Sweeney & Michel, LLC filed its most recent 13F on 07 Jun 2023, for the quarter ended 31 Mar 2023.

Drawing on the data and insights gathered via Radient, the focus now turns to significant highlights, equity transactions, and sales at Sweeney & Michel, LLC for Q1 2023, as reported in their most recent 13F filing.

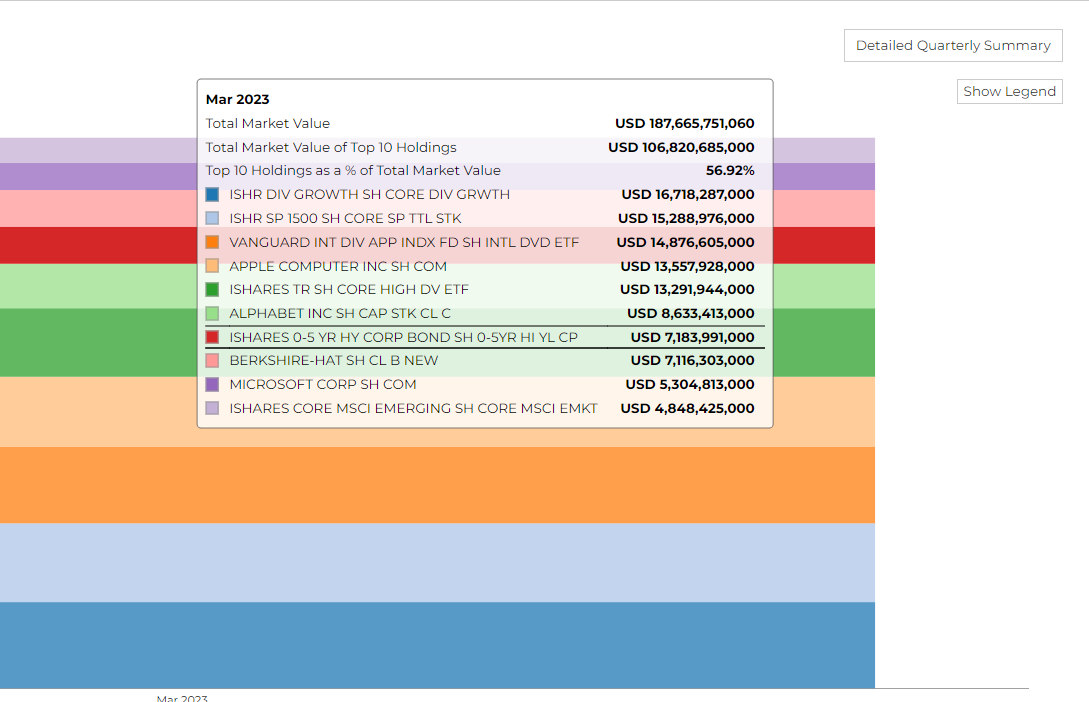

The firm disclosed 187.67 B in assets. It holds 102 securities in its 13F portfolio, and the top 10 holdings account for 56.9% of the portfolio.

Sweeney & Michel, LLC's top 3 holdings include Ishares Tr, Vanguard ($14.8B) Apple Inc ($13.5B).

Top Buys made by Sweeney & Michel, LLC

Investment advisory firm Sweeney & Michel has made significant strides in diversifying its portfolio according to recent data. The firm has purchased stakes in various sectors, from tech giants to pharmaceuticals and financial services to energy.

In the exchange-traded fund (ETF) space, Sweeney & Michel has made some significant buys. It acquired 333,100 shares in iShares Core Dividend Growth, valued at $16.72 billion. Similarly, the firm took on 161,720 shares in iShares Core S&P Total US Stock Market, valued at $15.29 billion.

An additional 196,859 shares were acquired in the Vanguard International Dividend Appreciation ETF, valued at $14.88 billion.

Other purchases include

- 133,937 shares in iShares Core High Dividend ETF, worth $13.29 billion.

- 174,538 shares in iShares 0-5 Year High Yield Corporate Bond ETF, valued at $7.18 billion.

- It also acquired 97,711 shares in iShares Core MSCI Emerging Markets, worth $4.85 billion,

- 34,107 shares in Vanguard International High Dividend Yield ETF, valued at $3.55 billion.

Moving onto the tech sector

Sweeney & Michel picked up 75,654 shares in Apple Inc., valued at $13.56 billion, and 67,496 shares in Alphabet Inc., worth $8.63 billion. The firm also procured 15,898 shares in Microsoft Corp., valued at $5.3 billion.

Within the financial sector

The firm took a considerable stake in Berkshire Hathaway Inc., purchasing 21,344 shares worth $7.12 billion. It also acquired 22,924 shares in JPMorgan Chase & Co., valued at $3.19 billion, and bought 103,721 shares in Trico Bancshares, worth $3.87 billion.

In the healthcare sector

Sweeney & Michel acquired 30,127 shares in Johnson & Johnson, valued at $4.77 billion, and 24,063 shares in Merck & Co., Inc., worth $2.65 billion.

Sweeney & Michel also ventured into the telecommunications and energy sectors.

It picked up 102,371 shares in Verizon Communications Inc., valued at $3.55 billion, and 50,483 sponsored ADS shares in Shell Plc, worth $2.91 billion.