Union Pacific Corporation (UPC) is an industrials sector company that owns various transportation businesses. Its key operating company, Union Pacific Railroad Company, connects 23 states in the western two-thirds of the U.S. Its business includes agricultural products, automotive, chemicals, energy, industrial products, and intermodal.

The company also has connections with Canada's rail systems and is the primary railroad for six gateways to Mexico. In June 2012, UPC's fully owned subsidiary, PS Technology (PST), acquired the Yard Control Systems division of Ansaldo STS USA. UPC is traded on the NYSE and employs 41,735 people.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for Union Pacific Corporation (UPC), breaking down the 13F filings of its top buys and sells.

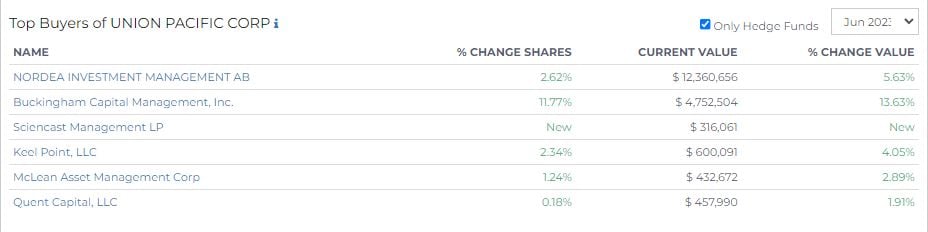

Top Buyers

Nordea Investment Management AB has increased their shares by 2.62%, bringing their current value to $12.36M, marking a 5.63% value increase.

Buckingham Capital Management, Inc. has boosted its stake by 11.77%, taking its total investment value to $4.75M, which corresponds to a 13.63% increase in value.

Sciencast Management LP, a new entrant, has invested $316K in the company.

Keel Point, LLC has increased its shares by 2.34%, amounting to a current value of $600K, indicating a 4.05% increase in value.

McLean Asset Management Corp has upped its stake by 1.24%, taking the total value to $433K, reflecting a 2.89% rise in value.

Quent Capital, LLC, with a modest 0.18% increase in shares, has a current investment value of $458K, corresponding to a 1.91% increase in value.

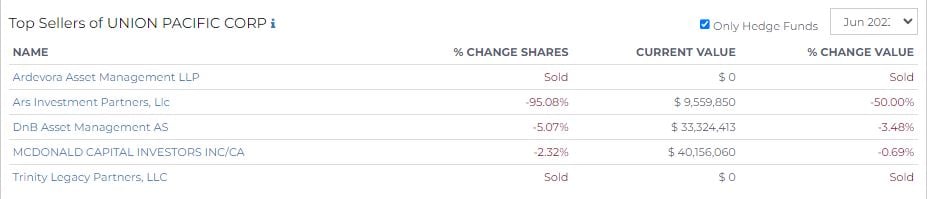

Top Sellers

Ardevora Asset Management LLP has sold all its shares in the company, hence the current value of their investment is $0.

Ars Investment Partners, LLC drastically reduced their stake by 95.08%, resulting in a current value of $9.56M. This considerable cutback equates to a 50% decrease in value.

DnB Asset Management AS decreased their shares by 5.07%, which brought the total value of their investment to $33.32M, a decrease in value of 3.48%.

MCDONALD CAPITAL INVESTORS INC/CA saw a modest reduction in their stake by 2.32%, leaving the current value at $40.16M, a slight drop in value of 0.69%.

Trinity Legacy Partners, LLC sold all their holdings in Union Pacific Corp, hence their current investment value is $0.