Roblox Corporation filed its most recent 13F on 12 May 2023, for the quarter ended 31 Mar 2023.

Operating within the Communication Services sector, Roblox Corporation is dedicated to creating a human co-experience platform that fosters shared interactions amongst billions of users. It's publicly traded on the New York Stock Exchange (NYSE). As of the latest data, Roblox boasts a workforce of 960 employees committed to shaping the future of online social interactions and shared digital experiences.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for Roblox Corporation, breaking down the 13F filings of its top buys and sells.

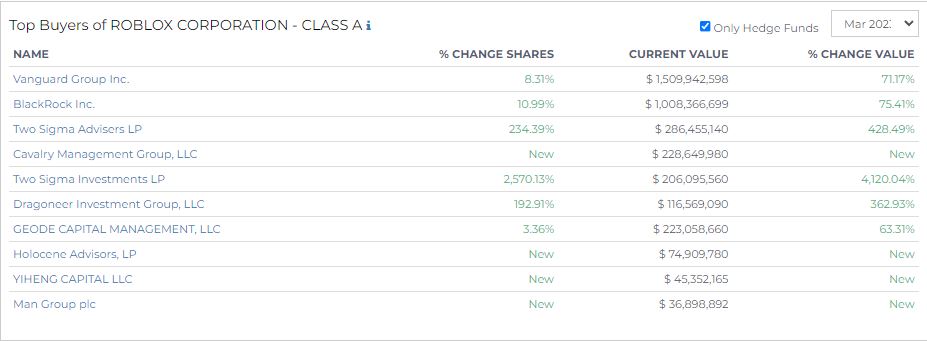

Top Buyers

In March 2023, the landscape of top buyers of Roblox Corporation - Class A shares saw some significant shifts, with both familiar players upping their stakes and new entrants emerging on the scene.

The Vanguard Group Inc. increased its shares by 8.31%, equating to a value of $1.51 billion, a massive 71.17% surge in value. BlackRock Inc. followed suit, with a 10.99% increase in shares, pushing the value of their holdings to just over $1 billion, an 75.41% uptick in value.

Two Sigma Advisers LP with a 234.39% hike in their share numbers, translating to a value of $286.46 million. This represents a staggering 428.49% value increase.

Cavalry Management Group, LLC and Holocene Advisors, LP are notable new entrants in the Roblox arena, initiating their positions with investments of $228.65 million and $74.91 million respectively.

Other newcomers include Yiheng Capital LLC injecting $45.35 million into Roblox.

Two Sigma Investments LP stood out with a 2,570.13% rise in their shares, leading to a value of $206.10 million, marking a value increase of 4,120.04%. Similarly, Dragoneer Investment Group, LLC boosted its shares by 192.91%, amounting to $116.57 million, a leap of 362.93% in value.

Finally, Geode Capital Management, LLC displayed a conservative approach with a 3.36% rise in shares, resulting in a value of about $223.06 million, corresponding to a 63.31% increase in value.

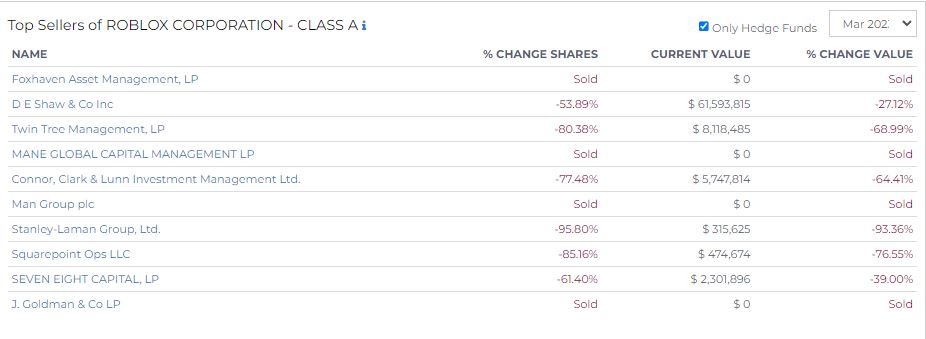

Top Sellers

In a major shift in the investment landscape, several top hedge funds have significantly reduced their holdings or completely sold their stakes in Roblox Corporation's Class A shares in March 2023.

Foxhaven Asset Management, LP; Mane Global Capital Management LP; and J. Goldman & Co LP entirely liquidated their holdings in Roblox.

Notable reductions in shares were seen from D E Shaw & Co Inc, which decreased its shares by 53.89%, leaving it with a current value of $61.6 million, a 27.12% reduction in value.

Twin Tree Management, LP also significantly decreased its position by 80.38%, leaving it with $8.12 million, a significant decrease of 68.99% in value.

Connor, Clark & Lunn Investment Management Ltd. downsized its holdings by 77.48%, leaving it with $5.75 million, a 64.41% reduction in value.

Stanley-Laman Group, Ltd. reduced its stake by a massive 95.8%, leaving it with just $315.6K, a 93.36% decline in value.

Squarepoint Ops LLC also witnessed a sizeable reduction in its stake by 85.16%, leaving it with $474.7K, marking a decrease of 76.55% in value.

Lastly, Seven Eight Capital, LP, reduced its stake by 61.4%, leaving it with a stake worth $2.3 million, which is a 39% reduction in value.