Tech Titans Lead FMR LLC's Portfolio: Microsoft, Apple, and Nvidia

Fidelity Management & Research Company LLC (FMR), a subsidiary of FMR LLC, offers a variety of investment supervisory services to institutional accounts. Its clients include Fidelity's mutual funds and exchange-traded funds, private unregistered investment funds, separately managed account clients, and other institutional accounts

FMR also creates model portfolios consisting of individual securities, mutual funds, and/or exchange-traded products for use by its affiliates.

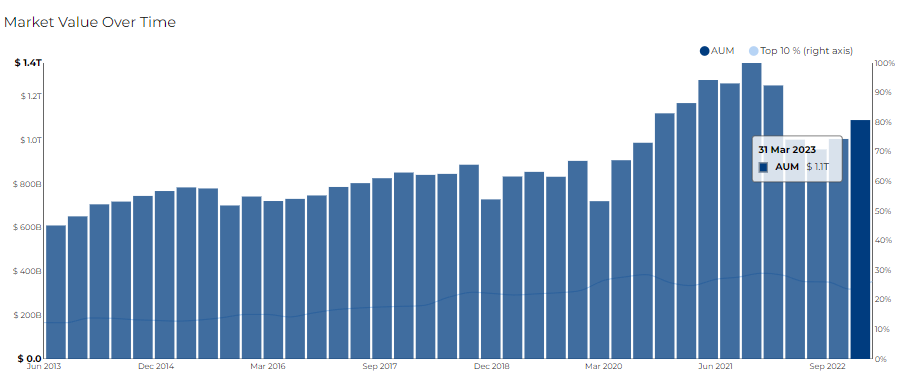

FMR filed its most recent 13F on 11 May 2023, for the quarter ended 31 Mar 2023.

Drawing on the data and insights gathered via Radient, the focus now turns to significant highlights, equity transactions, and sales at FMR LLC for Q1 2023, as reported in their most recent 13F filing.

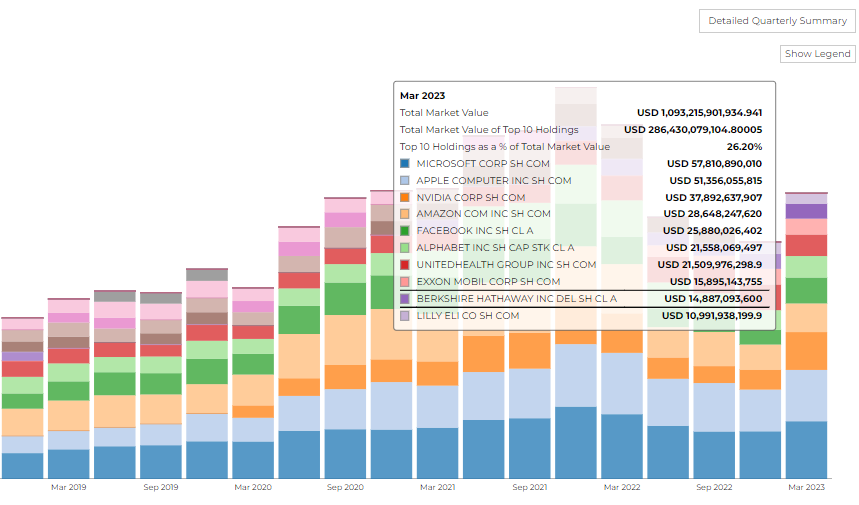

The firm disclosed 1.09 T in assets with a turnover rate of 16%. It holds 5255 securities in its 13F portfolio, and the top 10 holdings account for 26.2% of the portfolio.

The firm's top 3 holdings include Microsoft Corp ($57B), Apple Inc ($51B), and Nvidia Corporation ($37B).

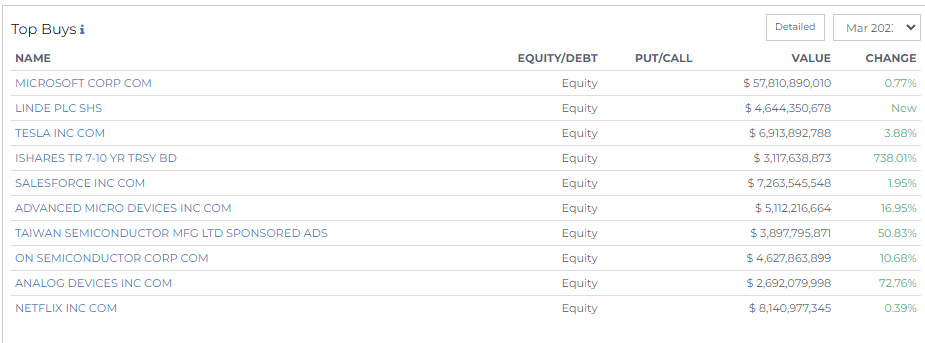

Top Buys of FMR LLC

The global investment powerhouse recently revealed a series of substantial investments, largely concentrated in the technology sector.

