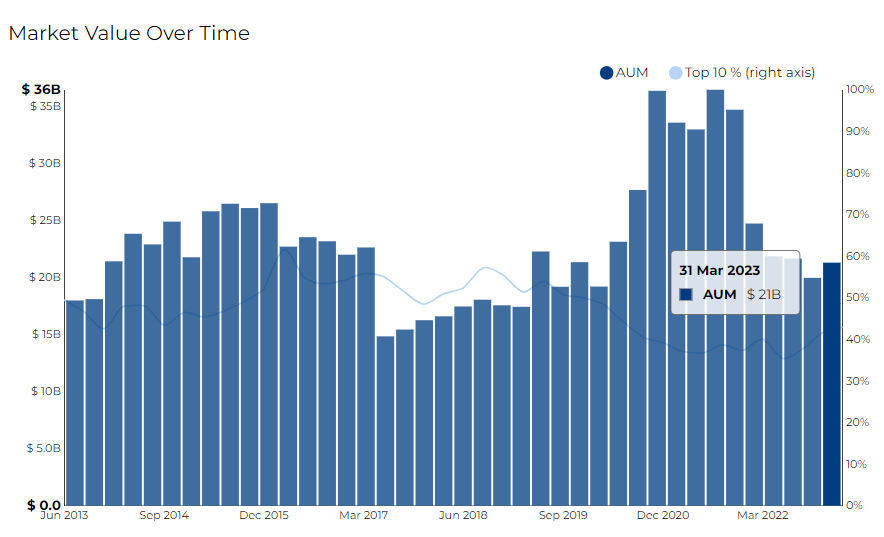

Viking Global Investors LP filed its most recent 13F on 15 May 2023, for the quarter ended 31 Mar 2023.

Drawing on the data and insights gathered via Radient, the focus now turns to significant highlights, equity transactions, and sales at Viking Global Investors LP for Q1 2023, as reported in their most recent 13F filing.

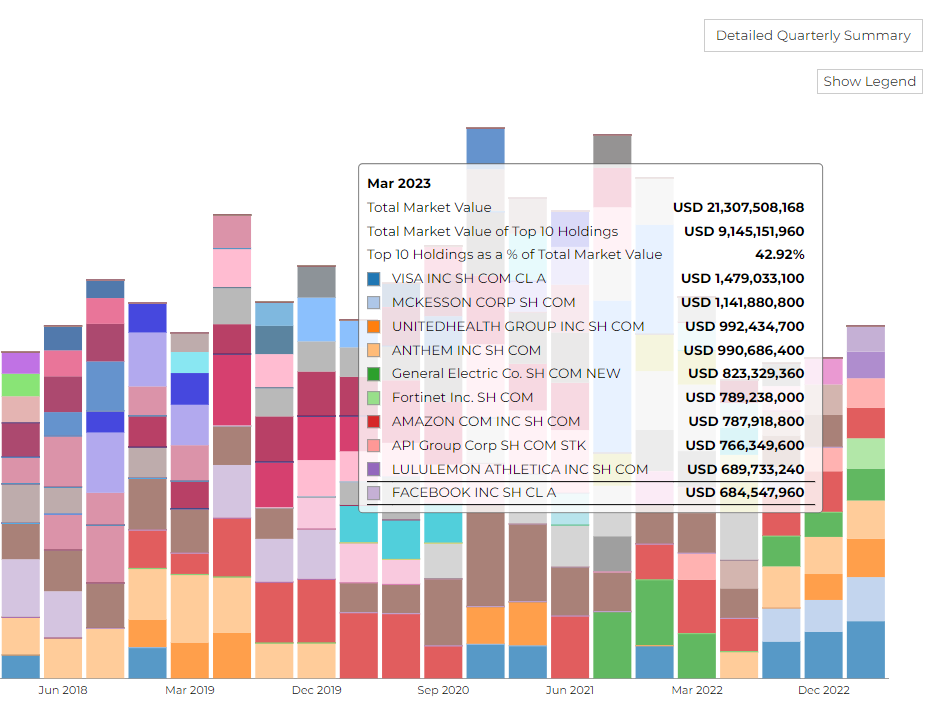

The firm disclosed 21.31 B in assets. It holds 81 securities in its 13F portfolio, and the top 10 holdings account for 42.9% of the portfolio.

Viking Global Investors LP's top 3 holdings include Visa Inc ($1.4B), Mckesson Corp ($1.1B), and Unitedhealth Group Inc (992M).

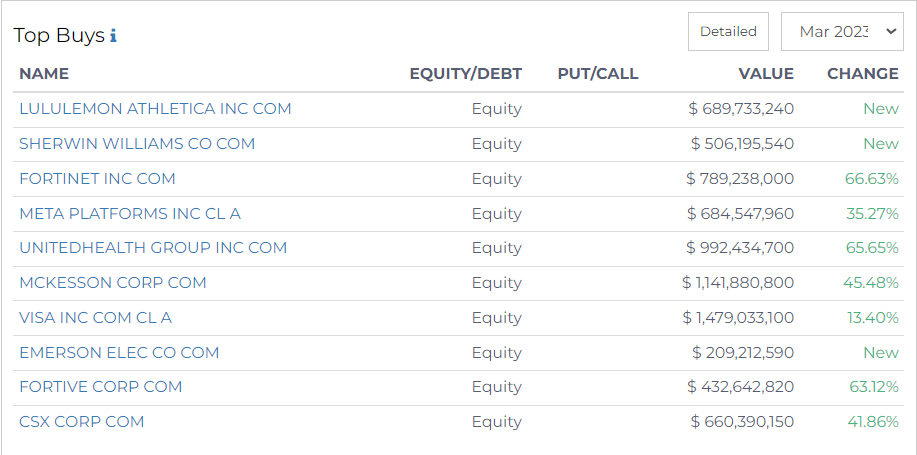

Top Buys by Viking Global Investors

Viking Global Investors LP, a global investment powerhouse, recently unveiled a series of major moves across various sectors in its latest filing. The firm made significant new acquisitions, and amplified its focus on the technology and healthcare sectors.

