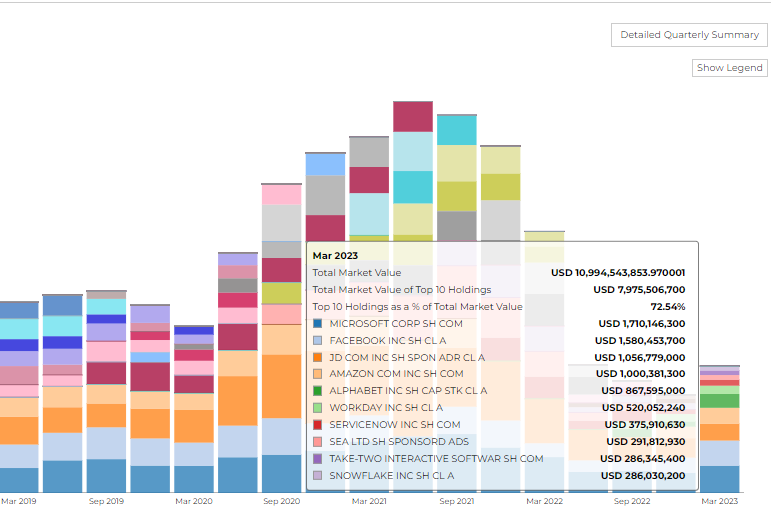

Tiger Global Management LLC filed its most recent 13F on 15 May 2023, for the quarter ended 31 Mar 2023. The firm disclosed 10.99 B in assets.

Drawing on the data and insights gathered via Radient, the focus now turns to significant highlights, equity transactions, and sales at Tiger Global Management for Q1 2023, as reported in their most recent 13F filing.

Top Buys made By Tiger Global Management

Alphabet Inc. (GOOGL): Tiger Global Management increased its stake in Alphabet by 124.4%, from 3.73M to 8.36M shares. The fund's position is now valued at $867.6M, up from its previous valuation of $328.85M.

Microsoft Corp. (MSFT): The fund's holdings in Microsoft saw a modest increase of 12.82%, moving from 5.26M to 5.93M shares. The total value of the stake is $1.71B, an increase from the prior value of $1.26B.

Amazon.com Inc. (AMZN): Tiger Global Management grew its Amazon shares by 12.74%, from 8.59M to 9.69M. The investment's value climbed to $1B from the previous $721.59M.

Apple Inc. (AAPL): The fund initiated a new position in Apple with 851K shares, valued at $140.33M.

Taiwan Semiconductor Manufacturing Ltd. (TSM): Tiger Global Management also started a new position with this tech company, purchasing 1.59M shares. The position is valued at $147.77M.

Consumer Discretionary Sector:

Take-Two Interactive Software Inc. (TTWO): The fund has dramatically increased its stake by 236.16%, from 714K to 2.4M shares. The position's value escalated to roughly $286.34M from the previous $74.35M.

Financial Sector:

Apollo Global Management Inc. (APO): Tiger Global Management significantly grew its stake by 316.41%, from 627.97K to 2.61M shares. The investment's value is $165.16M, a jump from the previous value of $40.06M.

XP Inc. (XP): The fund newly invested in XP Inc. with 7.3M shares, valued at $86.6M.

Information Technology Sector:

Intuit Inc. (INTU): The fund has increased its stake by 32,678%, moving from 1.37K to 448.4K shares. The value of the investment now stands at $199.91M, a significant increase from the previous $532.45K.

Datadog Inc. (DDOG): Tiger Global Management ramped up its stake in Datadog by 173.53%, from 966K to 2.64M shares. The value of the stake has surged to $192M from the earlier $71M.

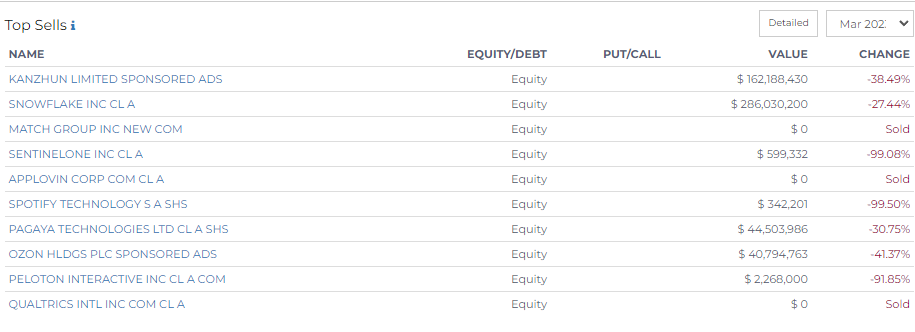

Top Sells by Tiger Global Management LLC

Tech Sector Sell-Off: Tiger Global Trims Stakes

Hedge fund giant Tiger Global has made significant sell-offs in the tech sector, according to its recent regulatory filings.

The firm substantially reduced its stakes in several tech companies. Most notably, it sold off 38.49% of its holdings in Kanzhun Limited (Sponsored Ads), bringing down its share count from 13.86M to 8.52M, translating to a value drop from $282.24M to $162.19M.

Snowflake Inc. also experienced a sizable divestment, with Tiger Global offloading 27.44% of its stakes. This move reduced its share count from 2.55M to 1.85M, decreasing the value from $366.74M to $286.03M.

Match Group Inc, a significant player in the online dating market, saw Tiger Global liquidate its entire stake of 1.46M shares, previously valued at $60.62M.

In a similar fashion, the firm fully divested from AppLovin Corp, letting go of all its 4.26M shares, which were previously worth $44.90M. The same fate was met by Qualtrics Intl Inc, with the hedge fund exiting its entire stake of 1.49M shares, formerly valued at $15.45M.

Tiger Global reduced its holdings in SentinelOne Inc. by 99.08%, resulting in a sharp decline from 3.98M shares to just 36,634 shares. The same pattern was evident with Spotify Technology S.A., as the fund cut down its stake by 99.5%, reducing the share count from 514,861 to a mere 2,561.

Pagaya Technologies Ltd experienced a sell-off of 30.75%, with Tiger Global's share count dropping from 63.00M to 43.63M. This change reflects a valuation decrease from $78.12M to $44.50M.

Ozon Holdings PLC, another prominent tech company, had a 41.37% reduction in Tiger Global's holdings. The fund's share count went down from 5.99M to 3.52M, resulting in a value decrease from $69.58M to $40.79M.

Finally, the interactive fitness company Peloton Interactive Inc also felt the sting, with Tiger Global cutting its stakes by 91.85%, reducing the shares from 2.45M to 200,000, and value from $19.49M to $2.27M.

-png.png)

-png.png)