Searle & Co. is an investment adviser based in Greenwich, Connecticut, offering personalized portfolio management services to clients. The firm provides customized portfolios or utilizes predefined strategies or model portfolios.

The fee for their services, not exceeding 2% annually, is negotiable and calculated as a percentage of assets under management. Fees are paid quarterly in arrears, based on the average month-end balance.

Drawing on the data and insights gathered via Radient, the focus now turns to significant highlights, equity transactions, and sales at Searle & Co. for Q1 2023, as reported in their most recent 13F filing.

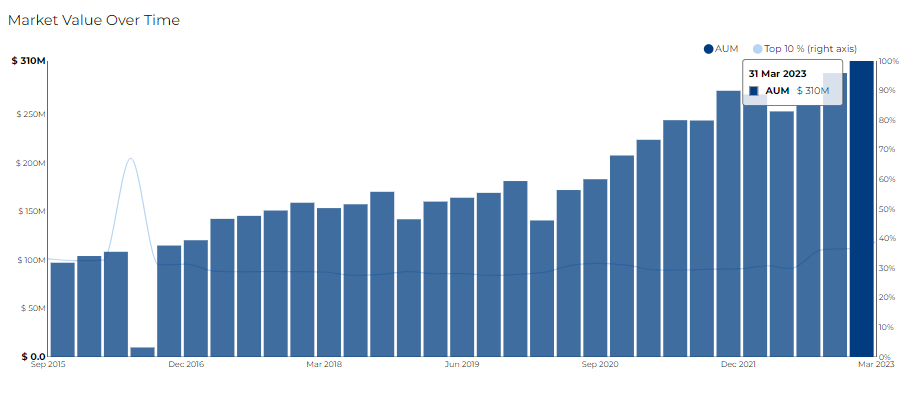

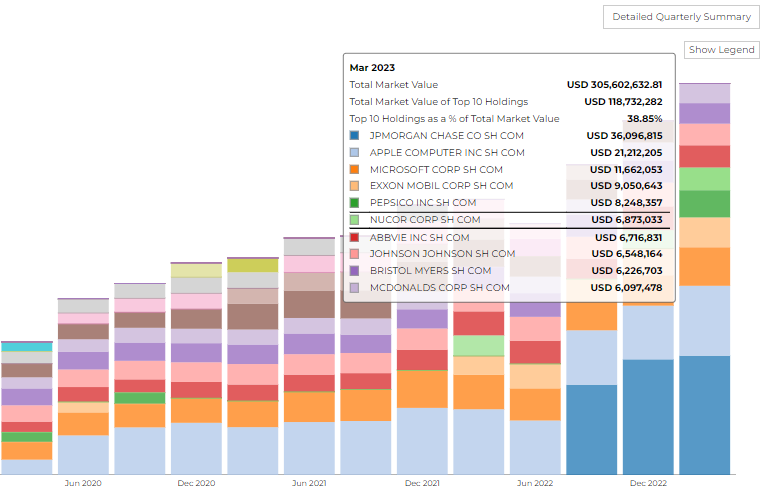

Searle & Co. filed its most recent 13F on 01 Jun 2023, for the quarter ended 31 Mar 2023. The firm disclosed 305.60 M in assets. It holds 148 securities in its 13F portfolio, and the top 10 holdings account for 38.9% of the portfolio.

Searle & Co.'s top 3 holdings include JPMorgan Chase Co ($36B), Apple Inc ($21B), and Microsoft Corp ($11.6B).

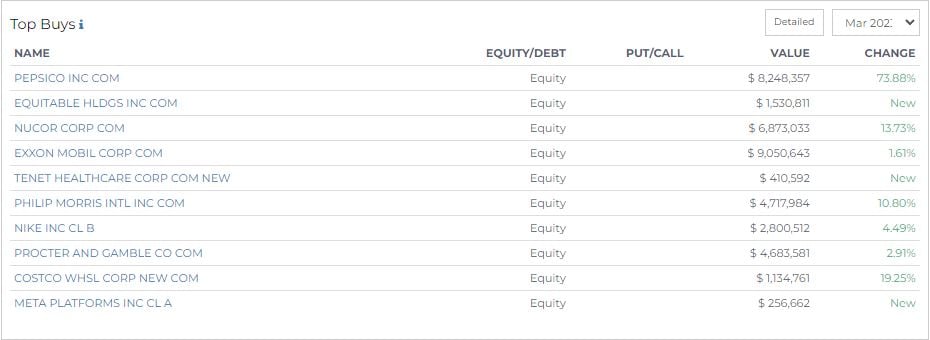

Searle & Co Makes Significant Acquisitions in Top Companies

Searle & Co, a prominent investment firm, recently disclosed its noteworthy acquisitions during the reporting period. Here are the key acquisitions made by Searle & Co categorized by common sector:

Consumer Goods:

Searle & Co made notable acquisitions in the consumer goods sector, increasing their holdings in PepsiCo Inc, Philip Morris International Inc, Procter and Gamble Co, and Nike Inc.

- Change in Shares: +43,210

- Previous Shares Amount: 24,850

- Change in Shares (%): +73.88%

- Current Value: $8.2 million

- Previous Value: $4.5 million

Philip Morris International Inc:

- Change in Shares: +47,194

- Previous Shares Amount: 42,594

- Change in Shares (%): +10.80%

- Current Value: $4.7 million

- Previous Value: $4.3 million

Procter and Gamble Co:

- Change in Shares: +29,950

- Previous Shares Amount: 29,104

- Change in Shares (%): +2.91%

- Current Value: $4.7 million

- Previous Value: $4.4 million

- Change in Shares: +22,100

- Previous Shares Amount: 21,150

- Change in Shares (%): +4.49%

- Current Value: $2.8 million

- Previous Value: $2.5 million

Energy:

The firm expanded their holdings in the energy sector with the acquisition of Exxon Mobil Corp.

