Merck & Co., Inc., listed on the NYSE, is a global healthcare company with around 69,000 employees. The company operates in four segments: Pharmaceuticals, Animal Health, Consumer Care, and Alliances, but only the Pharmaceuticals segment is reportable.

Merck delivers healthcare solutions through a range of products, including prescription medicines, vaccines, biological therapies, animal health products, and consumer care products. These are marketed directly or through joint ventures.

The Pharmaceutical segment offers therapeutic and preventive agents, typically sold by prescription, for various human disorders. Notably, on February 25, 2013, Dashtag, a part of Merck's Schering Plough Corp subsidiary, acquired a 17.95% stake in Fulford (India) Ltd.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for Merck & Co., Inc breaking down the 13F filings of its top buyers and sellers.

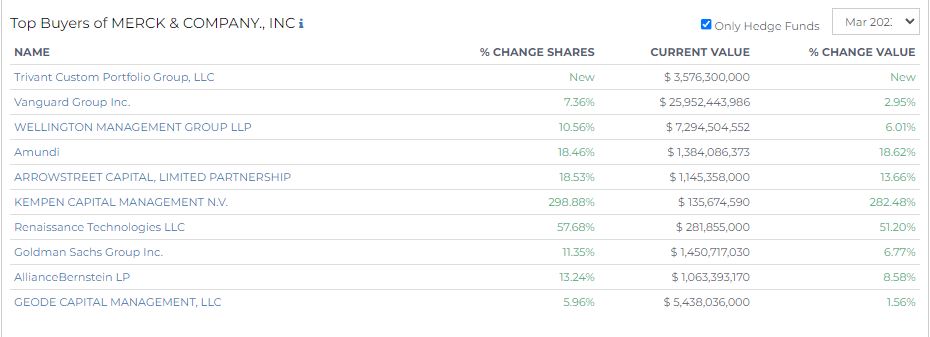

Top Buyers of Merck & Company Inc.

The top of the list saw a new entrant with Trivant Custom Portfolio Group, LLC, acquiring shares worth $3.58 billion.

Vanguard Group Inc. reported a 7.36% increase in shares, bringing their current value to $25.95 billion—a modest value increase of 2.95%. Similarly, Wellington Management Group LLP saw a 10.56% hike in shares, amounting to $7.29 billion, representing a value surge of 6.01%.

Amundi and Arrowstreet Capital, Limited Partnership saw significant share increases of 18.46% and 18.53%, respectively, bringing their values to $1.38 billion (up by 18.62%) and $1.15 billion (up by 13.66%).

Kempen Capital Management N.V. stood out with a 298.88% surge in shares, equivalent to $135.67 million, marking a value growth of 282.48%.

Renaissance Technologies LLC witnessed a 57.68% increase in shares, with the current value hitting $281.85 million—a value upturn of 51.20%. Goldman Sachs Group Inc. saw their shares go up by 11.35%, valued at $1.45 billion, marking a 6.77% value increase.

Further down the list, AllianceBernstein LP recorded a 13.24% share growth, which corresponded to $1.06 billion and an 8.58% value increase. Lastly, Geode Capital Management, LLC reported a share increase of 5.96%, equal to $5.44 billion, resulting in a value rise of 1.56%.

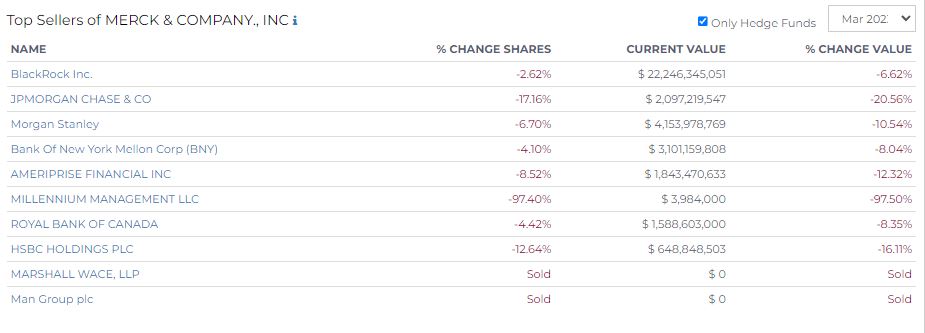

Top Sellers of Merck & Company Inc.

As of March 2023, several prominent hedge funds emerged as the top sellers of the pharmaceutical giant's stocks.

BlackRock Inc. reduced its shareholding by 2.62%, lowering its current value to $22.25 billion, a decrease in value of 6.62%. JPMorgan Chase & Co. significantly reduced its holdings by 17.16%, making its current value $2.10 billion, a considerable value decrease of 20.56%.

Morgan Stanley trimmed its stake by 6.7%, taking its current value to $4.15 billion, a decrease in value of 10.54%. Bank of New York Mellon Corp (BNY) also reduced its holdings by 4.1%, making the current value $3.10 billion, marking a value decline of 8.04%.

Ameriprise Financial Inc. decreased its shares by 8.52%, resulting in a current value of $1.84 billion, and a value change of -12.32%. Millennium Management LLC significantly reduced its stake by 97.40%, leaving its current value at $3.98 million, a decrease of 97.50%.

The Royal Bank of Canada (RBC) cut down its holdings by 4.42%, resulting in a current value of $1.59 billion, a decrease in value of 8.35%. Similarly, HSBC Holdings PLC reduced its stake by 12.64%, bringing its current value down to $648.85 million, a value decrease of 16.11%.

Lastly, Marshall Wace, LLP completely sold off its holdings.

Stay updated with 13F Form and Form ADV filings and disclosures, and sign up for a free trial on Radient.