Q1 2023 13F Review: Baupost Group's Notable Buys and Sells

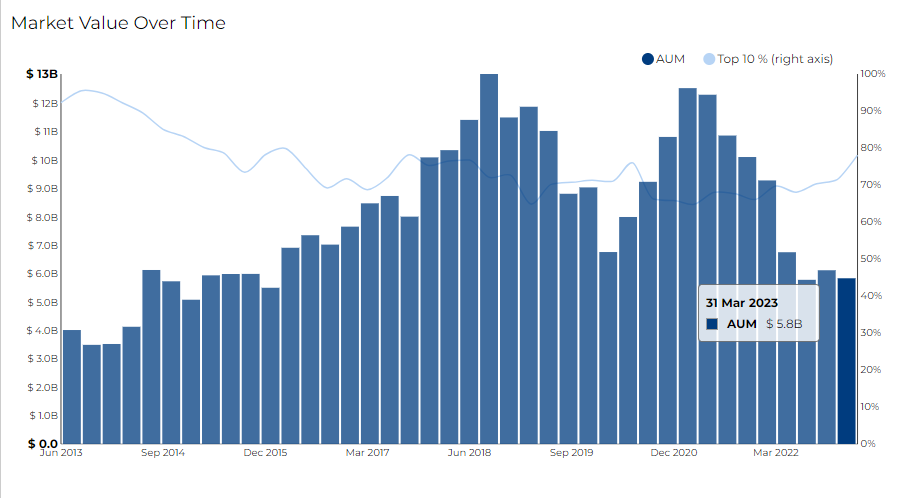

Baupost Group LLC filed its most recent 13F on 12 May 2023, for the quarter ended 31 Mar 2023

The Baupost Group is a privately-owned investment management firm headquartered in Boston, Massachusetts. Founded in 1982 by Seth A. Klarman, who serves as the CEO and portfolio manager, the company manages eleven domestic investment limited partnerships.

Based on the data and analytics obtained from Radient, let's delve into notable highlights, equity transactions, and sales during Q1 2023 at Baupost Group. The following insights are based on the company's latest 13F filing disclosures.

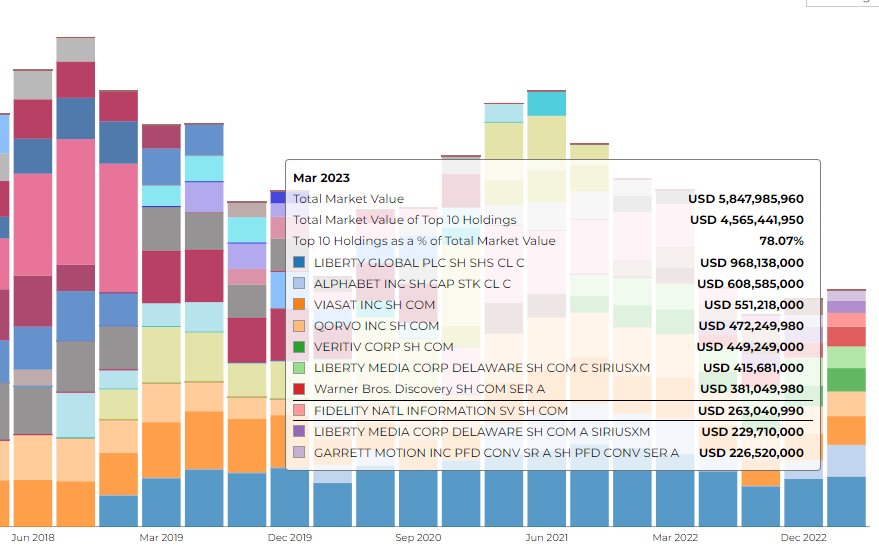

The firm disclosed 5.85 B in assets and recently liquidated 6 of its securities, resulting in a complete divestment of those holdings which will be covered in this blog. As a result, the current count of securities now stands at 31.

The top 10 holdings account for 78.07% of the portfolio. The firm's top three holdings are Liberty Global Plc (valued at $968M), Alphabet Inc (valued at $608M), and Viasat Inc (valued at $551.21M).

