T. Rowe Price Associates Inc. boosts stake in Apple Inc to $38B in Latest 13F Filing.

T. Rowe Price Associates is a global investment management firm headquartered in Baltimore, Maryland, which made significant investment moves in various companies, with a noticeable emphasis on the technology and consumer goods sectors.

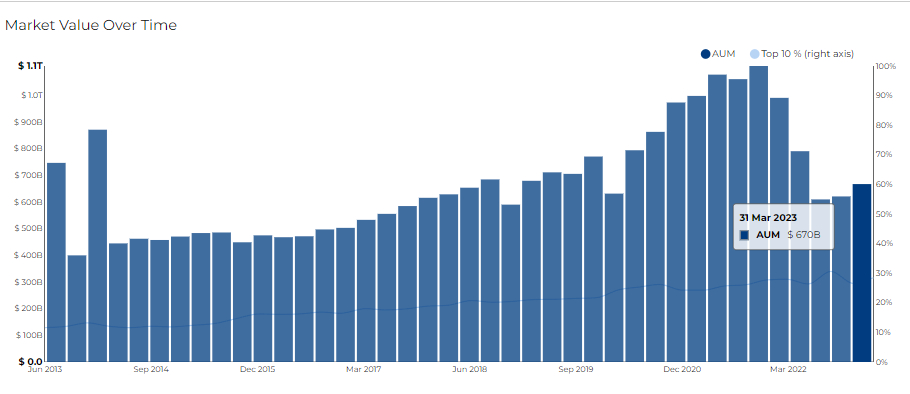

The firm filed its most recent 13F on 15 May 2023, for the quarter ended 31 Mar 2023.

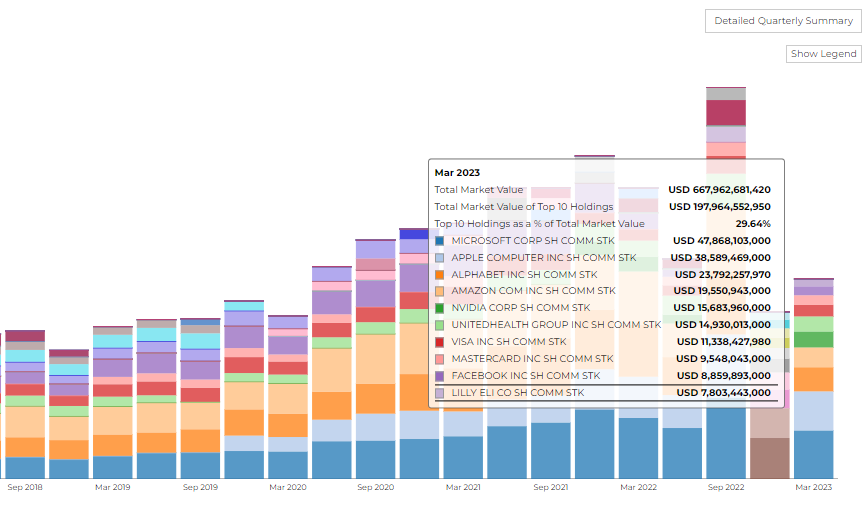

The firm disclosed 667.96 B in assets. It holds 2923 securities in its 13F portfolio, and the top 10 holdings account for 28.5% of the portfolio.

T. Rowe Price Associates Inc.'s top 3 holdings include Microsoft Corp ($47B), Apple Inc ($38B), and Amazon Com Inc ($19B).

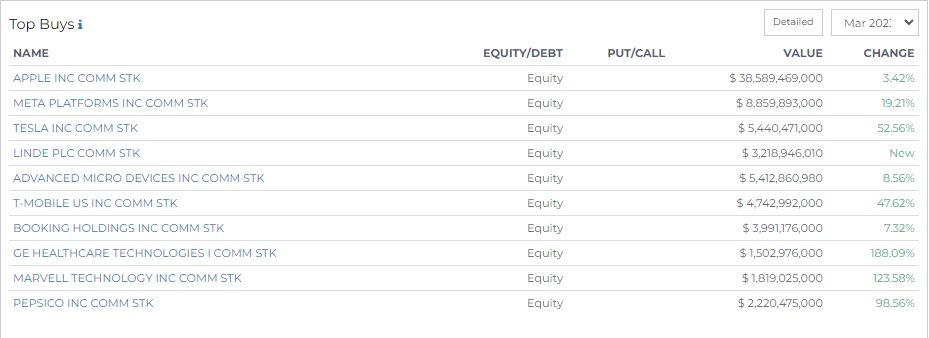

Top Buys made by T. Rowe Price Associates Inc.

