Top Sellers and Buyers of Thermo Fisher Scientific Inc.: Recent 13F Filing.

Thermo Fisher Scientific Inc., a key player in the Healthcare sector, is dedicated to serving science through its three segments: Analytical Technologies, Specialty Diagnostics, and Laboratory Products and Services.

The company operates under three brands: Thermo Scientific (technology), Fisher Scientific (channels), and Unity Lab Services (providing enterprise services for instruments and lab equipment).

Thermo Fisher is constantly expanding, as evidenced by the opening of a demonstration lab and training center in Seoul, South Korea, in April 2012. Additionally, it made several acquisitions in 2012, including Doe & Ingalls Management, LLC and One Lambda, Inc.

In September 2012, it also established a Molecular Biology Center of Excellence in Vilnius, Lithuania. However, in October 2012, it divested its Laboratory Workstations business to OpenGate Capital, LLC.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for Thermo Fisher Scientific Inc., breaking down the 13F filings of its top buyers and sellers.

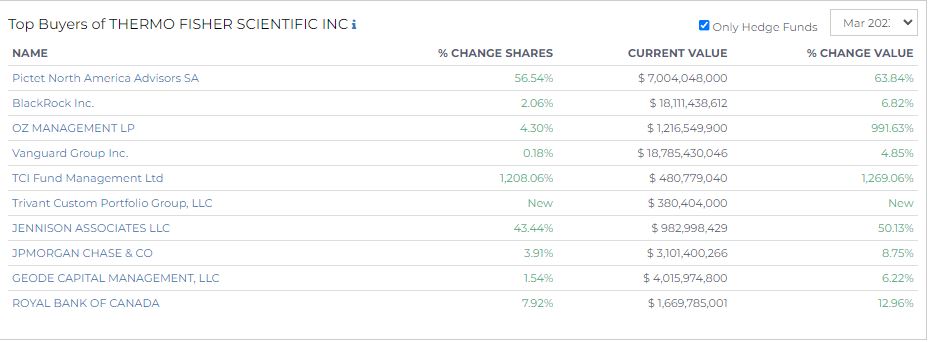

Top Buyers of Thermo Fisher Scientific

The recent March 2023 filing reveals significant shifts among the key stakeholders of Thermo Fisher Scientific.

Ranked by current value, the top buyers are:

Vanguard Group Inc. tops the list of the largest buyers with an investment value of $18.8 billion. The company saw a marginal rise in its shares by 0.18%. Followed by BlackRock Inc., who, with an investment worth $18.1 billion, moderately hiked their shares by 2.06% and subsequently lifted their value by 6.82%.

Meanwhile, Pictet North America Advisors SA increased their shares by 56.54%, contributing to a 63.84% increase in value, with the current value standing at $7 billion. Geode Capital Management, LLC, with an investment of $4 billion, has moderately increased its shares by 1.54%, leading to a 6.22% increase in value.

JPMorgan Chase & Co., with a 3.91% increase in their shares, has seen an 8.75% growth in value, putting their total investment at $3.1 billion. Royal Bank of Canada, with a stake worth $1.7 billion, increased its shares by 7.92%, which led to a 12.96% surge in value.

A noteworthy mention is OZ Management LP, which, with an investment of $1.2 billion, expanded its stake by 4.30%, resulting in a value increase of 991.63%.

Other significant players include:

- Jennison Associates LLC hiked its shares by 43.44%, and the value by 50.13% to $983M.

- TCI Fund Management Ltd increased its shares by 1,208.06% to $480.77 million.

- Trivant Custom Portfolio Group, LLC has recently entered the fray as a shareholder of Thermo Fisher Scientific securing shares worth $380.40 million.

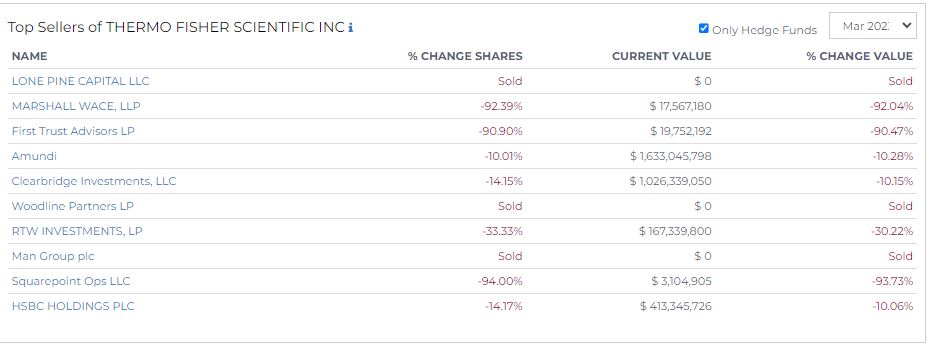

Top Sellers by Thermo Fisher Scientific Inc.

Among hedge funds, several top sellers, significantly reduce their stake or completely sell their shares.

Here are the top sellers, listed in order of the most notable decreases in the value of their holdings:

Marshall Wace, LLP, and First Trust Advisors LP saw massive reductions in their shareholdings.

- Marshall Wace, LLP holds a reduced portfolio value of $17.6M, a 92.39% decrease.

- First Trust Advisors LP decreased its shares by 90.90% to $19.75M.

Amundi also saw a reduction in its shares by 10.01%, leading to a 10.28% drop in portfolio value to $1.63B.

Similarly, Clearbridge Investments, LLC saw a 14.15% decrease in shares, which contributed to a 10.15% decrease in value to $1.03B.

Other notable sales include:

- RTW Investments, LP, reduced its stake by 33.33%, which led to a decrease in the portfolio value of 30.22% to approximately $167.34M.

- Squarepoint Ops LLC underwent a massive reduction of 94.00% in shares, resulting in a decrease of 93.73% in portfolio value to around $3.1M.

- HSBC Holdings PLC saw a decrease in shares by 14.17%, leading to a decrease in the portfolio value of 10.06% to around $413.35M.

The following firms have completely divested its holdings from the security:

- Lone Pine Capital LLC

- Woodline Partners LP

- Man Group plc