- In the IT sphere, FMR LLC amplified its stake in Microsoft Corp, one of the world's leading tech companies, with a buy-in of $57.8 billion (an increase of 0.77%).

- Likewise, Salesforce Inc., a prominent cloud-based software player, saw a 1.95% increase in FMR's holdings, resulting in an investment of $7.26 billion.

- Lastly, Netflix Inc., the media streaming giant, experienced a relatively modest increase of 0.39%, totaling an investment of $8.14 billion.

Electric Vehicle and Clean Energy Sector

- FMR LLC demonstrated its belief in the sustainability-focused sector with an increased 3.88% stake in Tesla Inc., the electric vehicle and clean energy frontrunner, amounting to $6.91 billion.

Semiconductor Industry

- Advanced Micro Devices (AMD), a prominent semiconductor firm, has seen FMR LLC elevate its equity holdings by 16.95%. This escalation brings the total investment in AMD to $5.11 billion.

- In a similar trend, FMR LLC has amplified its stake in Taiwan Semiconductor Mfg Ltd by 50.83% of the total investment to $3.89 billion.

- On Semiconductor Corp also attracted substantial investment from FMR LLC. A rise of 10.68% in equity holdings with total investment reaching $4.62 billion.

- Moreover, FMR LLC has expanded its portfolio with Analog Devices Inc., a leader in the design and manufacturing of analog, mixed-signal, and digital signal processing integrated circuits. The equity increase of 72.76% in Analog Devices Inc. pushes FMR LLC's total investment to $2.69 billion.

Financial Sector/ETF

- In a notable strategic move, FMR LLC expanded its holding in the iShares 7-10 Year Treasury Bond ETF by 738.01%, reaching an investment value of $3.11 billion.

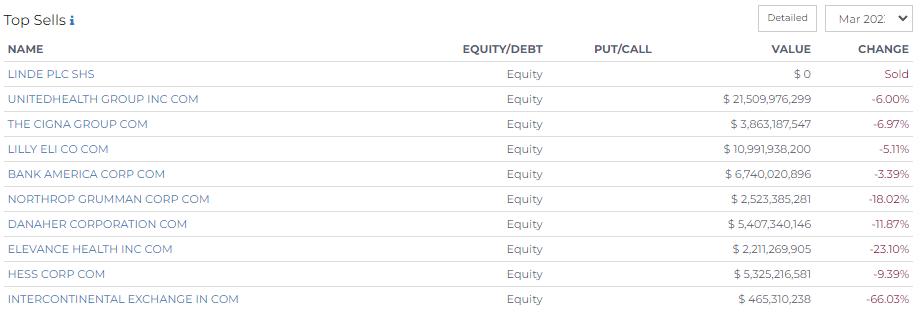

Top Sells By FMR LLC

FMR LLC has recently initiated a strategic reshaping of its portfolio, marked by a notable reduction in its positions across a variety of major companies in diverse sectors.

Healthcare Sector

The healthcare sector also witnessed notable changes.

- UnitedHealth Group Inc., a diversified health and well-being company, and The Cigna Group, a health services organization, saw decreases of 6.00% and 6.97% respectively in FMR LLC's equity holdings. This brought the total investments in these firms to $21.5 billion and $3.86 billion respectively.

- FMR LLC further reduced its stake in pharmaceutical company Lilly Eli Co by 5.11%, bringing the total investment value down to $10.99 billion.

Financial Sector

The financial sector saw FMR LLC scale back its investments as well.

- Bank of America Corp saw a decrease of 3.39% in FMR LLC's holdings, amounting to a remaining investment of $6.74 billion.

- Intercontinental Exchange Inc, an operator of global exchanges and clearing houses and provider of data and listings services, took a considerable hit with FMR LLC cutting its investment by a significant 66.03%, leaving only $465 million invested.

Defense Industry

- Northrop Grumman Corp, a leading global security company, experienced a sizable decrease of 18.02% in FMR LLC's holdings. The remaining investment stands at $2.52 billion.

Science and Technology Sector

- Danaher Corporation, a globally diversified conglomerate with its business in the science, healthcare, and technology sectors, also experienced a considerable sell-off from FMR LLC. Their holdings decreased by 11.87%, leading to an investment of $5.4 billion.

Healthcare Technology Sector

- Elevance Health Inc., a healthcare technology company, saw a considerable sell-off, with FMR LLC reducing its stake by 23.10%. This led to a remaining investment of $2.21 billion.

Energy Sector

- In the energy sector, FMR LLC reduced its holdings in Hess Corp, an exploration company, by 9.39%. The remaining stake is valued at $5.32 billion.