Verizon Communications Inc., listed on the NYSE, is a holding company and provider of various communication services, serving customers ranging from individuals to businesses and governmental agencies. The company operates through two main segments: Verizon Wireless and Wireline.

Verizon Wireless provides wireless voice and data services and equipment sales across the United States, serving both consumer and commercial customers. The Wireline segment, on the other hand, provides voice, Internet access, broadband video and data, Internet protocol network services, network access, long distance, and other services.

A notable event in the company's history is the acquisition of upLynk in November 2013, a technology and television cloud company, which was done through Verizon Digital Media Services. This acquisition expands their portfolio in digital media services. As of the latest data, Verizon Communications Inc. employs approximately 154,700 people.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for Verizon Communications Inc., breaking down the 13F filings of its top buys and sells.

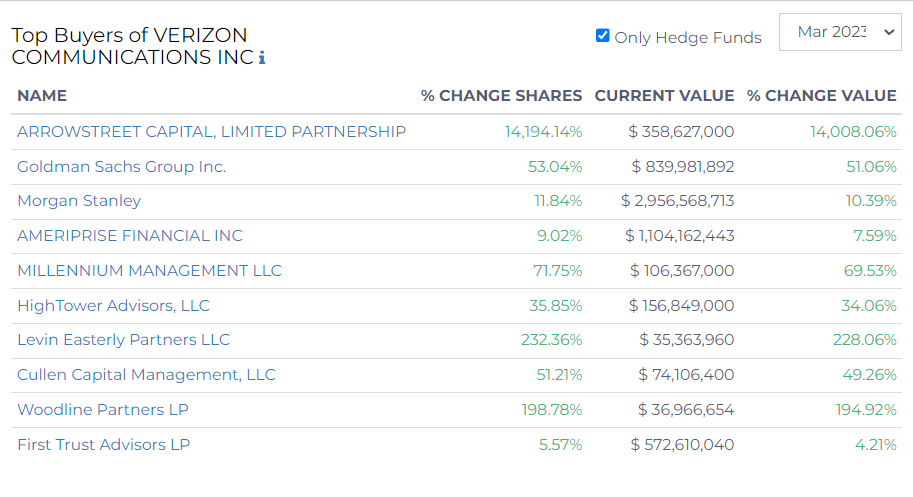

Top Buyers of Verizon Communications Inc.

March 2023 saw significant investment activity in the stocks of Verizon Communications Inc.

Arrowstreet Capital, Limited Partnership has increased its shares by 14,194.14%, bringing the current value to $358.6 million. Goldman Sachs Group Inc. boosted its stakes by 53.04%, with the current value standing at $839.98 million.

Morgan Stanley showed an increase in shares by 11.84%, making the current value $2.96 billion. Ameriprise Financial Inc reported a 9.02% increase, bringing their stakes' value to $1.1 billion. Millennium Management LLC reported a 71.75% rise in shares, with the current value at $106.36 million.

Other notable buyers include

- HighTower Advisors, LLC increased their stakes by 35.85%, with the current value now standing at $156.85 million.

- Levin Easterly Partners LLC had a significant rise of 232.36% in shares, bringing their current value to $35.36 million.

- Cullen Capital Management, LLC showed a 51.21% increase in shares, with their current value standing at $74.1 million.

- Woodline Partners LP increased its shares by 198.78%, bringing their current value to $36.97 million.

- Finally, First Trust Advisors LP reported a 5.57% increase in shares, making the current value $572.6 million.

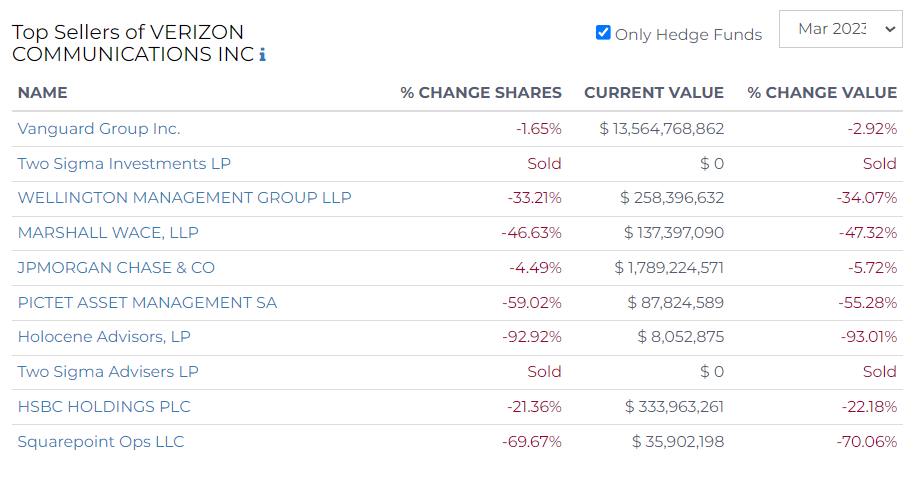

Top Sellers of Verizon Communications Inc.

The month of March 2023 witnessed significant selling activity of Verizon Communications Inc. stocks.

Vanguard Group Inc. decreased its shares by 1.65%, bringing the current value to around $13.56 billion. Two Sigma Investments LP has completely sold off its stakes.

Wellington Management Group LLP reported a 33.21% decrease in shares, making the current value $258.4 million. Marshall Wace, LLP saw a decrease of 46.63% in shares, bringing the current value to $137.4 million.

JP Morgan Chase & Co reported a 4.49% decrease in shares, making the current value $1.79 billion. Pictet Asset Management SA reported a 59.02% decrease in shares, with the current value standing at $87.82 million.

Other sellers include:

- Holocene Advisors, LP witnessed a 92.92% decrease in shares, making the current value $8.05 million.

- Two Sigma Advisers LP, like Two Sigma Investments LP, has sold off all its stakes in Verizon.

- HSBC Holdings PLC reported a 21.36% decrease in shares, bringing the current value to $333.96 million.

- Finally, Squarepoint Ops LLC reported a 69.67% decrease in shares, making the current value $35.9 million.