In the technology sector, T. Rowe Price bolstered its stakes in three leading companies: Apple Inc., Meta Platforms Inc., and Tesla Inc.

- Apple saw a 3.42% increase in investment, reaching a current holding value of $38.59 billion.

- Meta Platforms, formerly known as Facebook, experienced a 19.21% hike, bringing its holding value to $8.86 billion.

- Tesla, the electric vehicle and clean energy company, experienced a substantial increase in T. Rowe Price's stake by 52.56%, totaling $5.44 billion.

In the consumer goods sector, T. Rowe Price added considerable value to its stakes in PepsiCo Inc., the multinational food, snack, and beverage corporation, which saw a 98.56% increase in T. Rowe Price's stake, bringing the holding value to $2.22 billion.

T. Rowe Price also invested significantly in various other sectors.

In the telecom sector, T-Mobile US Inc. saw an increase of 47.62% in T. Rowe Price's holdings, bringing the investment value to $4.74 billion.

The online travel company Booking Holdings Inc. also saw an uptick of 7.32%, raising the value of its holdings to $3.99 billion.

In the healthcare sector, GE Healthcare Technologies I witnessed a remarkable increase in T. Rowe Price's stake by 188.09%, totaling $1.50 billion in holdings.

The online travel company Booking Holdings Inc. also saw an uptick of 7.32%, raising the value of its holdings to $3.99 billion.

In the healthcare sector, GE Healthcare Technologies I witnessed a remarkable increase in T. Rowe Price's stake by 188.09%, totaling $1.50 billion in holdings.

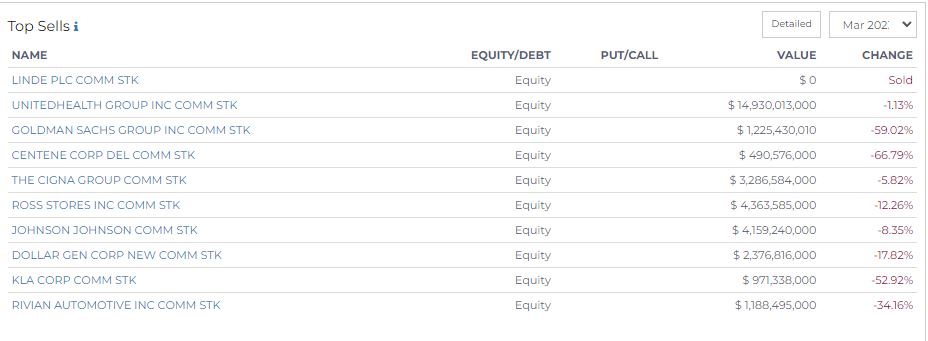

Top Sells

In a significant portfolio adjustment this March 2023, T. Rowe Price made notable sales in several security holdings.

In the financial sector, the most notable moves included a substantial reduction of its stakes in Goldman Sachs Group Inc and KLA Corp.

- T. Rowe Price slashed its holdings in Goldman Sachs by 59.02% and KLA Corp by 52.92%, leaving the remaining value of these securities at $1.23 billion and $971.3 million respectively.

Despite the firm's substantial divestments, several healthcare companies retained a hefty presence in its portfolio.

- For instance, even after a minor reduction of 1.13%, UnitedHealth Group Inc still holds a significant value of $14.93 billion.

- The Cigna Group experienced a stake reduction of 5.82%, leaving T. Rowe Price Associates' remaining investment at a value of $3.29 billion.

- Johnson & Johnson, the multinational healthcare corporation, saw a reduction of T. Rowe Price Associates' holdings by 8.35%. Despite this, the remaining value of its security stood at $4.16 billion.

In the retail sector, T. Rowe Price Associates trimmed its investments in both Ross Stores Inc and Dollar General Corp.

- Ross Stores saw a cut of 12.26% which left its remaining value in T. Rowe Price's portfolio at around $4.36 billion.

- Dollar General Corp, on the other hand, experienced a more considerable decrease of 17.82%, reducing the value of its securities to about $2.38 billion in the portfolio.

Stay up to date with the latest 13F Filing disclosures and RadientAnalytics insights.