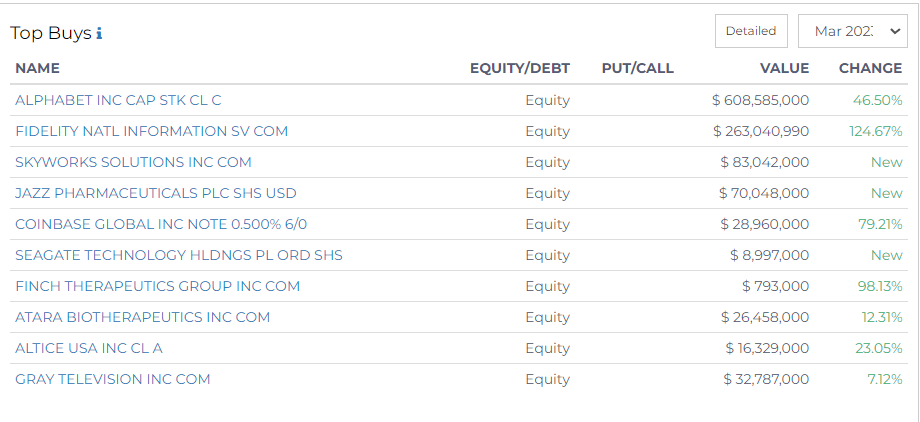

Top Buys by Baupost Group LLC

Baupost Group has been focusing on diversifying its investments across various sectors, as revealed in the most recent 13F filings from March 2023.

- Significant moves were made in Alphabet Inc, where Baupost increased its stake by 46.5% to $608.59M.

- Additionally, the hedge fund entered new positions with Skyworks Solutions Inc and Seagate Technology Holdings, investing $83.04M and $8.99M, respectively.

The financial services sector

- Baupost increased its position in Fidelity National Information Services by 124.67%, bringing its total investment to $263.04M.

- Additionally, the stake in Coinbase Global Inc grew by 79.21%, totaling $28.96M.

The pharmaceuticals and biotechnology sector also saw an influx of investment.

- New additions to Baupost's portfolio include Jazz Pharmaceuticals at $70.05M and Finch Therapeutics Group Inc, where the investment was increased by 98.13% to $793,000.

- Furthermore, Atara Biotherapeutics Inc saw a stake increase of 12.31%, with the total investment now standing at $26.46M.

Media and communications sector

- Baupost increased its investment in Altice USA Inc by 23.05% to $16.33M, and Gray Television Inc saw a boost of 7.12%, bringing the total investment to $32.79M.

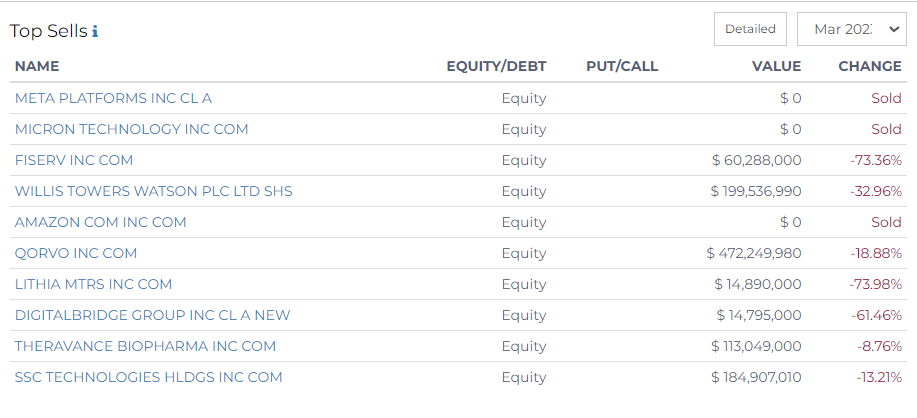

Top Sells By Baupost Group Inc

Baupost Group has strategically divested multiple holdings across various sectors.

In the technology sphere

- The hedge fund entirely liquidated its stakes in Meta Platforms Inc and Micron Technology Inc.

- Additionally, Baupost significantly reduced its position in Fiserv Inc by 73.36% to $60.29M, and also cut its stake in Qorvo Inc by 18.88% to $472.25M, indicating a substantial shift in its tech investments.

The e-commerce sector was also impacted, as Baupost fully exited its position in Amazon and Redfin Corp, selling all of its shares.

Within the financial services industry, Baupost trimmed its holdings.

- Willis Towers Watson saw its investment reduced by 32.96% to $199.54M, while SS&C Technologies Holdings Inc experienced a 13.21% decrease in Baupost's stake, leaving it valued at $184.91M.

In the automotive sector, the hedge fund significantly scaled down its stake in Lithia Motors Inc by 73.98%, with the value of remaining shares at just $14.89M.

The telecommunications sector was not immune to this divestment trend either.

- Baupost trimmed its stake in DigitalBridge Group Inc by 61.46%, leaving the current holding at $14.80M.

Finally, in the pharmaceuticals and biotechnology sector, Baupost decreased its stake in Theravance Biopharma Inc by 8.76%, with the remaining shares valued at $113.05M.