Oracle Corporation, a leading technology company, offers a broad portfolio of enterprise software and computer hardware products and services. Its primary operations are divided into three areas: software, hardware systems, and services.

The software business is further segmented into new software licenses and software license updates and product support. The hardware systems business consists of hardware systems products and hardware systems support.

The services business offers consulting, managed cloud, and education services. The company acquired Taleo Corporation on April 5, 2012, and Nimbula Inc on March 13, 2013. Oracle Corporation is listed on the NYSE and employs approximately 138,000 people.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for Oracle Corporation, breaking down the 13F filings of its top buys and sells.

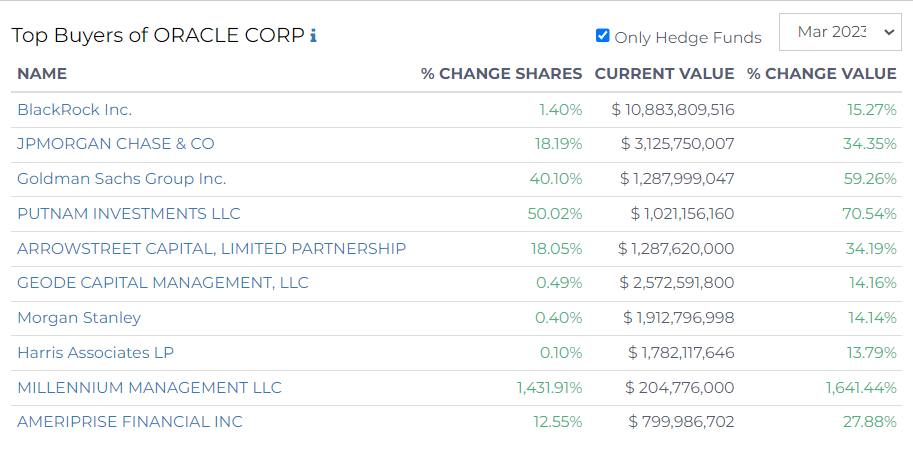

Top Buyers and Sellers of Oracle Corp Shares in Q1 2023

Top Buyers

- BlackRock Inc. increased its shareholdings by 1.40% to a current value of $10.88B, an increase in value by 15.27%.

- JPMorgan Chase & Co had an increase of 18.19% in shares, taking its current value to $3.13B, an impressive 34.35% change in value.

- Goldman Sachs Group Inc. expanded its shareholdings by 40.10% bringing its current value to $1.29B, with a surge of 59.26% in value.

- Putnam Investments LLC escalated its shareholdings by a whopping 50.02%, taking its current value to $1.02B, a 70.54% rise in value.

- Arrowstreet Capital, Limited Partnership increased its shareholdings by 18.05%, achieving a current value of $1.29B, a 34.19% hike in value.

- Geode Capital Management, LLC had a marginal increase in shares by 0.49%, with its current value at $2.57B, a 14.16% increase in value.

- Morgan Stanley incremented its shareholdings by 0.40% with a current value of $1.91B, a 14.14% increase in value.

- Harris Associates LP increased its shares slightly by 0.10% to a current value of $1.78B, a 13.79% increase in value.

- Millennium Management LLC massively amplified its shareholdings by 1,431.91%, taking its current value to $204.78M, a striking 1,641.44% increase in value.

- Ameriprise Financial Inc increased its shareholdings by 12.55%, achieving a current value of $799.99M, a 27.88% hike in value.

Top Sellers

- Two Sigma Advisers LP decreased its shareholdings by 86.63% to a current value of $46.13M, an 84.80% drop in value.

- Hotchkis & Wiley Capital Management LLC reduced its shareholdings by 39.84%, bringing its current value to $456.38M, a 31.61% decrease in value.

- Los Angeles Capital Management & Equity Research Inc massively reduced its shares by 98.10% to a current value of $2.98M, a 97.84% fall in value.

- Carmignac Gestion reduced its shares by 38.89% to a current value of $195.81M, a 30.54% decrease in value.

- Two Sigma Investments LP slashed its shareholdings by 98.19% to a current value of $1.73M, a dramatic 97.95% fall in value.

- Whale Rock Capital Management LLC reduced its shareholdings by 46.89% to a current value of $120.96M, a 39.62% fall in value.

- DnB Asset Management AS cut its shares by 64.18% to a current value of $36.64M, a 59.28% decrease in value.

- Robeco Investment Management, Inc cut its shares by 23.04%, amounting to a current value of $211.50M, a 12.58% decrease in value.

- Janus Henderson Group PLC saw a reduction of 20.35% in shares, with its current value at $170.73M, a 9.46% drop in value.

- Nordea Investment Management AB reduced its shareholdings by 14.17%, resulting in a current value of $428.54M, a slight decrease of 3.48%.