Latest 13F Filing: Top Buyers and Sellers of Chevron Corp

Chevron Corporation is an international energy company involved in petroleum, chemicals, mining, power generation, and energy services. It oversees investments in U.S. and global subsidiaries and affiliates, providing administrative, financial, managerial, and technical support.

The company operates through two main branches: upstream and downstream. Upstream activities encompass the exploration, development, and production of crude oil and natural gas, liquefied natural gas processing, transportation and regasification, crude oil transportation via international pipelines, and a gas-to-liquids project.

Downstream activities include refining crude oil into petroleum products, transporting crude oil and refined products through various methods, and manufacturing and marketing petrochemicals, industrial plastics, and fuel and lubricant additives. Chevron Corporation currently employs 51,900 people worldwide.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for Chevron Corporation, breaking down the 13F filings of its top buyers and sellers.

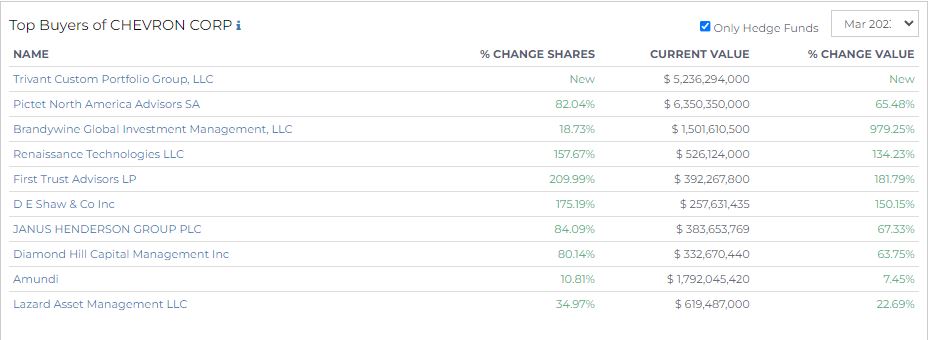

Top Buyers of Chevron Corp (CVX)

The company has recently seen substantial changes in its share ownership among some of the top institutional investors.

Trivant Custom Portfolio Group, LLC, became a new investor in Chevron with current holdings valued at $5.24 billion. Pictet North America Advisors SA has increased its share ownership by 82.04%, boosting its holdings' value to $6.35 billion.

Brandywine Global Investment Management, LLC, grew its stake by 18.73%, which elevated the value of its holdings by 979.25% to $1.5 billion.

Renaissance Technologies LLC significantly increased its holdings by 157.67%, taking the value of its shares to $526.1 million.

First Trust Advisors LP notably expanded its stake in Chevron by 209.99%, with the current value of its holdings at $392.3 million, reflecting a value increase of 181.79%. Similarly, D E Shaw & Co Inc increased its shareholding by 175.19%, boosting the value of its investment to $257.6 million.

Other notable buyers include:

- Janus Henderson Group PLC, a notable investor in Chevron Corporation, has increased its share ownership by 84.09%, which corresponds to a value of $383.65 million.

- Diamond Hill Capital Management Inc, another key investor, has grown its stakes in Chevron Corporation by 80.14%, $322.67 million.

- Amundi, one of the leading investors, made a comparatively modest increase in their share ownership by 10.81% $1.79 billion.

- Lazard Asset Management LLC, also a significant investor, has expanded its shareholding in Chevron Corporation by 34.97%, $619.48 million.

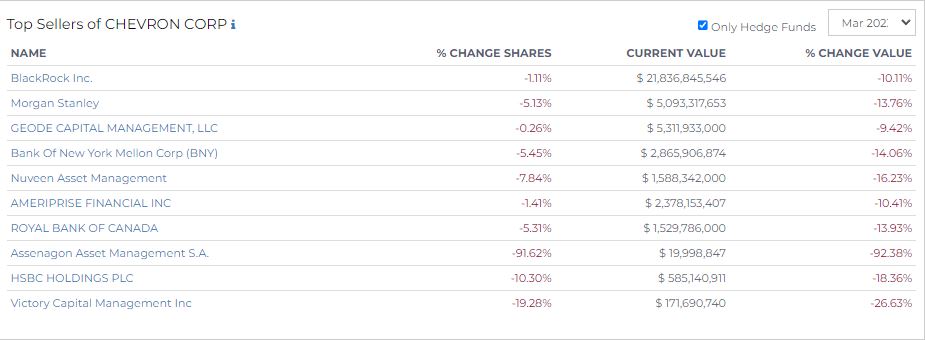

Top Sellers of Chevron Corp (CVX)

Several major institutional investors have significantly cut back their stakes in Chevron Corporation.

BlackRock Inc. maintains the largest current holdings despite a slight reduction of 1.11% in its stake. Its holdings are now valued at $21.84 billion.

Next is Morgan Stanley, which saw a decrease in its shareholdings by 5.13%, leaving its current holdings valued at $5.09 billion.

Close behind is Geode Capital Management, LLC, which experienced a minor stake reduction of 0.26%, leaving its current holdings valued at $5.31 billion.

Bank Of New York Mellon Corp (BNY) is next, having decreased its stake by 5.45%, which brought its current holdings down to $2.87 billion.

Ameriprise Financial Inc comes next, with a decrease in holdings by 1.41% and a current value of $2.38 billion.

Nuveen Asset Management follows, having significantly cut its stakes by 7.84%, leaving its current holdings valued at $1.59 billion.

Royal Bank of Canada (RBC) comes next, having reduced its stake by 5.31%. Its current holdings are worth $1.53 billion.

HSBC Holdings PLC has seen its holdings reduce by 10.30%, leaving its current value at $585.1 million.

Victory Capital Management Inc is next, with its holdings having reduced by 19.28% and now standing at $171.7 million.

At the bottom of the list is Assenagon Asset Management S.A., which has significantly reduced its stake by 91.62%, leaving its current holdings standing at $20 million.