Recent 13F Filing: Greenlight Capital Inc.'s Top Buys and Sells

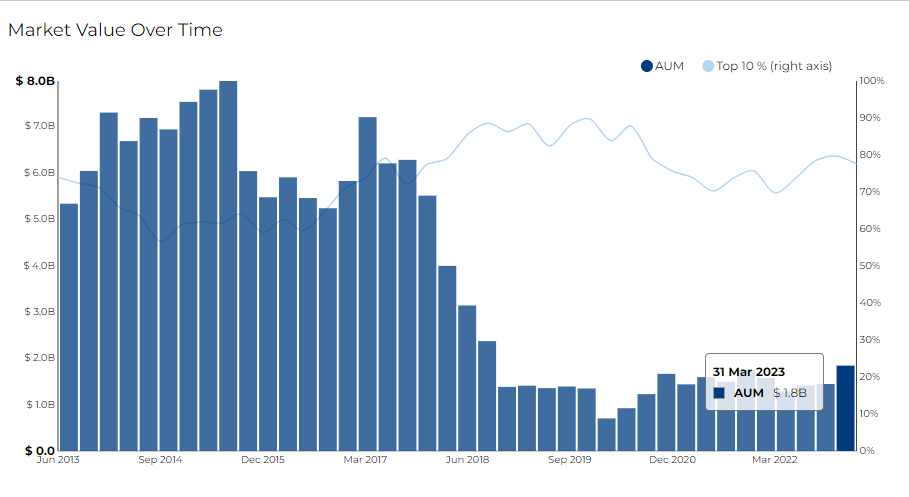

Greenlight Capital Inc filed its most recent 13F on 15 May 2023, for the quarter ended 31 Mar 2023.

Greenlight Capital, Inc. primarily focuses on trading and investing in long and short publicly-listed equity securities and cyclically attractive distressed debt. The firm offers investment advisory services to four capital funds that make all investment decisions on their behalf.

The executives and direct owners include Barrett Christopher Brown as the Chief Financial Officer, Steven Adam Rosen as the Chief Compliance Officer, and Daniel E Roitman as the Chief Operating Officer. The President and Director, David Michael Einhorn, holds 75%+ ownership.

Drawing on the data and insights gathered via Radient, the focus now turns to significant highlights, equity transactions, and sales at Greenlight Capital Inc for Q1 2023, as reported in their most recent 13F filing.

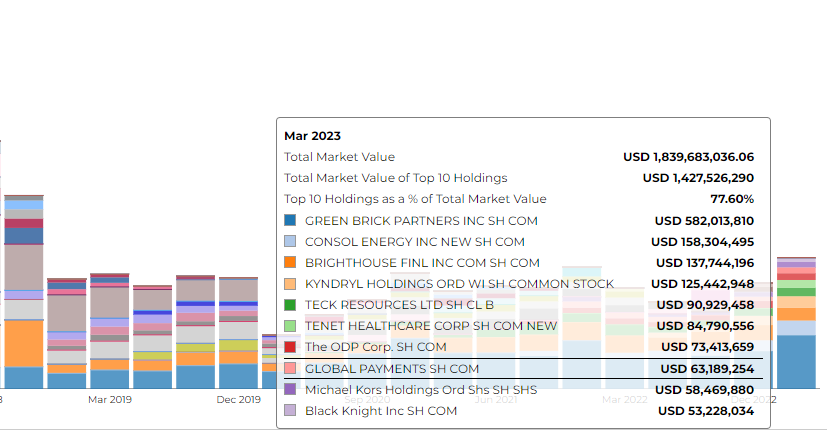

The firm disclosed 1.84 B in assets. It holds 39 securities in its 13F portfolio, and the top 10 holdings account for 77.6% of the portfolio.

Greenlight Capital Inc's top 3 holdings include Green Brick Partners Inc ($582.01M), Consol Energy Inc New ($158M), and Brighthouse Finl Inc ($137.74M).

Top Buys By Greenlight Capital Inc.

Greenlight Capital, the New York-based investment advisory firm, has made notable investments across various sectors. Here's a summary of the firm's top 10 investments categorized by sector:

Technology:

- Black Knight Inc: Greenlight Capital bought 924,740 shares of Black Knight Inc, contributing a total of $53.22 million to the company's equity.

