Shopify Inc. is a technology sector company offering a cloud-based commerce platform for small and medium-sized businesses. It allows merchants to manage multiple aspects of their business across various sales channels, including web, mobile, social media, and physical locations.

Originally known as Jaded Pixel Technologies Inc., the company was renamed Shopify Inc. in 2011. Founded in 2004, Shopify is based in Ottawa, Canada, employs 3,000 staff, and is listed on the NYSE.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for Shopify Inc., breaking down the 13F filings of its top buyers and sellers.

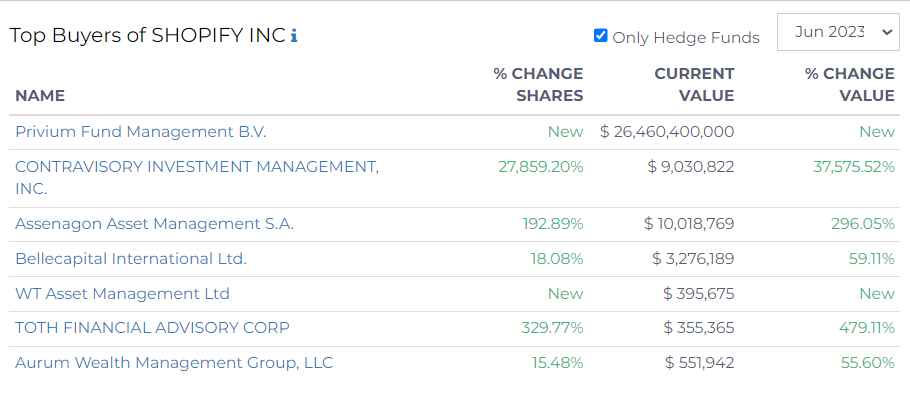

Top Buyers

In recent financial developments, Shopify Inc., one of the leading global commerce companies, has witnessed significant investment activity.

Netherlands-based Privium Fund Management B.V. became a new entrant, making a purchase amounting to $26.46B.

Another notable participant was Assenagon Asset Management S.A., which augmented its shares by 192.89%, elevating their value to $10.02M. This translates to a value increase of 296.05%.

Bellcapital International Ltd. chose to increment their shares by 18.08%, raising their current value to $3.28M, marking an increase of 59.11%.

Other notable buyers include:

- Toth Financial Advisory Corp made a significant move, increasing its shares by 329.77% which pushed their current value to $355,365, resulting in a significant increase of 479.11%.

- New market player WT Asset Management Ltd invested in Shopify with a current value standing at $395,675.

- Aurum Wealth Management Group, LLC also enhanced its position, upping its shares by 15.48%, taking its current value to $551,942, an increase of 55.60%.

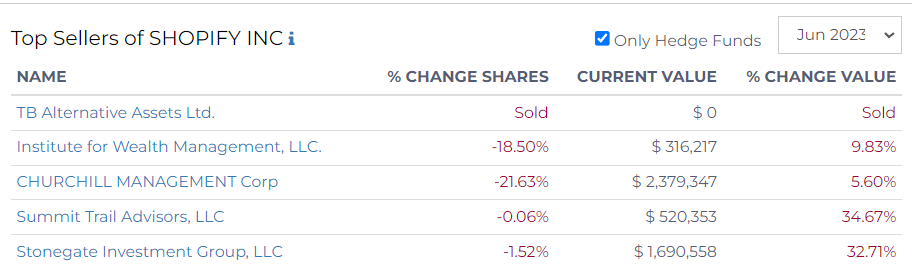

Top Sellers

TB Alternative Assets Ltd., one of the primary sellers, completely liquidated their Shopify holdings.

Institute for Wealth Management, LLC., reduced its Shopify holdings by 18.50%, leaving its current value at $316,217. This adjustment resulted in a 9.83% change in value.

Churchill Management Corp also trimmed its stake in Shopify, witnessing a decrease of 21.63% in its shares.

- Despite this reduction, the corporation managed to maintain a current value of $2.38M, marking a change in value of 5.60%.

Summit Trail Advisors, LLC, made a marginal cut in its shares by 0.06%, leaving its current value at around $520,353. Despite the decrease in shares, there was a notable value increase of 34.67%.

Lastly, Stonegate Investment Group, LLC, decreased its Shopify shares by 1.52%, leading to a current value of $1.69M. The firm still managed a value increase of 32.71%.