Who's Buying and Selling Johnson & Johnson (JNJ) Equity? Recent 13F Filing Disclosures.

Johnson & Johnson, a globally recognized holding company in the healthcare sector, is dedicated to the research, development, and manufacture of a diverse range of healthcare products. The company operates through over 275 subsidiaries located in 60 countries, marketing its products worldwide.

Notable events include the acquisition of Flexible Stenting Solutions, Inc. in March 2013 by Johnson & Johnson's Cordis Corporation and the opening of the Johnson & Johnson Innovation Center in Boston in June 2013.

Additionally, in August 2013, Johnson & Johnson completed the acquisition of Aragon Pharmaceuticals, Inc., a company focused on the discovery and development of treatments for hormonally driven cancers.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for Johnson & Johnson, breaking down the 13F filings of its top buyers and sellers.

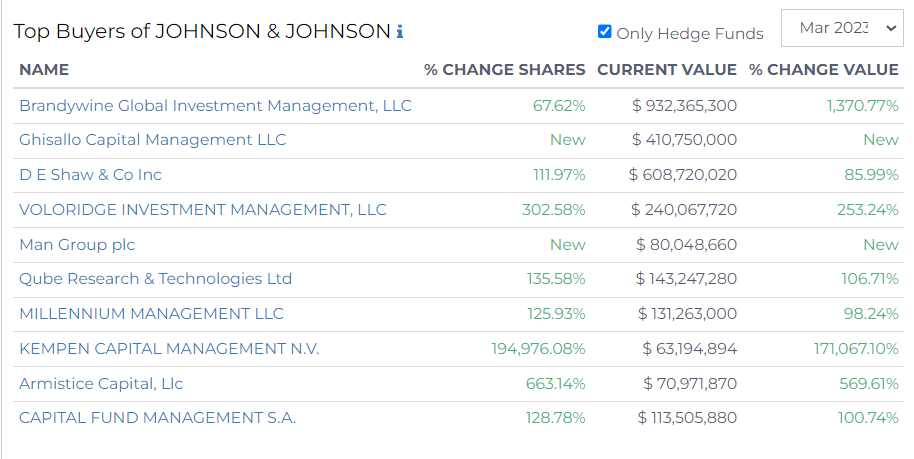

Top Buyers of Johnson & Johnson (JNJ)

In recent developments, Johnson & Johnson has seen some notable purchases from top hedge funds in March 2023.

The Philadelphia-based Brandywine Global Investment Management, LLC significantly increased its stake by 67.62%, raising its current value in the healthcare giant by 1,370.77% to $932.4 million.

A new entrant to Johnson & Johnson's shareholder roster is Ghisallo Capital Management LLC who bought $410.75 million.

D E Shaw & Co Inc. also expanded their position in the company by 111.97%, boosting their holdings' value by 85.99% to $608.7 million.

Additionally, Voloridge Investment Management, LLC increased its shares by an impressive 302.58%, raising its investment value by 253.24% to about $240 million.

Qube Research & Technologies Ltd and Millennium Management LLC also boosted their holdings by 135.58% and 125.93%, increasing their portfolio value to $143.2 million and $131.3 million respectively.

However, the most startling increase came from Kempen Capital Management N.V., which increased its position in Johnson & Johnson by 194,976.08%, bringing its current value to $63.2 million from $36,920 last quarter.

Finally, Armistice Capital, LLC and Capital Fund Management S.A. significantly expanded their stakes by 663.14% and 128.78% respectively, raising their value to $71 million and $113.5 million.

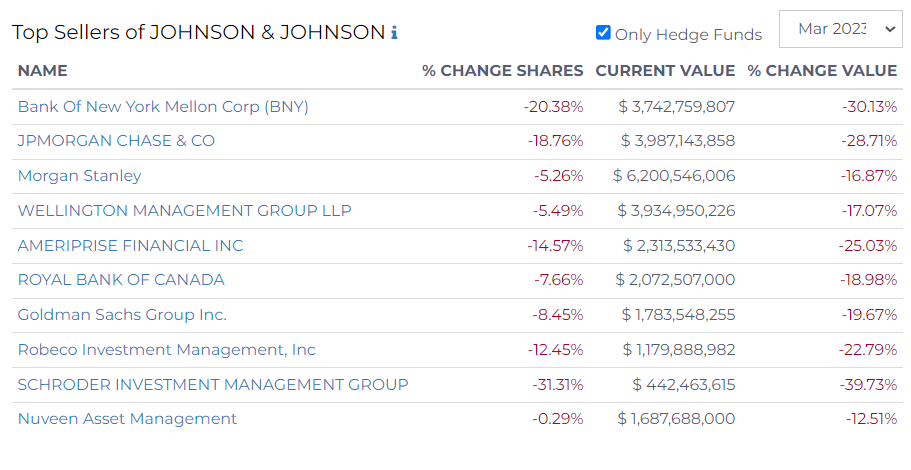

Top Sellers of Johnson & Johnson (JNJ)

In the latest development on Wall Street, several hedge funds significantly reduced their holdings in healthcare giant Johnson & Johnson in March 2023.

Leading the pack of sellers, the Bank Of New York Mellon Corp (BNY) cut its shares by 20.38%, diminishing its investment value by 30.13% to $3.74 billion.

Following closely, JPMorgan Chase & Co reduced their stakes by 18.76%, resulting in a 28.71% decrease in their holdings' value to about $3.99 billion.

Well-known financial services firm, Morgan Stanley, scaled back its position by 5.26%, bringing down its investment value by 16.87% to $6.20 billion.

Similarly, Wellington Management Group LLP, trimmed their holdings by 5.49%, causing a 17.07% drop in their portfolio value to $3.93 billion.

Ameriprise Financial Inc reduced its Johnson & Johnson shares by 14.57%, resulting in a 25.03% drop in investment value to $2.31 billion.

The Royal Bank of Canada and Goldman Sachs Group Inc. followed suit, decreasing their stakes by 7.66% and 8.45%, reducing their values to $2.07 billion and $1.78 billion respectively.

Robeco Investment Management, Inc also witnessed a considerable reduction of 12.45% in their Johnson & Johnson shares, resulting in a 22.79% decrease in their investment value to about $1.18 billion.

The most significant decrease in value was seen from Schroder Investment Management Group, which saw a drop of 31.31% in their shares, causing a substantial 39.73% reduction in their investment value to just $442.46 million.

Lastly, Nuveen Asset Management slightly reduced its holdings by 0.29%, leading to a 12.51% decrease in its portfolio value to $1.69 billion.