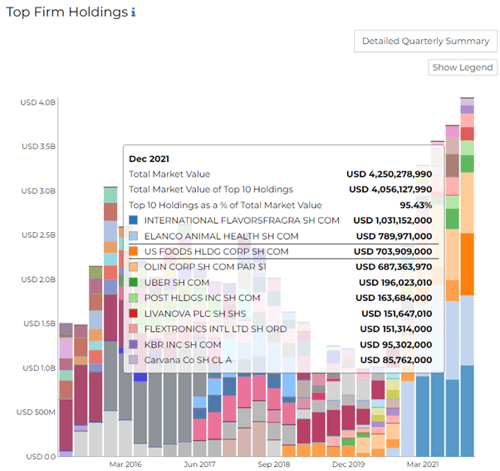

Sachem Head Capital

Sachem Head Capital’s recent Form 13F, for the period ending 31st December 2021 disclosed a market value of $4.3 B. With a turnover of 65%, the firm primarily invests in the sectors of materials (42%) and consumer discretionary ( 24.6%).

Over Q4 2021, Sachem’s top bought securities included- USFD ( $703M). In Feb 2022, Sachem which owns 8.7% of USFD, tried to take control of USFD’s board and nominated seven directors. Sachem called the nominations "the last option available" to protect stockholder interests after US Foods failed to make operational improvements and lift margins. Sachem has held USFD since Q4 2018.

The top 10 holdings of the firm contribute nearly 95.4% to the firm’s total market value. In Q4 2021, the firm completely liquidated 8 securities and added 5 new positions to its portfolio.

Sachem is managed by Scott Ferguson.

Baupost Group

Baupost’s Seth Klarman in his year-end note mentioned Baupost's strategy is especially suited to invest during times of disruption, uncertainty and unpredictability. He added that Baupost's primary success factors include its "long-term flexible investment mandate, experience investing amidst great uncertainty, intellectual honestly in a rapidly evolving world, appreciation of optionality and a record of assessing and mitigating downside risk."

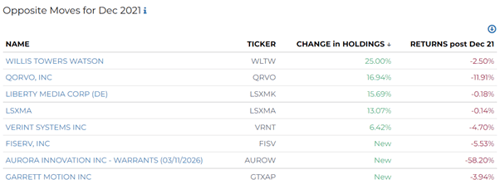

Baupost’s latest Form 13F discloses a market value of $10B. The firm reported a market value of $11B for Q3 2021, and the fall in the market value of the firm can be attributed to its trading activity. According to RADiENT data, Baupost bought Aurora Innovation ( 0.02 % of the portfolio) in Q4, which returned -58.20% post- December 2021.

In Q4 2021, the firm liquidated 11 securities including EBAY, Shaw Communications, IFF, FB and Micron Technology. The firm primarily invests in the IT (40%) and communications(37%) sectors.

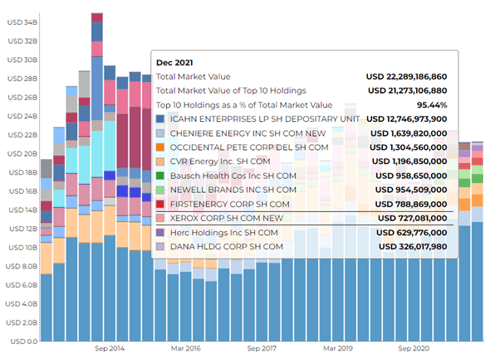

Icahn Carl Capital

In Feb 2021, IFF added Barry Bruno to its board of directors as a part of an agreement with investor Icahn Capital. Carl Icahn owns a 4% stake in the company.

Icahn’s last reported 13F filing for Q4 2021 included $22B in managed 13F securities and a top 10 holdings concentration of 95.44%. Icahn Carl is a highly concentrated fund where its largest holding is Icahn Enterprises LP ( shares of value $12B). Icahn Enterprises operates as a holding company through the following 10 segments:

- Investment (Various private investment funds)

- Automotive (Ownership of Icahn Automotive Group)

- Energy (Ownership in CVR Energy Inc)

- Railcar (Ownership in American Railcar Industries Inc)

- Food Packaging (Ownership in Viskase Cos)

- Metals (Company indirect wholly-owned subsidiary, PSC Metals Inc)

- Real Estate (Consists of rental real estate, property development and resort activities)

- Home Fashion (Indirect wholly-owned subsidiary WestPoint Home LLC)

- Railcar (Ownership in Railcar Leasing LLC)

- Mining (Holds interest in Ferrous Resources LTD)

With a turnover of 6.25%, the firm invests mostly in the industrial sector. The firm has been industrials centric since Q4 2003.

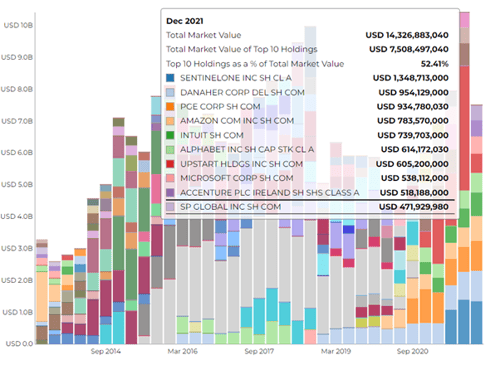

Third Point LLC

The firm's latest 13F discloses a market value of $14B, a decrease of 22% from its Q3 2021 reported market value. Approximately 95% of the change in the market value of the firm can be attributed to trading activity. Third Point dramatically reduced its holding in Upstart Holdings from Q3 2021 to Q4 2021. It trimmed its position in Upstart Holdings to 4.2% of the portfolio, from 21.5% last quarter. fell from $3.9B in Q3 to $605M in Q4. Third Point liquidated 49 securities and added 28 new positions to its portfolio in Q4 2021, its largest addition includes – Accenture Plc, Rivian Automotive and Amazon.

Daniel Loeb made a profit of about $300M on its stake in Rivian, through a series of investments over the past year including in its convertible notes.

In the first 10 months of this year, Third Point is up 35.7 per cent, its best year of returns in more than a decade.

Recent News:

The Russian-Ukraine war has taken a toll on the global financial markets. Numerous fund managers have suspended Russia – focused funds. Big fund managers including JPMorgan, Amundi, and BNP Paribas have frozen Russian-linked assets worth at least $3B. Majority of the Russia-focussed funds are now suspended, and almost $13 B in Russian stocks owned by US and Europe-based funds are now in sanctioned companies.

One can expect these events to affect the trading activity and market value of the firms covered in the blog. However, activist investor, Icahn Carl has a different take on the global event. In a recent interview he commented that he doesn’t see the Russia-Ukraine as the economy's biggest problem. "I think that this market possibly has over-reacted to what's going on in the Ukraine."

Stay tuned to find out how US asset managers have reacted to the this conflict !

Explore more latest Form 13F disclosures with RADiENT!

Users can also track older filings, compare performance across years and export aggregated firm data via RADiENT. To know more write to us at support@radientanalytics.com