Wellington Management Group: Recent 13F Filing Disclosures

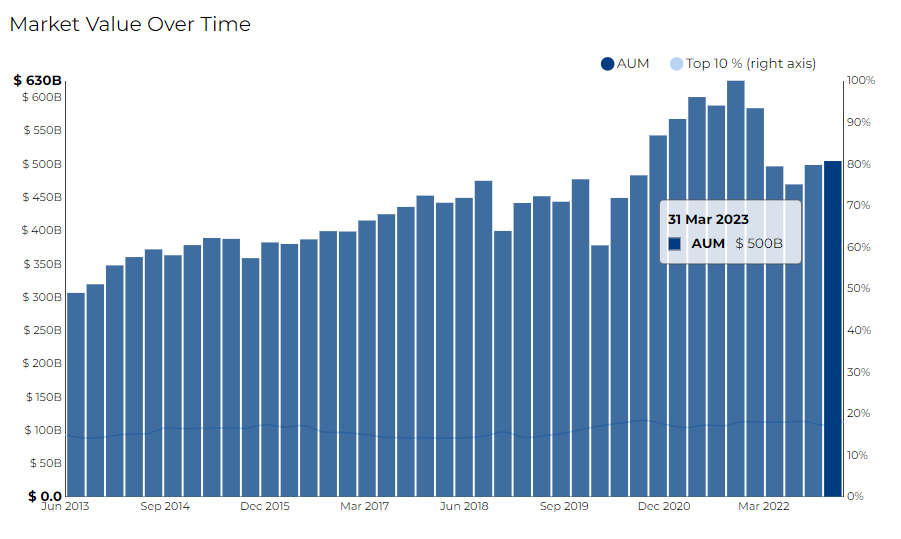

Wellington Management Group LLP filed its most recent 13F on 12 May 2023, for the quarter ended 31 Mar 2023.

At the executive level, Erin Kimberly Murphy serves as the Chief Financial Officer, Gregory Scott Konzal is the Head of Legal for Americas, Jean Marie Hynes is the Chief Executive Officer, Stephen Klar is the President, and James Scott Peterson is the Chief Compliance Officer.

Drawing on the data and insights gathered via Radient, the focus now turns to significant highlights, equity transactions, and sales at Wellington Management Group for Q1 2023, as reported in their most recent 13F filing.

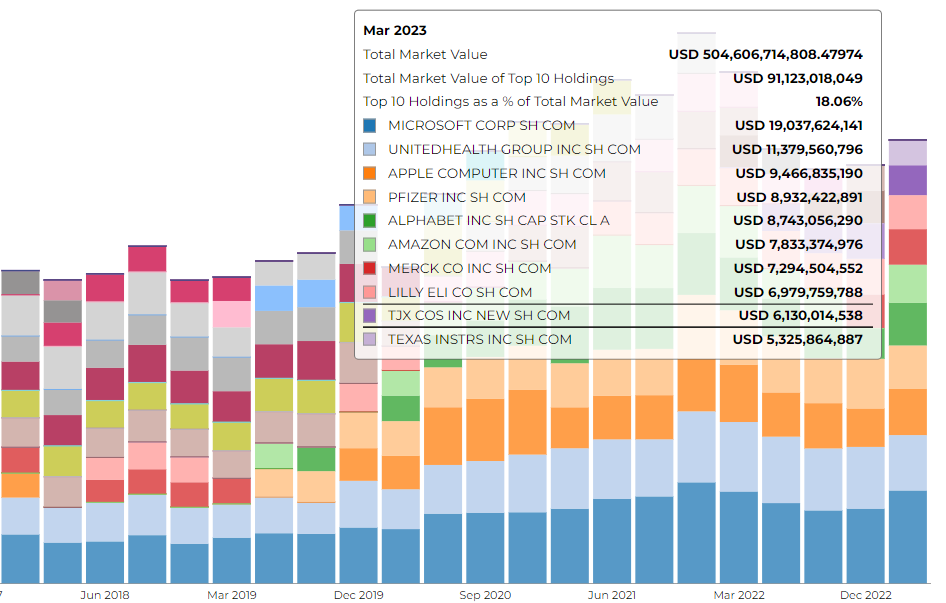

The firm disclosed 504.61 B in assets. It holds 1982 securities in its 13F portfolio, and the top 10 holdings account for 18.1% of the portfolio.

The firm's top 3 holdings include Microsoft Corp ($19.03B), Unitedhealth Group Inc ($11.38B), and Apple Inc ($9.46B).

