Who's Buying and Selling MasterCard Inc. (MA) Equity? Recent 13F Filing Disclosures.

MasterCard Incorporated is a global financial services company specializing in electronic payments. It connects consumers, financial institutions, businesses, and governments worldwide, offering a range of payment solutions, including credit, debit, prepaid, and related payment programs.

Its clients include issuers, acquirers, merchants, government entities, telecoms, and other businesses. MasterCard's portfolio of payment brands includes MasterCard, Maestro, and Cirrus, which are licensed to clients for use in their payment solutions.

In 2011, the company expanded its offerings by acquiring the prepaid card program management operations of Travelex Holdings Ltd., now known as Access Prepaid Worldwide.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for MasterCard Inc., breaking down the 13F filings of its top buyers and sellers.

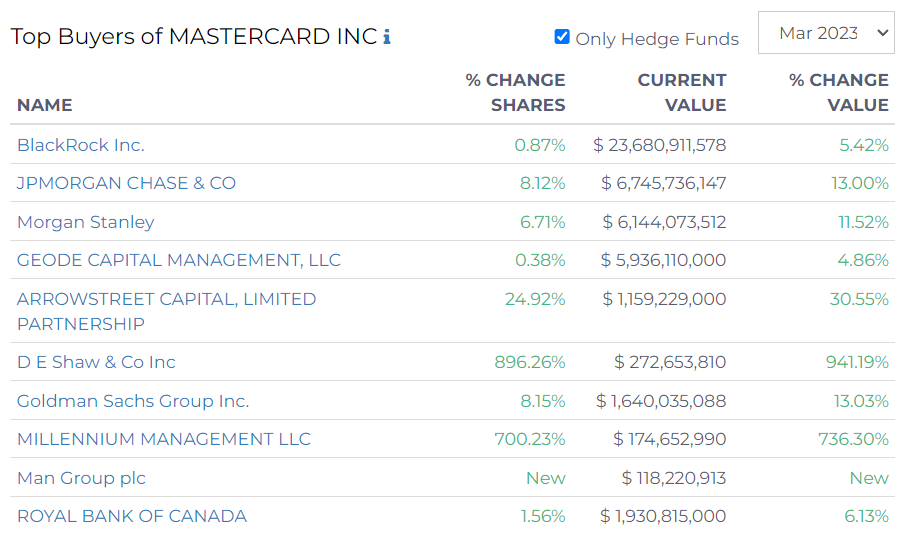

Top Buyers of Mastercard Inc (MA)

Mastercard Inc. has seen substantial buying interest from leading financial institutions in the recent quarter, according to recent filings.

BlackRock Inc. - The world's largest asset manager marginally increased its holdings by 0.87%, with a current value of $23.68 billion. This represents a value increase of 5.42%.

JPMorgan Chase & Co. - JPMorgan expanded its holdings by 8.12%, with the value of its position now standing at $6.75 billion, an increase of 13.00% in value.

Morgan Stanley - Morgan Stanley reported a 6.71% increase in its shares, bringing its current valuation to $6.14 billion. This marks a value uptick of 11.52%.

Geode Capital Management, LLC - This firm increased its holdings by 0.38%, with its holdings now valued at $5.94 billion, a 4.86% increase in value.

Royal Bank of Canada - This bank increased its Mastercard holdings by 1.56%, raising its position's value to $1.93 billion. This represents a 6.13% increase in value.

Goldman Sachs Group Inc. - The bank raised its Mastercard holdings by 8.15%, leading to a valuation of $1.64 billion, a 13.03% increase in value.

Arrowstreet Capital, Limited Partnership - This firm made a significant stake increase of 24.92%, which now values its holdings at approximately $1.16 billion, a 30.55% increase in value.

D E Shaw & Co Inc - The firm reported a massive 896.26% increase in shares. This substantial growth brought its holdings' valuation to $272.65 million, which corresponds to a remarkable value increase of 941.19%.

Millennium Management LLC - The company expanded its shares by 700.23%, resulting in an increase in the value of its holdings to $174.65 million, a value increase of 736.30%.

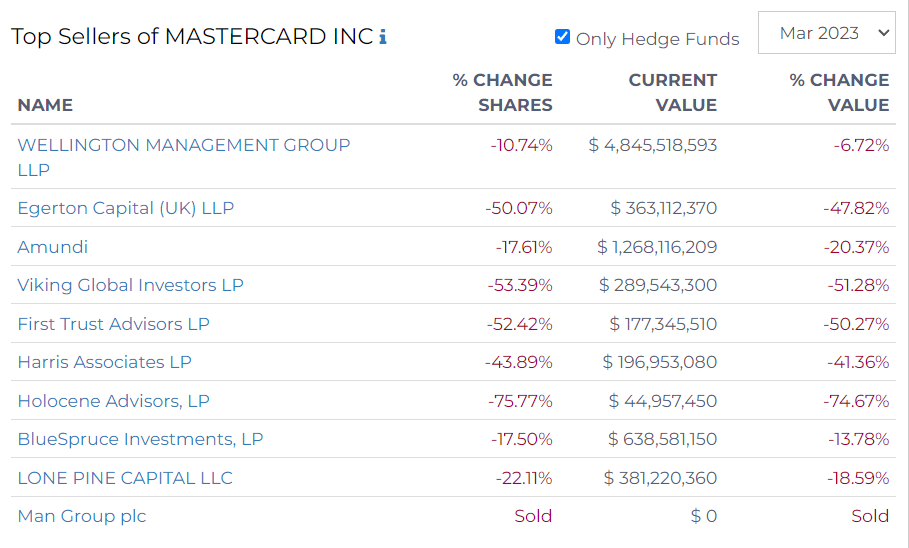

Top Sellers of Mastercard Inc (MA)

Mastercard Inc. has seen significant selling activity among leading hedge funds in the recent quarter, as per recent disclosures.

Wellington Management Group LLP, a prominent global investment management company, reduced its holdings by 10.74%. The current valuation of its position is $4.85 billion, indicating a value decrease of 6.72%.

Egerton Capital (UK) LLP exhibited a decrease in its holdings by 50.07%, bringing the value of its holdings to $363.11 million, a value drop of 47.82%.

Amundi, the European asset management leader, also lessened its stake by 17.61%, resulting in a current valuation of $1.27 billion.

Viking Global Investors LP notably decreased its stake in Mastercard Inc. by 53.39%, resulting in its holdings being valued at $289.54 million.

First Trust Advisors LP also engaged in significant selling activity with a 52.42% reduction in their positions. The current value of their holdings stands at $177.35 million.

Harris Associates LP pared down its holdings in Mastercard Inc. by 43.89%. This reduction led to a decrease in the value of their positions to $196.95 million, a value decrease of 41.36%.

Holocene Advisors, LP reduced their holdings by 75.77% now standing at $44.95 million.

BlueSpruce Investments, LP, decreased its stake in Mastercard Inc. by 17.50%. The current value of their holdings now stands at $638.58 million.

Lone Pine Capital LLC also made significant reductions in their stake, with a decrease of 22.11%, the current value of their holdings is now $381.22 million.