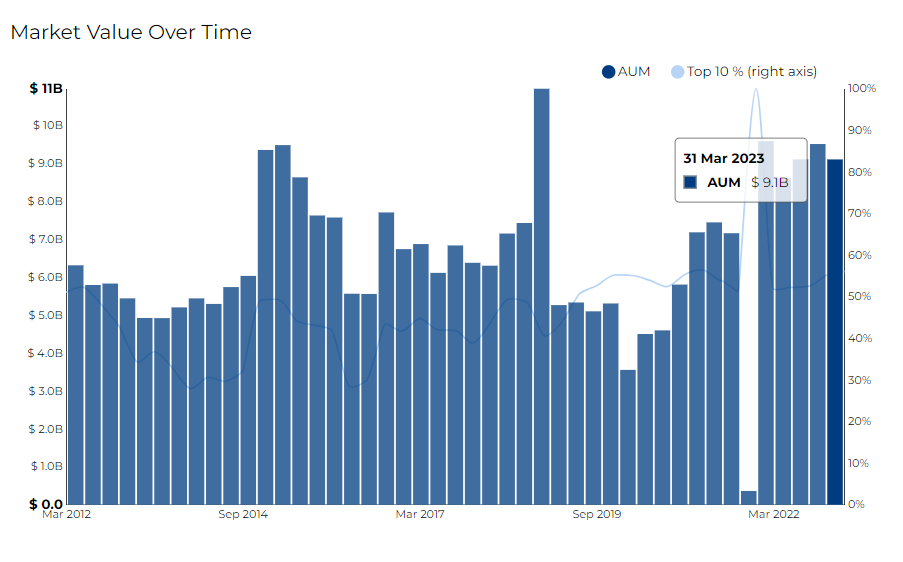

Oaktree Capital Management LP filed its most recent 13F on 15 May 2023, for the quarter ended 31 Mar 2023.

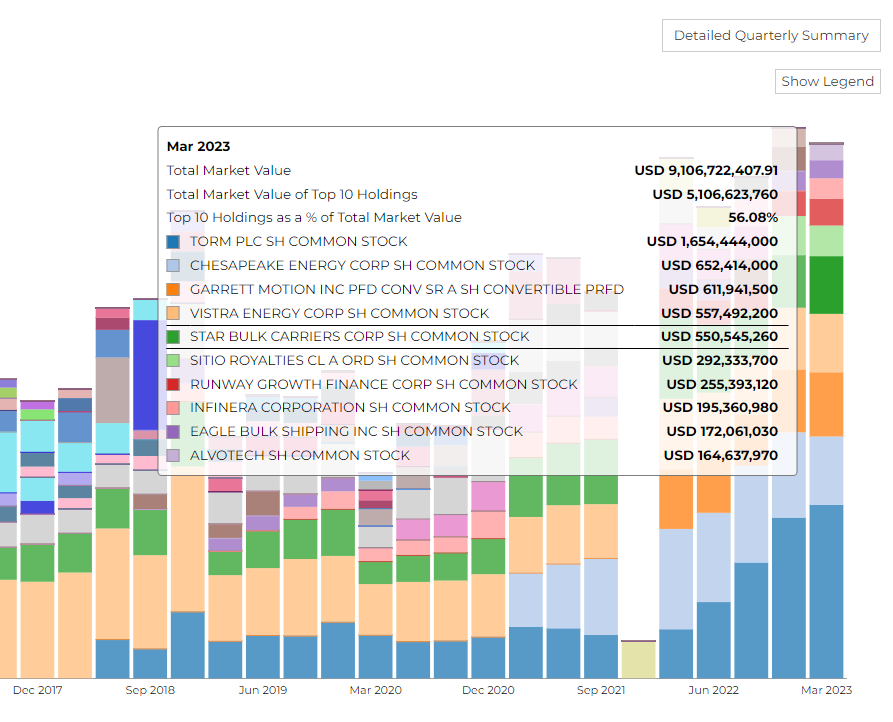

The executive leadership of Oaktree Capital comprises of Howard Marks and Bruce Karsh as Co-Chairmen, with Bruce Karsh also serving as the Chief Investment Officer. Jay Wintrob is the firm's Chief Executive Officer, while John Frank holds the position of Vice Chairman. Lastly, Sheldon Stone, serves as Principal and Co-Portfolio Manager.The firm disclosed 9.11 B in assets. It holds 301 securities in its 13F portfolio, and the top 10 holdings account for 56.1% of the portfolio.

Oaktree Capital Management LP's top 3 holdings include Torm Plc ($1.65B), Chesapeake Energy Corp ($652.41M), and Garrett Motion Inc ($611.94M).

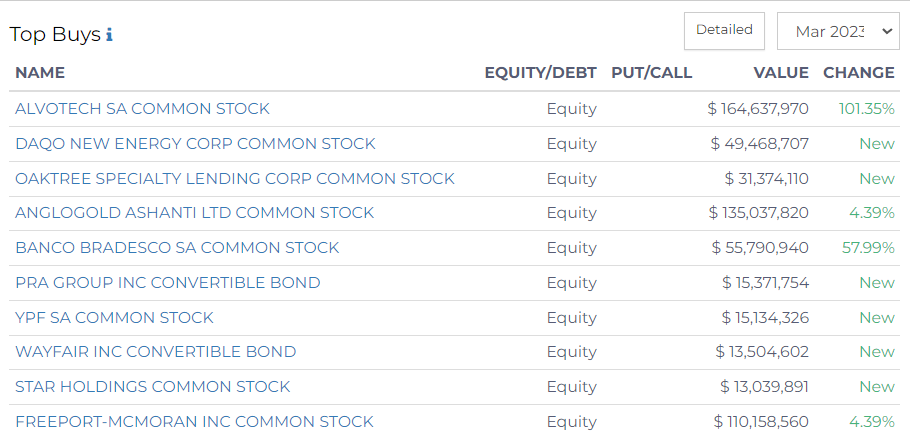

Top Buys made by Oaktree Capital Management

Oaktree Capital Management has directed its investment focus towards several prominent sectors. The firm's recent investments have predominantly been concentrated in the pharmaceutical, financial services, and energy sectors.

