Wal-Mart Stores, Inc. (Walmart) is a global retail company operating in various formats. It is divided into three segments: Walmart U.S., Walmart International, and Sam's Club. For the fiscal year ending in January 2013, the Walmart U.S. segment, which includes retail operations in all 50 states, Puerto Rico, and online retail operations at walmart.com, accounted for approximately 59% of net sales.

The Walmart International segment, encompassing retail operations in 26 countries, contributed around 29% of net sales. The Sam's Club segment operates membership warehouse clubs in 47 states, Puerto Rico, and online at samsclub.com. Walmart is listed on the NYSE and employs approximately 2.3 million people.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for Walmart, breaking down the 13F filings of its top buys and sells.

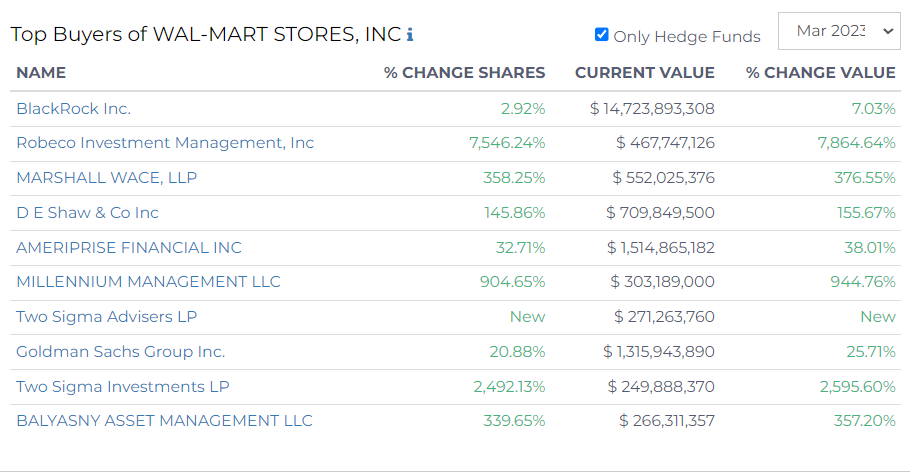

Top Buyers of Wal-Mart Stores, Inc

In March 2023, prominent hedge funds made significant purchases of Wal-Mart Stores, Inc. shares.

BlackRock Inc., with a 2.92% increase in shares, currently holds a value of $14.72B, marking a 7.03% increase in value. Robeco Investment Management, Inc saw a significant rise, increasing their shares to a value of $467.75M.

Marshall Wace, LLP increased its shares by 358.25%, reaching a value of $552.03M, a 376.55% increase in value. D E Shaw & Co Inc grew their shares by 145.86%, leading to a current value of $709.85M, a 155.67% increase in value.

Other key buyers include

- Ameriprise Financial Inc, with a 32.71% increase in shares to a value of $1.51B, a 38.01% increase in value;

- Millennium Management LLC, with a 904.65% increase in shares to a value of $303.19M, a 944.76% increase in value

- Two Sigma Advisers LP, who are new entrants with a value of $271.26M.

- Goldman Sachs Group Inc. increased their shares by 20.88%, with a current value of $1.31B, a 25.71% increase in value.

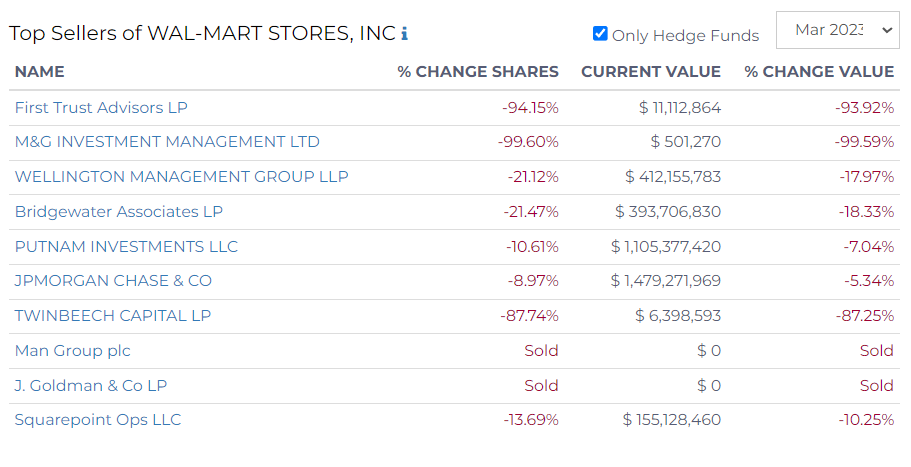

Top Sellers of Wal-Mart Stores, Inc

During the same period, some hedge funds reduced their holdings in Wal-Mart Stores, Inc.

First Trust Advisors LP decreased their shares by 94.15% to a value of $11.11M, a decrease of 93.92%. M&G Investment Management Ltd drastically reduced their shares by 99.60% to a mere $501.27K, a similar decrease in value.

Wellington Management Group LLP reduced their shares by 21.12%, leading to a current value of $412.15M, a 17.97% decrease in value. Bridgewater Associates LP also reduced their shares by 21.47%, resulting in a current value of $393.71M, an 18.33% decrease in value.

Other notable sellers include

- Putnam Investments LLC, with a 10.61% decrease in shares to a value of $1.11B, a 7.04% decrease in value;

- JPMorgan Chase & Co, who reduced their shares by 8.97% to a value of $1.48B, a 5.34% decrease in value.

- J. Goldman & Co LP fully sold off their shares.

- Squarepoint Ops LLC decreased their shares by 13.69%, with a current value of $155.13M, a 10.25% decrease in value.