Stonebridge Capital Advisors is an SEC-registered investment advisory firm that was founded in 1997. The firm is headquartered in St. Paul, Minnesota, and has offices in Denver, Colorado, and Hendersonville, Tennessee.

Stonebridge Capital Advisors provides investment management, wealth management, and advisory services to high-net-worth individuals, families, nonprofits, and institutions.

The firm's investment philosophy is based on a long-term, value-oriented approach. Stonebridge Capital Advisors seeks to identify undervalued companies with strong fundamentals and a history of profitability. The firm's investment process is based on a rigorous analysis of financial statements, industry trends, and competitive dynamics.

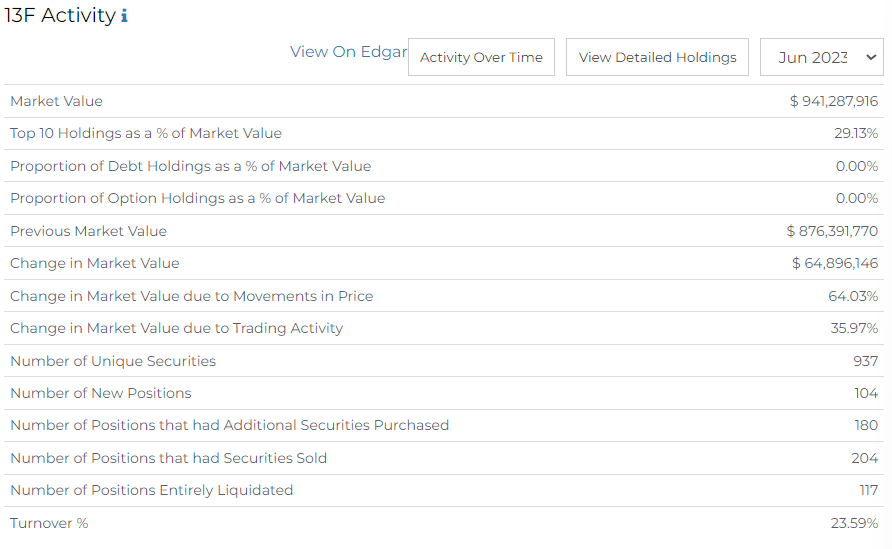

Stonebridge Capital Advisors LLC held a total of 928 equity securities at the end of Q2 2023, with a total market value of $941.288 million. This represents a 7.5% increase from the previous quarter. The firm's top 10 holdings account for approximately 29.14% of the portfolio.

Stonebridge Capital Advisors LLC's top purchases include Apple Inc Com ($61.7M), Microsoft Corp Com ($41.6M), Alphabet Inc Cap Stk Cl A ($30.2M), Amazon Com Inc Com ($25M), Ishares Core Sp 500 ETF ($24.1M).

Stonebridge bought 104 new securities and entirely liquidated 117 positions from its portfolio in Q2 2023. The largest securities by value, bought by the firm were Amazon, Vanguard, and Microsoft.

- Sector Allocation: The portfolio is diversified across a variety of sectors, with the largest sector allocations being technology (20.0%), healthcare (18.5%), and consumer discretionary (16.0%).

- Geographic Allocation: The portfolio is primarily invested in U.S. stocks (85.0%), with smaller allocations to European stocks (7.5%) and Asian stocks (7.5%).

- Trading Activity: The firm had a turnover rate of 19.10% in Q2 2023. This means that the firm bought or sold approximately 20% of its portfolio during the quarter.

Overall, Stonebridge Capital Advisors LLC's 13F filing suggests that the firm is maintaining a long-term investment horizon and is focused on identifying high-quality companies with strong fundamentals. The firm's portfolio is well-diversified across sectors and geographies. The firm's trading activity was moderate in Q2 2023, with the firm making a few notable changes to its portfolio.

Here are some specific observations about the firm's portfolio:

- The firm's top 10 holdings are all well-established companies with strong track records of growth and profitability.

- The firm has increased its holdings in technology stocks, such as Amazon.com, Inc. (AMZN), Alphabet Inc. (GOOG), and Microsoft Corporation (MSFT). This suggests that the firm is bullish on the technology sector.

- The firm has also increased its holdings in healthcare stocks, such as Johnson & Johnson (JNJ) and Meta Platforms, Inc. (META). This suggests that the firm believes that the healthcare sector is attractive.

- The firm has sold out of its positions in some retail stocks, such as Home Depot Inc. (HD) and Lowe's Companies, Inc. (LOW). This suggests that the firm is concerned about the outlook for the retail sector.

Overall, Stonebridge Capital Advisors LLC is focused on identifying high-quality companies that are well-positioned for long-term growth.