Pharmaceutical Sector

Oaktree has demonstrated an aggressive investment strategy with biopharmaceutical company Alvotech SA. Its shareholding saw a surge of 101.35%, with an additional 6.4 million shares. This takes their total holdings to 12.8 million shares, which are currently valued at $164.6 million, more than a 100% increase from its previous value of $63.4 million.

Financial Services Sector

Within the financial services sector, Oaktree expanded its stake in Banco Bradesco SA by a significant 58%. It acquired another 7.8 million shares, increasing its total stake to 21.3 million shares. This investment is presently valued at $55.8 million, marking a considerable jump from its earlier value of $38.8 million.

Oaktree has also initiated a new investment in Oaktree Specialty Lending Corp, purchasing 1.7 million shares with a value of $31.4 million.

Energy Sector

In the energy sector, the firm showcased interest in Dacquo New Energy Corp and YPF SA. For Dacquo, Oaktree bought 1.1 million shares valued at $49.5 million. Meanwhile, it invested in 1.4 million shares of YPF SA, amounting to $15.1 million.

Debt Collection Industry

Oaktree has moved into the debt collection industry by investing in PRA Group Inc. Here, it purchased 15.4 million shares, which amounts to a total investment value of $15.4 million.

E-commerce Sector

In the e-commerce sector, Oaktree initiated a stake in Wayfair Inc. It purchased 20.3 million shares in the form of convertible bonds, with a total investment value of $13.5 million.

Holding Company

As for Star Holdings, a holding company, Oaktree acquired 749.9 thousand shares amounting to $13 million, marking its entry into this segment.

Mining Sector

Oaktree has also made significant investments in the mining sector, particularly with Freeport-Mcmoran Inc and AngloGold Ashanti Ltd.

- For Freeport-Mcmoran, the firm increased its holdings by 4.39%, purchasing an extra 113.3 thousand shares, now holding a total of 2.7 million shares valued at $110.2 million.

- In AngloGold Ashanti Ltd, Oaktree boosted its stake by 4.39%, buying an additional 234.9 thousand shares. The total shares now stand at 5.6 million, with a current market value of $135 million, up from its previous $103.8 million.

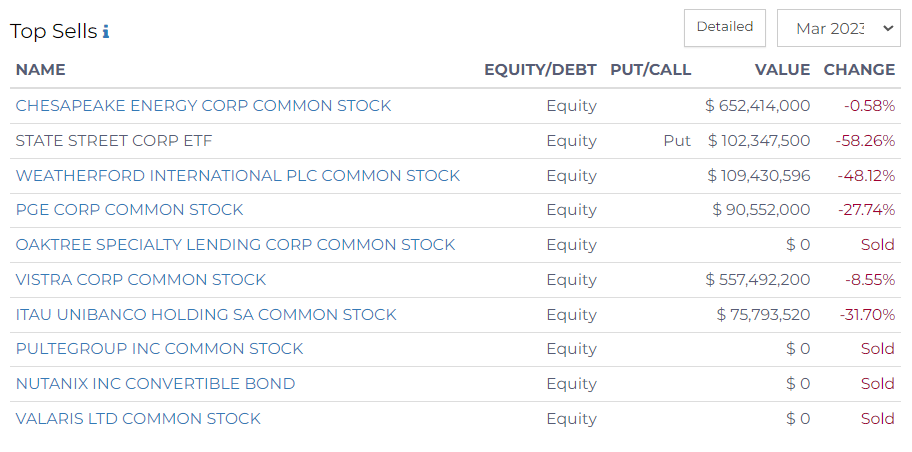

Top Sells

Oaktree Capital has recently made some noteworthy sell-offs across various sectors, with Chesapeake Energy Corp and State Street Corp among the top divestitures, according to the latest data.

In the Energy sector

Chesapeake Energy Corp saw a slight reduction of 0.58% in shares owned by Oaktree Capital, dropping from 8.63M to 8.58M shares. This brought down the value from $814.4M to $652.4M.

- Furthermore, Weatherford International PLC saw a significant decrease of 48.12% in shares, going from 3.55M to 1.84M, with the value dropping from $181M to $109.43M.

- Similarly, Vistra Corp experienced a 8.55% decrease in shares, from 25.4M to 23.23M, decreasing the value from $589.3M to $557.5M

- . Also in the Energy sector, Valaris Ltd saw its shares go from 370,155 to zero.

In the Financial sector

State Street Corp's shares decreased significantly by 58.26% from 599,000 to 250,000, bringing its value down from $229.1M to $102.3M.

Meanwhile, Oaktree Specialty Lending Corp saw a complete sell-off, with shares going from 5.01M to zero.

In Utilities sector

PG&E Corp saw a 27.74% reduction in Oaktree Capital's holdings, from 7.75M to 5.6M shares, marking a decrease in value from $126M to $90.55M.

In the Industrial sector

PulteGroup Inc shares were completely sold off, going from 619,000 to zero.

In the Technology sector

Nutanix Inc also experienced a full sell-off of their convertible bonds, decreasing from 26.53M to zero.

In the Banking sector

Itau Unibanco Holding SA saw a 31.7% reduction in shares, decreasing from 22.79M to 15.56M, bringing its value down from $107.3M to $75.79M.