Exxon Mobil Corp:- Change in Shares: +76,480

- Previous Shares Amount: 75,265

- Change in Shares (%): +1.61%

- Current Value: $9.1 million

- Previous Value: $8.3 million

Healthcare:

Searle & Co entered the healthcare sector with the acquisition of Tenet Healthcare Corp.

Tenet Healthcare Corp:- Change in Shares: +5,600

- Previous Shares Amount: 0

- Change in Shares (%): N/A

- Current Value: $410,592

- Previous Value: $0

Technology:

The firm ventured into the technology sector with the acquisition of Meta Platforms Inc.

- Change in Shares: +1,068

- Previous Shares Amount: 0

- Change in Shares (%): N/A

- Current Value: $256,662

- Previous Value: $0

Basic Materials:

The firm strengthened their position in the basic materials sector by acquiring Nucor Corp.

Nucor Corp:

- Change in Shares: +46,383

- Previous Shares Amount: 40,783

- Change in Shares (%): +13.73%

- Current Value: $6.9 million

- Previous Value: $5.4 million

Services:

- Change in Shares: +2,255

- Previous Shares Amount: 1,891

- Change in Shares (%): +19.25%

- Current Value: $1.1 million

- Previous Value: $863,242

Financials:

The firm entered the financials sector with the acquisition of Equitable Holdings Inc.

Equitable Holdings Inc:- Change in Shares: +58,900

- Previous Shares Amount: 0

- Change in Shares (%): N/A

- Current Value: $1.5 million

- Previous Value: $0

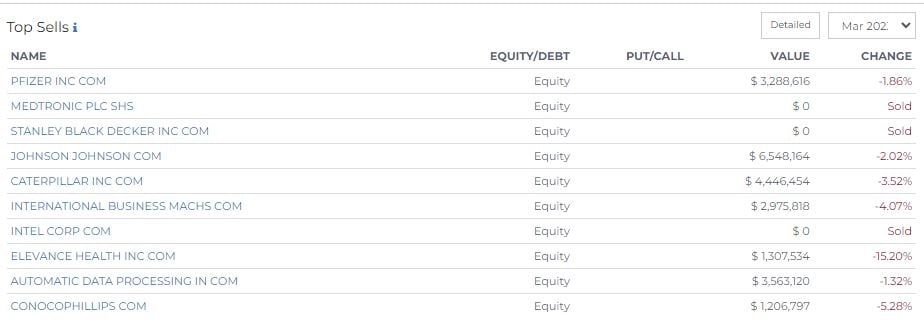

Searle & Co Makes Significant Sales in Top Companies

Recently revealed its top sells during the reporting period. These divestments reflect their decision to reduce their holdings in certain companies. Here are the key sells made by Searle & Co categorized by common sectors:

Healthcare:

Searle & Co reduced its holdings in the healthcare sector, divesting from Pfizer Inc and Medtronic PLC.

- Change in Shares: -84,562

- Previous Shares Amount: 86,162

- Change in Shares (%): -1.86%

- Current Value: $3.3 million

- Previous Value: $4.4 million

- Change in Shares: 0

- Previous Shares Amount: 13,919

- Change in Shares (%): -100.00%

- Current Value: $0

- Previous Value: $1.1 million

Elevance Health Inc:

- Change in Shares: -2,790

- Previous Shares Amount: 3,290

- Change in Shares (%): -15.20%

- Current Value: $1.3 million

- Previous Value: $1.7 million

Industrials:

Searle & Co completely sold its holdings in Stanley Black Decker Inc.

Stanley Black Decker Inc:

- Change in Shares: 0

- Previous Shares Amount: 12,169

- Change in Shares (%): -100.00%

- Current Value: $0

- Previous Value: $914,135

Caterpillar Inc:

- Change in Shares: -20,322

- Previous Shares Amount: 21,064

- Change in Shares (%): -3.52%

- Current Value: $4.4 million

- Previous Value: $5.0 million

Consumer Goods:

- Change in Shares: -40,001

- Previous Shares Amount: 40,825

- Change in Shares (%): -2.02%

- Current Value: $6.5 million

- Previous Value: $7.2 million

Information Technology:

Searle & Co decreased its holdings in International Business Machines Corp and completely divested from Intel Corp and Automatic Data Processing Inc.

International Business Machines Corp:

- Change in Shares: -23,541

- Previous Shares Amount: 24,541

- Change in Shares (%): -4.07%

- Current Value: $3.0 million

- Previous Value: $3.5 million

Intel Corp:

- Change in Shares: 0

- Previous Shares Amount: 17,709

- Change in Shares (%): -100.00%

- Current Value: $0

- Previous Value: $468,049

Automatic Data Processing Inc:

- Change in Shares: -16,196

- Previous Shares Amount: 16,412

- Change in Shares (%): -1.32%

- Current Value: $3.6 million

- Previous Value: $3.9 million

Energy:

- Change in Shares: -11,729

- Previous Shares Amount: 12,383

- Change in Shares (%): -5.28%

- Current Value: $1.2 million

- Previous Value: $1.5 million

Stay up to date with the latest 13F Filing disclosures on RadientAnalytics.