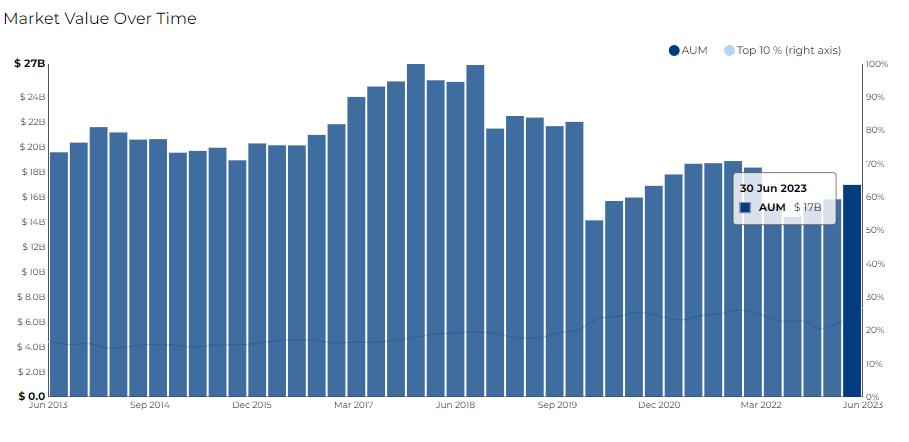

Panagora Asset Management INC filed its most recent 13F on 11 Aug 2023, for the quarter ended 30 Jun 2023.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for Panagora Asset Management, breaking down the 13F filings of its top buys and sells for June 2023.

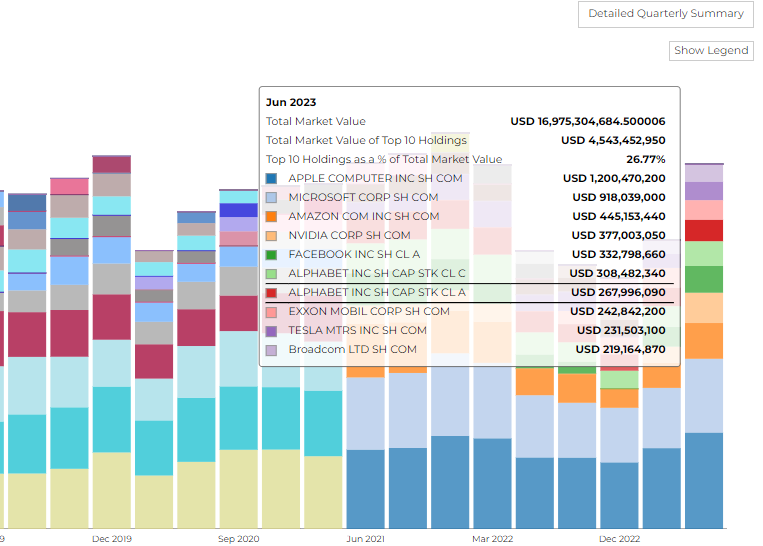

The firm disclosed 16.98 B in assets. It holds 1240 securities in its 13F portfolio, and the top 10 holdings account for 26.8% of the portfolio. The firm has a turnover rate of 33.95%.

Panagora Asset Management's top purchases include Apple Inc, Microsoft Corp, Amazon Com Inc, Nvidia Corporation, Meta Platforms Inc.

Panagora Asset Management: Report on Top Buys

Panagora Asset Management has made significant changes in its portfolio, evident from their latest equity acquisitions. Here's a snapshot of their top buys, categorized by sector:

Technology:

- Apple Inc.

- Shares: 6.19M (up 1.41% from 6.10M)

- Current Value: $1.2B (previously $1.006B)

- Nvidia Corporation

- Shares: 891.22K (up 23.26% from 723.05K)

- Current Value: $377M (previously $200.84M)

- Microsoft Corp.

- Shares: 2.70M (up 3.66% from 2.60M)

- Current Value: $918.04M (previously $749.78M)

- Amazon.com Inc.

