Vericel Corporation is a biopharmaceutical company specializing in patient-specific expanded cellular therapies. Based in Cambridge, Massachusetts, and listed on the NASDAQ, Vericel was founded in 1989.

It markets two autologous cell therapy products in the United States: Carticel, for treating cartilage defects in the knee, and Epicel, a permanent skin replacement for patients with severe burns. It's also developing MACI, a new treatment for knee cartilage defects, and ixmyelocel-T, a therapy for advanced heart failure due to ischemic dilated cardiomyopathy.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for Vericel Corporation, breaking down the 13F filings of its top buys and sells.

Here's the report on the major buying and selling activity in Vericel Corp as of March 2023:

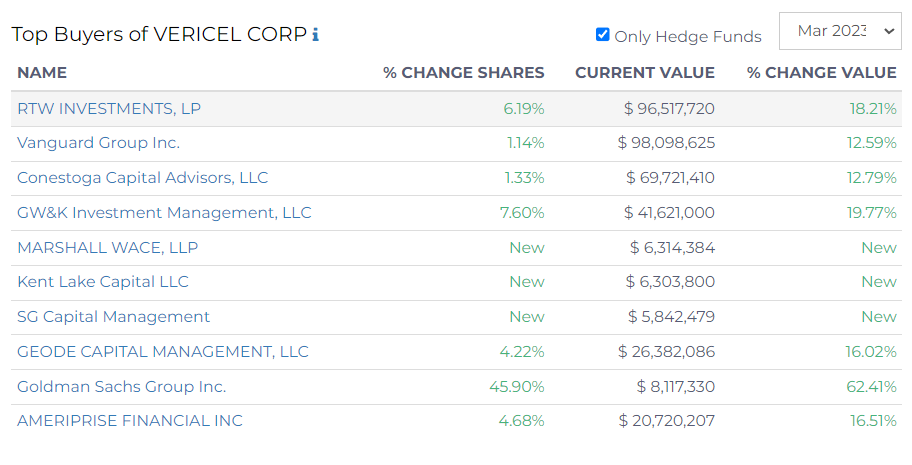

Top Buyers:

- RTW Investments, LP increased their stake in Vericel Corp by 6.19%, now worth $96.52M

- Vanguard Group Inc. raised their holdings by 1.14%, current value at $98.10M.

- Conestoga Capital Advisors, LLC increased their stake by 1.33%, now valued at $69.72M.

- GW&K Investment Management, LLC raised their holdings by 7.6%, now worth $41.62M.

- Marshall Wace, LLP entered a new position in Vericel Corp, worth $6.31M.

- Kent Lake Capital LLC also took a new position, valued at $6.3M.

- SG Capital Management entered a new position in Vericel Corp, valued at $5.84M.

- Geode Capital Management, LLC increased their stake by 4.22%, now valued at $26.38M.

- Goldman Sachs Group Inc. dramatically increased their holdings by 45.9%, now worth

$8.12M. - Ameriprise Financial Inc increased their holdings by 4.68%, valued at $20.72M.

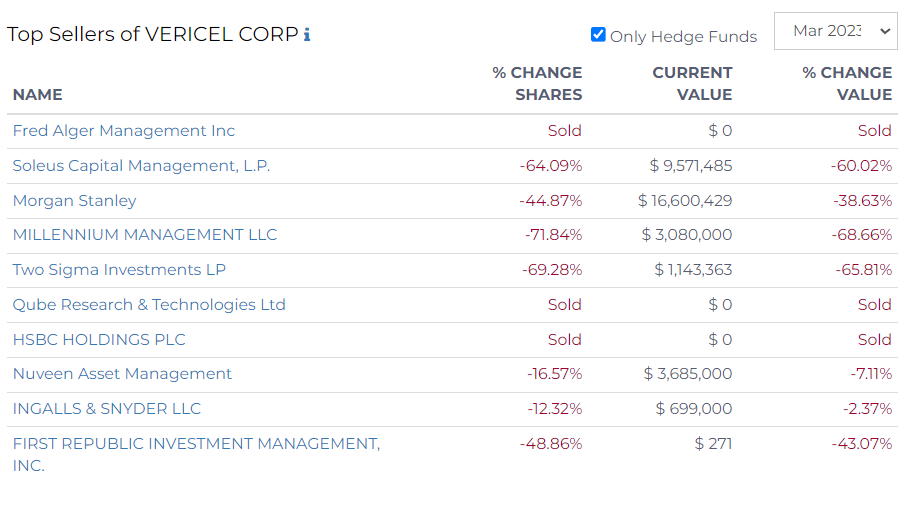

Top Sellers:

- Fred Alger Management Inc sold their entire stake in Vericel Corp.

- Soleus Capital Management, L.P. reduced their stake by 64.09%, now worth $9.57M.

- Morgan Stanley cut their holdings by 44.87%, now valued at $16.6M.

- Millennium Management LLC significantly reduced their stake by 71.84%, now worth $3.08M.

- Two Sigma Investments LP decreased their holdings by 69.28%, now worth $1.14M.

- Qube Research & Technologies Ltd sold out their entire position in Vericel Corp.

- HSBC Holdings PLC also sold their entire stake.

- Nuveen Asset Management reduced their holdings by 16.57%, now worth $3.69M.

- Ingalls & Snyder LLC decreased their stake by 12.32%, now valued at $699K.

- First Republic Investment Management, Inc. cut their holdings by 48.86%, now valued at $271.