Water Island Capital LLC Top Buys and Sells: 13F Filing Disclosures

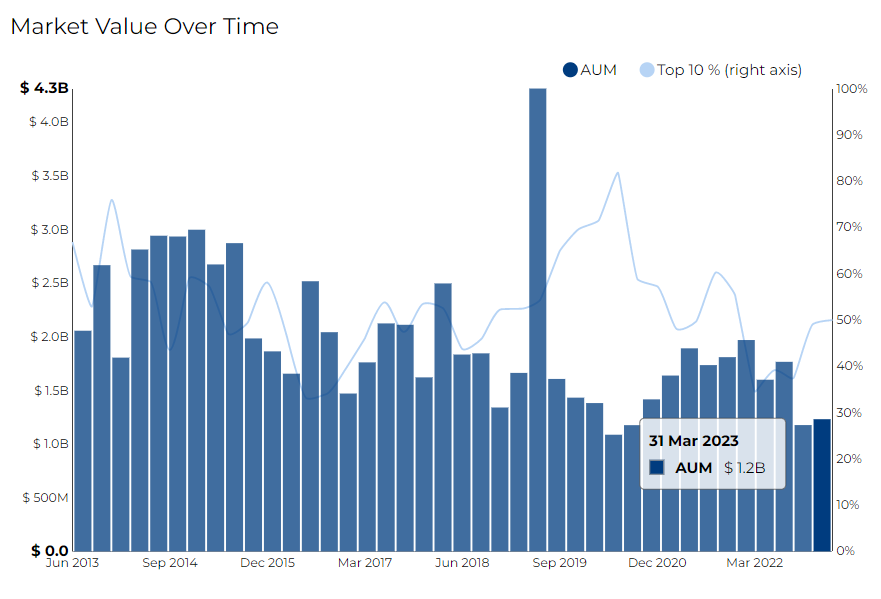

Water Island Capital filed its most recent 13F on 25 May 2023, for the quarter ended 31 Mar 2023.

Water Island Capital founded in 2000, specializes in event-driven investing. It is owned by Water Island Capital Partners LP and controlled by its general partner, Water Island Capital Partners GP LLC. John Orrico is the majority owner of these entities.

Drawing on the data and insights gathered via Radient, the focus now turns to significant highlights, equity transactions, and sales at Water Island Capital for Q1 2023, as reported in their most recent 13F filing.

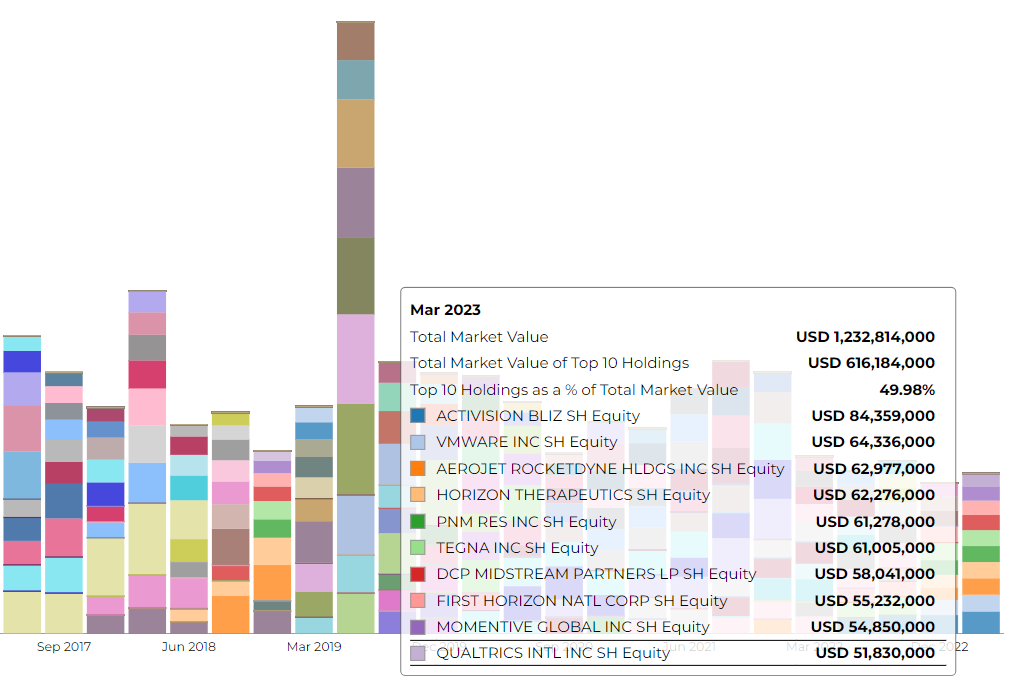

The firm disclosed 1.23 B in assets with a turnover rate of 110%. It holds 74 securities in its 13F portfolio, and the top 10 holdings account for 50.0% of the portfolio.

Water Island Capital LLC's top 3 holdings include Activision Blizzard Inc ($84.36M), Vmware Inc ($64.33M), and Aerojet Rocketdyne Hldgs Inc ($62.97M).