- Global Payments Inc: Greenlight Capital increased its shareholding by 26.90% in Global Payments Inc, taking the total value of its shares to $ 63.18 million from $46.99 million.

- Concentrix Corp: Greenlight Capital raised its stake by 116.58%, contributing a total of $25.27 million up from $12.78 million.

Healthcare:

Tenet Healthcare Corp: The investment firm increased its shares by 116.57%, investing a total of $84.79 million, up from the previous value of $32.14 million.

Energy:

- Consol Energy Inc: Greenlight Capital increased its shareholding by 49.88%, now holding a total value of $158.30 million, up from $117.81 million.

- Gulfport Energy Corp: The investment firm increased its shares by 125.50%, investing a total of $22.64 million, up from $9.24 million.

Financial Services:

- First Citizens Bancshares Inc: Greenlight Capital invested in 22.5k shares of First Citizens Bancshares Inc, totaling $21.94 million.

- New York Community Bancorp Inc: The firm purchased 2.28M shares, contributing a total of $20.6M to the company's equity.

Other notable buys made by the firm:

- Rice Acquisition Corp II: Greenlight Capital bought 760k shares of Rice Acquisition Corp II, totaling $7.77 million.

- Teck Resources Ltd: Greenlight Capital increased its shareholding by 11.39% in Teck Resources Ltd, taking the total value of its shares to $90.93 million from $84.58 million.

In summary, the key theme emerging from Greenlight Capital's top ten buys is that the firm is keen on diversifying its portfolio across various sectors. From healthcare to energy, the firm has made notable investments, indicating a strategic approach toward potential growth sectors.

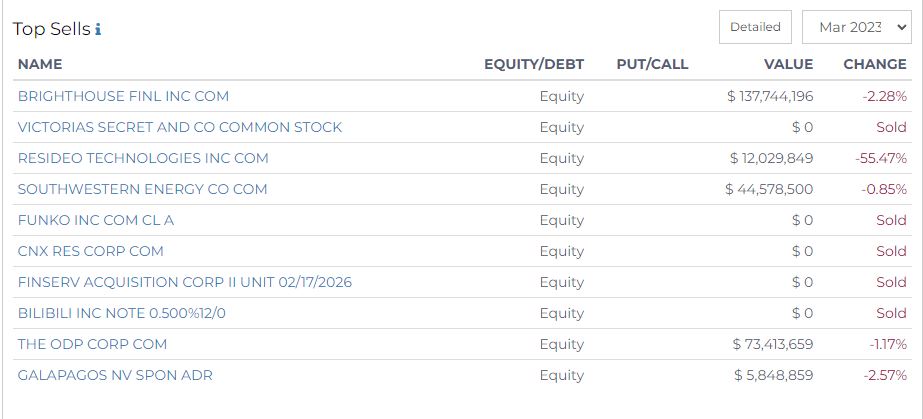

Top Sells made by Greenlight Capital

The firm has divested from various sectors recently. Here are the top ten sales, categorized by sector:

Financials:

Brighthouse Financial Inc: Greenlight reduced its shares by 2.28%, resulting in a decrease in the value from $163.84M to $137.74M.

Consumer Discretionary:

Victoria's Secret & Co: The firm fully divested from this company, showing a decrease of 100.00% from the previous value of $14.71M.

Industrial Goods:

Resideo Technologies Inc: Greenlight cut back its shares by 55.47%, resulting in a decrease in value from $24.31M to $12.03M.

Energy:

- Southwestern Energy Co: The firm slightly reduced its shares by 0.85%, bringing down the value from $52.60M to $44.58M.

- CNX Res Corp: The firm fully divested all its holdings from this company.

Consumer Goods:

Funko Inc: Greenlight completely sold out its investment in this company, reducing the previous value of $5.69M to $0.

Financial Services:

Finserv Acquisition Corp II: Greenlight sold all its units, reducing its value from $3.16M to $0.

Technology:

- Bilibili Inc: The firm divested completely from this company, reducing the value from $1.84M to $0.

- The ODP Corp: Greenlight slightly reduced its shares by 1.17%, decreasing the value from $75.20M to $73.41M.

Healthcare:

Galapagos NV: The firm reduced its shares by 2.57%, resulting in a decrease in value from $6.89M to $5.85M.