Top Buyers and Sellers of Staar Surgical Company: Recent 13F Disclosures

STAAR Surgical, a healthcare sector company, is a global leader in the design, development, manufacture, and sale of implantable lenses for the eye.

The company is well-known for its implantable Collamer lenses (ICLs), used in refractive surgery to correct visual disorders traditionally treated with glasses or contact lenses. STAAR's portfolio includes both lens-based and laser-based procedures such as LASIK, with intraocular lenses (IOLs) and ICLs being its principal products in ophthalmic surgery.

This blog post will delve into the key players who have been buying and selling STAAR Surgical shares from the latest 13F filing for March 2023.

The data and tables utilized in this blog are sourced from the 13F Form filing feature provided by Radient.

Top Buyers of STAAR Surgical Company

In March 2023, there was a significant increase in the buying activity surrounding the shares of Staar Surgical Company.

Anatole Investment Management Ltd made the most substantial move by initiating a new position valued at $130.63 million. This marked the largest new stake in the company during this period. Anatole holds 2 securities in its 13F portfolio with its holdings in STAAR Surgical representing 73.56% of its total market value.

BlackRock Inc. increased its shares by 2.00%, resulting in a 34.38% value increase to reach a total of $374.26 million.

Palo Alto Investors, LLC boosted its stake by 8.65% to $86.16 million. Its holdings in STAAR represent 7.14% of Palo Alto's total market value.

Geode Capital Management, LLC has increased its stake in STAAR Surgical by 4.40%, which has boosted the value of its holdings to $60.22 million.Nuveen Asset Management has significantly ramped up its investment in STAAR Surgical, with a 90.31% increase in shares bringing its total investment to $24.76 million.

The Goldman Sachs Group Inc. and Renaissance Technologies LLC saw significant increases in their holdings.

- Goldman Sachs Group inc's STAAR holdings increased by 133.92% valued at $29.47 million.

- Renaissance Technologies' investment in STAAR Surgical has significantly increased by 1,398.48% from the last quarter. The stake, which was $961,000, has now surged to $18.97 million.

Other new entrants to the list of top buyers include Assenagon Asset Management S.A. and Oxbow Capital Management (HK) Ltd, with their investments valued at $13.51 million and $10.23 million, respectively.

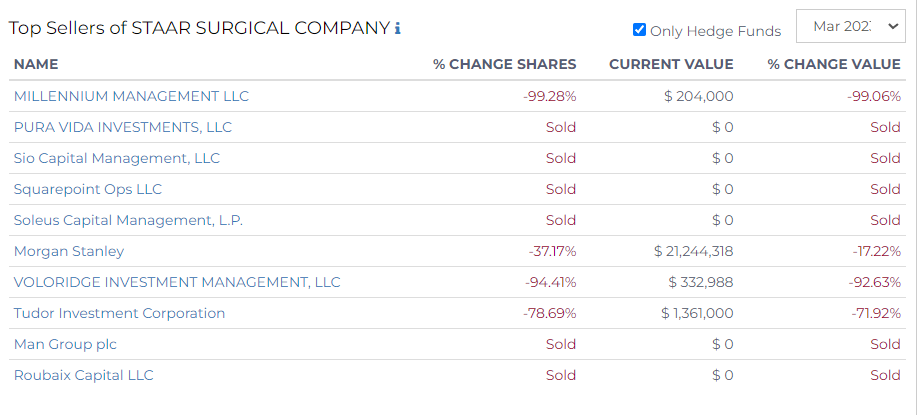

Top Sellers of STAAR Surgical Company

On the selling side, Millennium Management LLC reduced its holdings in Staar Surgical Company by 99.28%, leaving it with a remaining value of just $204,000, representing a decrease of 99.06% in value.

Several firms exited their positions entirely, selling their entire stakes in the security:

- Pura Vida Investments, LLC,

- Sio Capital Management, LLC held stakes worth $7.62 million in the previous quarter.

- Squarepoint Ops LLC

- Soleus Capital Management, L.P.'s holdings were $5.39 million last quarter.

- Man Group plc

- Roubaix Capital LLC

Notable reductions in holdings were also seen by the following:

- Morgan Stanley reduced its stake by 37.17% to $21.24 million.

- Voloridge Investment Management, LLC cut its shares by 94.41%, leaving it with a value of $332,988.

- Tudor Investment Corporation decreased its stake by 78.69%, with the value dropping to $1.36 million.

For more up-to-date 13F and Form ADV filings, hedge fund news, and insights, explore our main blog and SEC Filings blog.