In the Consumer Discretionary sector, the firm made substantial new investments in Lululemon Athletica Inc., acquiring 1.9 million shares with a valuation of $690 million.

Turning to the Materials sector, Viking Global also ventured into Sherwin Williams Co. with a new stake of 2.2 million shares, amounting to $506 million.

In the Industrials sector, the firm also bet on Emerson Electric Co. with an acquisition of 2.4 million shares, totaling $209 million.

In the Information Technology sector, Viking Global reinforced its position, making an increase in its stake in Fortinet Inc. The firm escalated its holdings by 66.63% to 11.9 million shares, valued at $789 million.

The firm also increased its position in Meta Platforms Inc. by 35.27%, taking its share amount to 3.2 million, with a value of $685 million.

Additionally, Viking Global augmented its holdings in Visa Inc. by 13.4% to 6.6 million shares, reaching a valuation of $1.48 billion. In another significant move, Viking Global amplified its stake in Fortive Corp. by 63.12% to 6.3 million shares, now valued at $433 million.

Turning to the Healthcare sector, Viking Global bolstered its shares in UnitedHealth Group Inc. by 65.65% to 2.1 million shares, now valued at just under $1 billion. Additionally, the firm expanded its holdings in McKesson Corp. by 45.48% to 3.2 million shares, worth $1.14 billion.

In the Industrials sector, Viking Global also amplified its stake in CSX Corp by 41.86%, taking its holdings to 22 million shares, with a valuation of $660 million.

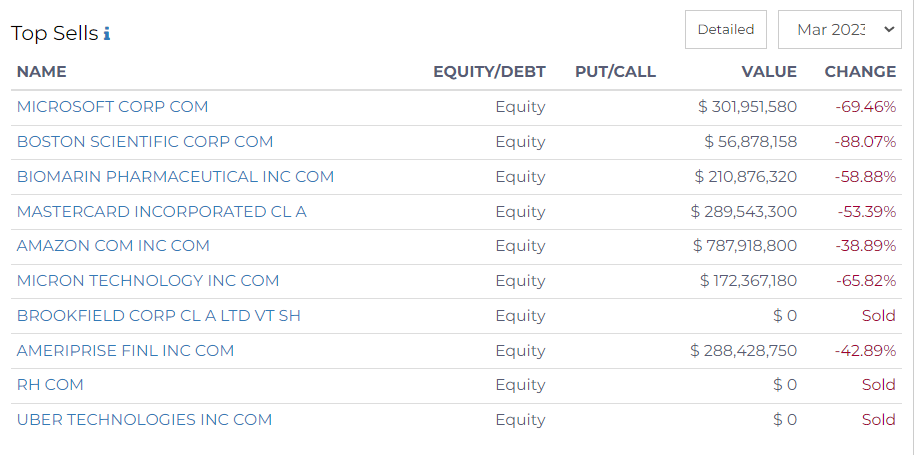

Top Sells by Viking Global Investors

The most recent 13f filing revealed a reduction in positions across the technology, healthcare, consumer discretionary, and financial services sectors.

In the Technology sector, Viking Global significantly reduced its stake in industry giants Microsoft Corp. and Amazon Inc.

- The firm decreased its holdings in Microsoft by 69.46%, leaving 1,047,352 shares valued at $302 million.

- Its position in Amazon saw a reduction of 38.89%, with the remaining 7.6 million shares valued at $788 million.

- The firm also scaled back its holdings in Micron Technology Inc. by 65.82%, leaving 2.9 million shares worth $172 million.

Moving to the Healthcare sector, Viking Global sold a considerable portion of its holdings in Boston Scientific Corp. and BioMarin Pharmaceutical Inc.

- The firm's stake in Boston Scientific dropped by 88.07%, leaving 1.1 million shares worth $57 million.

- Its position in BioMarin Pharmaceutical saw a decrease of 58.88%, with the remaining 2.2 million shares valued at $211 million.

The firm also made significant divestments in the Financial Services sector.

- The firm cut its stake in Mastercard Incorporated by 53.39% to 796,740 shares, now worth around $290 million.

- Its position in Ameriprise Financial Inc. decreased by 42.89%, with the remaining 941,040 shares valued at $288 million.

In the Consumer Discretionary sector, Viking Global sold its entire holdings in RH and Uber Technologies Inc. The firm divested all its shares in both companies, leaving a total of zero shares from the previous counts of 748,344 and 7.9 million, respectively.

Lastly, in the Utilities sector, the firm also sold off its entire position in Brookfield Corp., reducing its shares from 7,262,078 to zero.