- Shares: 3.41M (up 12.84% from 3.03M)

- Current Value: $445.15M (previously $312.58M)

Financial Services:

- iShares TR

- Equity Class: MSCI EAFE ETF

- Shares: 1.43M (up 3,435.35% from 40.34K)

- Current Value: $103.39M (previously $2.88M)

- Mastercard Incorporated

- Equity Class: CL A

- Shares: 508.19K (up 74.86% from 290.63K)

- Current Value: $199.87M (previously $105.62M)

Retail:

- Walmart Inc.

- Shares: 747.58K (up 345.06% from 167.97K)

- Current Value: $117.50M (previously $24.77M)

- Costco Wholesale Corporation

- Shares: 166.64K (up 450.92% from 30.25K)

- Current Value: $89.71M (previously $15.03M)

Industrials:

- Caterpillar Inc.

- Shares: 315.08K (up 469.86% from 55.29K)

- Current Value: $77.53M (previously $12.65M)

Consumer Goods:

- Coca Cola Co.

- Shares: 1.46M (up 208.93% from 474.21K)

- Current Value: $88.22M (previously $29.42M)

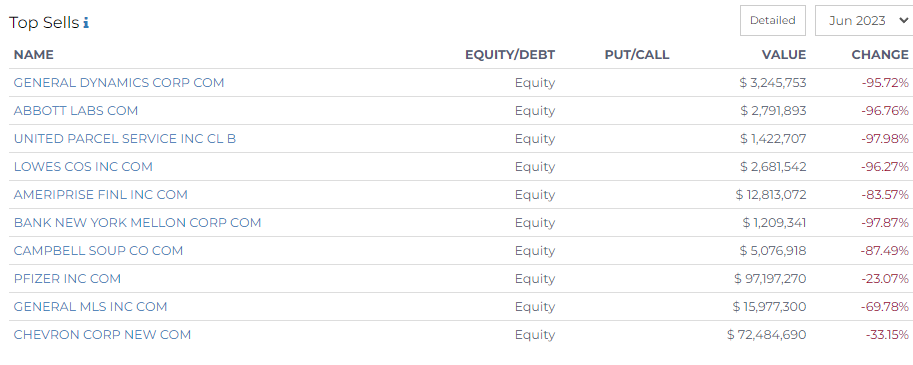

Report on Top Sells

Panagora Asset Management has made significant sales across various sectors. This report provides a breakdown of the top sells made by the firm, focusing on the change in the number of shares and the corresponding value.

Defense Sector:

- Current Shares: 15.09k (-337.74k)

- Change in Shares: -95.72%

- Current Value: $3.25M (-$77.27M)

Healthcare Sector:

Abbott Labs:

- Current Shares: 25.61k (-765.06k)

- Change in Shares: -96.76%

- Current Value: $2.79M (-$77.27M)

Pfizer Inc:

- Current Shares: 2.65M (-794.56k)

- Change in Shares: -23.07%

- Current Value: $97.20M (-$43.33M)

Logistics and Transportation Sector:

United Parcel Service Inc:

- Current Shares: 7.94k (-385.95k)

- Change in Shares: -97.98%

- Current Value: $1.42M (-$74.99M)

Retail Sector:

- Current Shares: 11.88k (-306.85k)

- Change in Shares: -96.27%

- Current Value: $2.68M (-$61.05M)

Financial Services Sector:

Ameriprise Finl Inc:

- Current Shares: 38.58k (-196.23k)

- Change in Shares: -83.57%

- Current Value: $12.81M (-$59.16M)

Bank New York Mellon Corp:

- Current Shares: 27.16k (-1.25M)

- Change in Shares: -97.87%

- Current Value: $1.21M (-$56.81M)

Food and Beverage Sector:

- Current Shares: 111.07k (-776.51k)

- Change in Shares: -87.49%

- Current Value: $5.08M (-$43.72M)

General Mills Inc:

- Current Shares: 208.31k (-480.99k)

- Change in Shares: -69.78%

- Current Value: $15.98M (-$42.93M)

Energy Sector:

- Current Shares: 460.66k (-228.41k)

- Change in Shares: -33.15%

- Current Value: $72.48M (-$39.94M)

Curious about 13F filings from other hedge funds? Sign up for a free trial here.

-png.png)