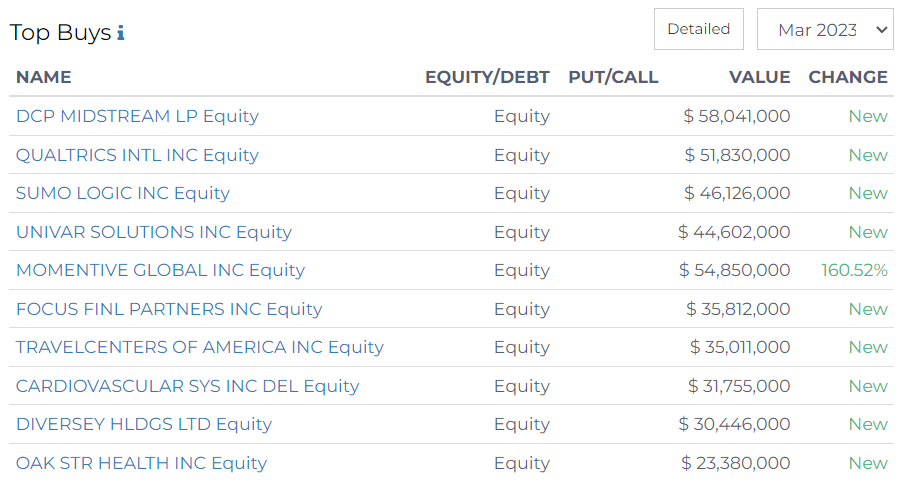

Top Buys made by Water Island Capital

Water Island Capital recently made noteworthy investments in various sectors according to the latest filings.

In the energy sector, the firm led with a significant investment in DCP Midstream LP, with an equity purchase of $58m. TravelCenters of America Inc. also saw a new equity investment worth $35m.

The technology sector witnessed a capital influx with new equities in Qualtrics International Inc. and Sumo Logic Inc., valued at $51.8m and $46.1m, respectively.

The healthcare sector also received attention with new investments in Cardiovascular Systems Inc. and Oak Street Health Inc., valued at $31.8m and $23.4m, respectively.

The financial sector saw a new investment in Focus Financial Partners Inc. worth $35.8m.

In addition, the firm invested $44.6m in Univar Solutions Inc., a notable player in the chemical distribution industry. Similarly, the firm placed $30.4m into Diversey Holdings Ltd., involved in hygiene and cleaning solutions.

Notably, the firm's investment in Momentive Global Inc. saw a significant surge, with an increase of 160.52%, bringing the total equity value to $54.9m.

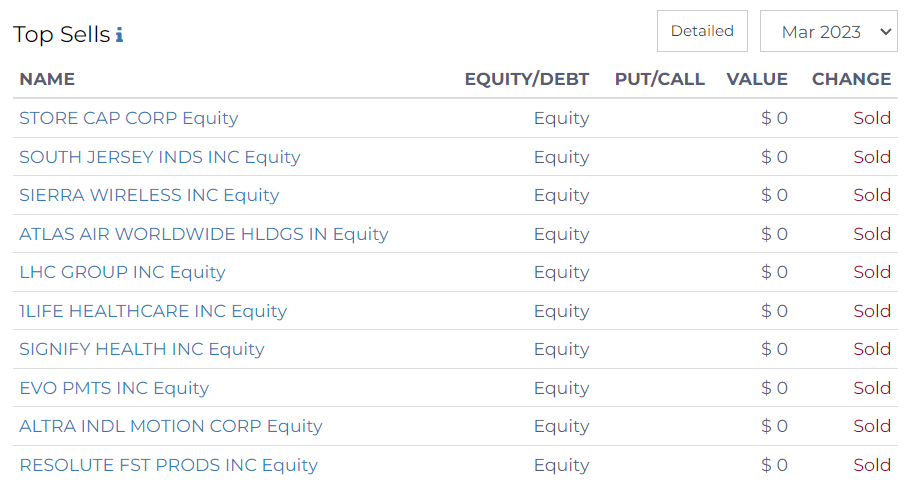

Top Sells made by Water Island Capital

Water Island Capital has made significant changes to its investment portfolio, divesting from several companies across a range of sectors, according to recent filings. The firm has fully divested 42 holdings.

In the real estate sector, Water Island liquidated its complete stake in STORE Capital Corp, previously valued at $56.9M. South Jersey Industries Inc., an energy service company, was also sold off entirely, previously valued at $55.3M.

In the tech sector, the firm sold all its holdings in Sierra Wireless Inc., previously valued at $53.5M. Notably, all holdings in tech giants Coupa Software Inc. and NVIDIA Corporation were also sold.

From the logistics and transportation sector, the firm offloaded all equity in Atlas Air Worldwide Holdings Inc., previously valued at $43.5M, and Atlas Corp., previously valued at $23.9M.

The healthcare sector saw a divestment from LHC Group Inc., 1Life Healthcare Inc., Signify Health Inc., Aveo Pharmaceuticals Inc., and Apollo Endosurgery Inc., indicating a notable shift in Water Island Capital's healthcare portfolio.

In finance, the firm completely sold off its holdings in EVO Payments Inc., previously valued at $28.6M, and significantly reduced its holdings in Black Knight Inc.

The manufacturing sector also saw complete exits with the sale of all equity holdings in Altra Industrial Motion Corp and Resolute Forest Products Inc.

A reduction in holdings was observed in companies like iRobot Corp., Rogers Corp., Magnachip Semiconductor Corp., Lakeland Bancorp Inc., and Hartford Financial Services Group Inc.