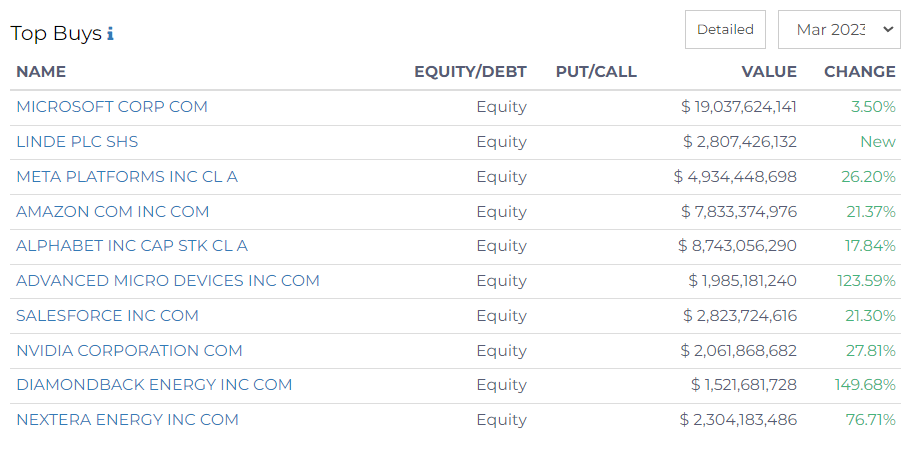

Wellington Management Group: Top Equity Buys

The firm has made significant investments in a range of companies as evidenced by their most recent transactions, with most of its investments in the tech sector.

Tech Sector:

- They've invested $19.04B in Microsoft, marking a 3.5% increase in their holdings.

- Meta Platforms also saw a considerable boost, with an investment increase of 26.2% to $4.93B.

- Amazon followed closely with a 21.37% rise to $7.83B while Alphabet Inc received a similar surge with a 17.84% increase to $8.74B.

- Advanced Micro Devices and Nvidia Corporation experienced growth. Wellington's investment in AMD grew by 123.59% to $1.99B, while its stake in Nvidia increased by 27.81% to $2.06B.

- The firm increased its holdings in Salesforce by 21.3% to $2.82B.

In the energy sector

NextEra Energy and Diamondback Energy both saw considerable boosts, with NextEra Energy's increase of 76.71% bringing Wellington's total investment in the company to $2.30B and Diamondback an increase of 149.68% to $1.52B.

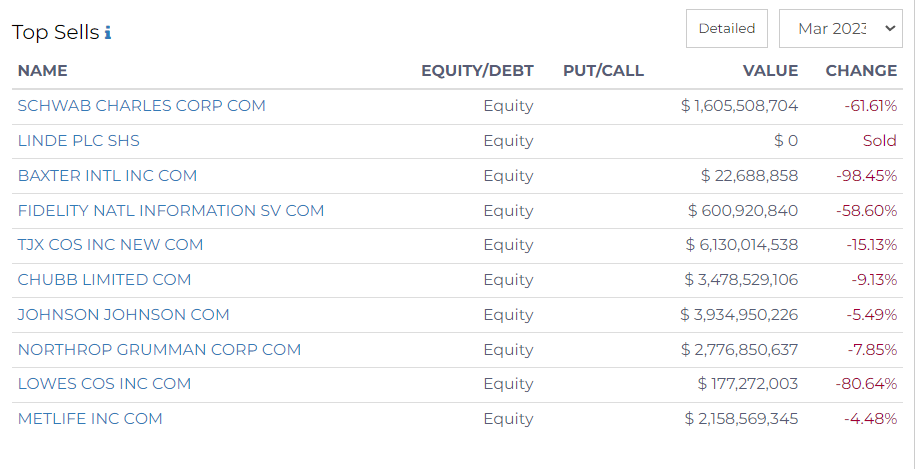

Wellington Management Group: Top Equity Sells

In contrast, Wellington divested equities across various sectors in March 2023.

Financial Sector:

- Their holding in Schwab Charles Corp saw the most significant decrease, dropping by 61.61% to $1.61B.

- Similarly, Fidelity National Information Services saw a 58.6% decrease to $600.92M.

Healthcare Sector:

- Baxter International saw a reduction of 98.45% to a value of just $22.69M.

- Johnson & Johnson experienced a 5.49% reduction in holdings by Wellington Management, bringing the total value down to $3.93 billion.

Insurance Sector:

- MetLife saw a reduction of 4.48% in holdings by Wellington Management, resulting in a current value of $2.16 billion.

- Wellington Management reduced its holdings in Chubb Limited by 9.13%, decreasing its overall position to $3.48 billion.

Retail Sector:

- TJX Companies experienced a 15.13% reduction, bringing Wellington's total holdings to $6.13B.

- Finally, Lowe's Companies saw a substantial reduction of 80.64% to $177.27M.

- The firm's stake in Northrop Grumman by 7.85%, diminishing the company's total value to $2.78 billion.