Top Buyers and Sellers of PepsiCo Inc: Recent 13F Disclosures

PepsiCo Inc, a prominent multinational corporation in the food, snack, and beverage sector, has experienced substantial shifts in investment activities in the recent quarter.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for PepsiCo. Inc, breaking down the 13F filings of its top buyers and sellers.

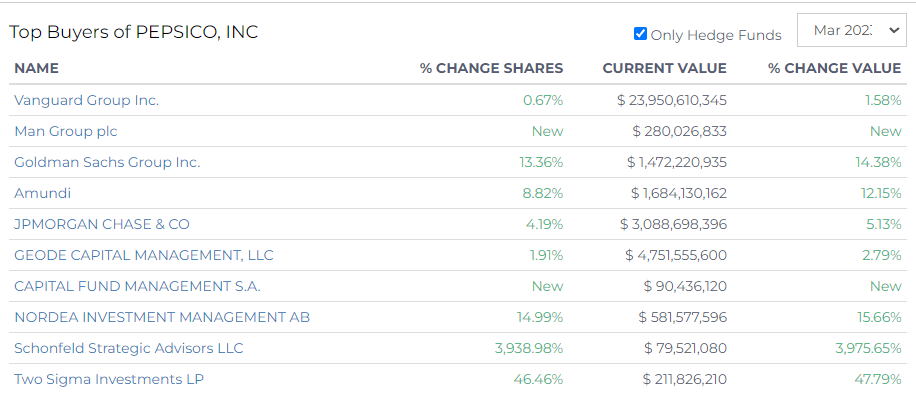

Top Buyers of PepsiCo, Inc (PEP)

The corporation has experienced substantial investment activity over the recent period.

This table details the top buyers of PepsiCo and the changes in their holdings.

Vanguard Group Inc. increased its share by 0.67%, resulting in a current value of $23.95B

Capital Fund Management S.A. is a new entrant in the shareholders' list, holding $90.44M in value.

Goldman Sachs Group Inc. boosted its shares by 13.36%, increasing the value of its investment to $1.47B, Similarly, Amundi hiked its share by 8.82% at $1.68B.

JPMorgan Chase & Co and Geode Capital Management, LLC also showed positive activity.

JPMorgan Chase & Co increased its share by 4.19% ($3.09B in value, a 5.13% rise), while Geode Capital Management, LLC upped its share by 1.91%, resulting in a 2.79% increase in value at $4.75B.

Nordea Investment Management AB had a significant increase in its shares by 14.99%, resulting in a 15.66% value increase to $581.58M.

Two Sigma Investments LP made an aggressive move by increasing its share by 46.46%, resulting in a value surge of 47.79% to $211.83M.

The most striking shift came from Schonfeld Strategic Advisors LLC, which increased its shares by 3,938.98%. This led to a value rise of 3,975.65% to $79.52M.

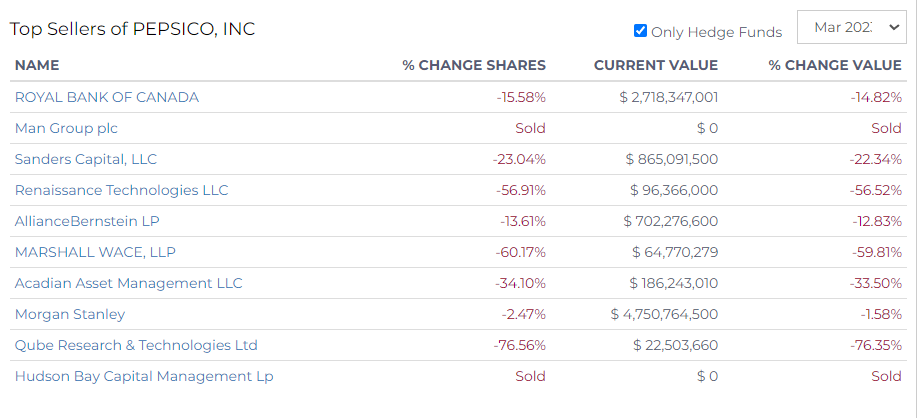

Top Sellers of PepsiCo, Inc (PEP)

This report outlines the top sellers of PepsiCo and changes in their positions.

Royal Bank of Canada reduced its shares in PepsiCo by 15.58%, resulting in a current value of $2.72B.

Hudson Bay Capital Management Lp exited its position, selling all its shares in PepsiCo.

Sanders Capital, LLC, also reduced its stake in PepsiCo by 23.04%, bringing the value of its holdings down to $865.09M—a 22.34% decrease.

Renaissance Technologies LLC sold more than half of its stake, with a 56.91% decrease in shares. The resulting value of their investment now stands at $96.37M, a 56.52% decrease in value.

AllianceBernstein LP reduced its shares by 13.61%, decreasing the value of its investment by 12.83% to $702.28M. Similarly, Marshall Wace, LLP decreased its share by 60.17%, with a resulting value of $64.77M—a 59.81% decrease.

Acadian Asset Management LLC also reduced its stake in PepsiCo, decreasing its shares by 34.10%, bringing the value of its investment to $186.24M—a 33.50% reduction.

Morgan Stanley showed a modest decrease in its shares by 2.47%, decreasing the value of its investment to $4.75B—a 1.58% drop.

Qube Research & Technologies Ltd showed the most dramatic decrease, reducing its shares by 76.56%, thus decreasing the value of its investment by 76.35% to $22.50M.