Top Sellers and Buyers of Trupanion, Inc.: Recent 13F Filing.

Trupanion, Inc. is a monthly subscription service provider offering medical insurance plans for cats and dogs. Operating primarily in the United States, Canada, and Puerto Rico, it serves pet owners and veterinarians via third-party referrals and online acquisition channels.

The company was initially established as Vetinsurance International, Inc. in 2000, and it changed its name to Trupanion, Inc. in 2013. Its headquarters are located in Seattle, Washington.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for Trupanion. Inc, breaking down the 13F filings of its top buyers and sellers.

Top Buyers of Trupanion Inc.

The security has seen a shift in its major shareholders recently, as shown by the substantial changes in equity holdings.

New investors have been added to Trupanion's shareholders' list including:

- 12 West Capital Management LP invested $12.9 million.

- PDT Partners LLC bought shares worth $2.9 million.

- Pura Vida Investments LLC acquired stocks worth $2.3 million.

Among existing shareholders, Wellington Management Group LLP increased their stake by 23.34%, with the current value of their holdings at $73.7 million, a rise of 11.3%.

Clearbridge Investments, LLC increased its stake by 24.46% to a current value of $59.6 million, which is a value increase of 12.31%.

TwinBeech Capital LP significantly increased its shares in Trupanion the most, the firm increased its shares by 575.51%, pushing the current value of its stake to $7.5 million, which represents a value rise of 509.57%.

Marshall Wace LLP also increased its shares by 33.53% to a current value of $16.1 million, signifying a value rise of 20.5%. Tudor Investment Corporation likewise exhibited substantial growth, increasing their shares by 174.28%, raising the current value of their stake to $4.6 million, a value boost of 147.56%.

Lastly, Greenlea Lane Capital Management, LLC raised its stake by 52.77%, pushing the current value of its shares to $5.8 million, marking a value increase of 37.85%.

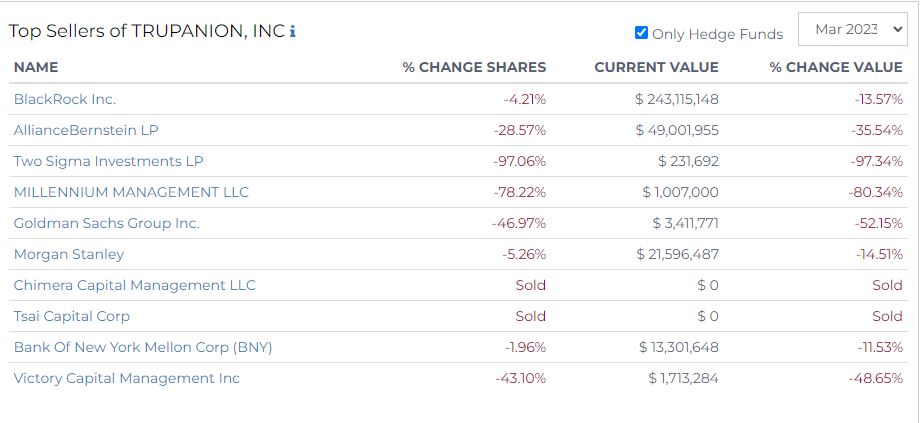

Top Sellers of Trupanion Inc.

BlackRock Inc., one of Trupanion's largest stakeholders, has reduced its holdings by 4.21%, reducing its current portfolio value to $243.1 million, a 13.57% decrease in value.

Similarly, AllianceBernstein LP has shown a significant pullback in its stake, shedding 28.57% of its shares, translating to a drop of 35.54% in current value, which now stands at $49 million.

Two Sigma Investments LP reduced its stake by a stunning 97.06%, bringing its current holdings to a meager $231,692, reflecting a value decrease of 97.34%.

In a similar trend, Millenium Management LLC also sold off a majority of its holdings, reducing its stake by 78.22% to a current value of $1 million, a significant decrease from its previous holding value.

Goldman Sachs Group Inc. and Morgan Stanley, two global banking giants, have also shrunk their investments in Trupanion.

- Goldman Sachs has trimmed its holdings by 46.97%, witnessing a 52.15% fall in its current value to $3.4 million, while Morgan Stanley reduced its position by 5.26%, with its current value down 14.51% to $21.6 million.

Two noteworthy complete exits from Trupanion's shareholder list are Chimera Capital Management LLC and Tsai Capital Corp, both of whom sold their entire stakes.

Even Bank Of New York Mellon Corp (BNY) and Victory Capital Management Inc trimmed their holdings in Trupanion. BNY's shares decreased 1.96%, lowering its current value by 11.53% to $13.3 million.

On the other hand, Victory Capital Management Inc. made a substantial cut to its position, selling off 43.10% of its shares, plummeting its current value by 48.65% to $1.7 million.